AIG

-

The move from Chubb comes at a moment of perceived weakness for AIG.

-

Approached for comment, Chubb denies that it submitted “an offer” for AIG.

-

The payment will cover what the filing called “foregone incentives at his former employer”.

-

The industry veteran retired from AIG at the end of last year.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

Whether Clement's promotion was influenced by an inappropriate relationship is in scope.

-

The timing is unhelpful as the global insurer tries to get on the front foot with M&A.

-

AIG made the shock announcement earlier today that John Neal is not joining the insurer.

-

The ex-Lloyd’s CEO was due to join AIG as president but will not take up the role due to personal circumstances.

-

Zaffino said AIG will continue to assess strategic opportunities after the Convex, Onex and Everest deals.

-

Underwriting income for North America quadrupled to $384mn, and the segment recorded a CoR of 82.6%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

Onex’s own balance sheet will become a 63% owner and AIG takes a 35% stake.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The company will implement a new leadership structure after his departure.

-

AIG’s filing alleges copyright and trademark breaches, as well as violations of unfair business practice laws.

-

Clients in the segments that AIG trades in may not be as receptive to the idea as the insurer would like.

-

The Delaware high court’s reasoning could find application in other cases.

-

The state’s Supreme Court upheld two lower court decisions finding no liability.

-

Claude Wade is to step down from his role to address ongoing health issues.

-

The carrier is the first Fortune 500 company to take a stake in a League Two club.

-

The former executive passed away following a 40-year career in insurance.

-

Insurers did not see a slowdown in rate but some are still fine-tuning their portfolios following the LA fires.

-

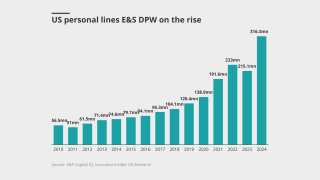

Submissions flow at E&S arm Lexington increased 28% year-over-year in Q2.

-

Q2 cat losses at AIG declined to $170mn from $330mn in the prior year quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The former Everest executive has more than 30 years of A&H experience.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.

-

John Neal was due to start at Aon as global reinsurance CEO in September.

-

The former Lloyd’s CEO will not make his planned move to Aon.

-

He has pleaded not guilty to the criminal charges, which carry potential life sentences.

-

When it comes to sympathetic juries, high net worth individuals are under the same pressure as corporations.

-

The January wildfires did little to hamper their appetite, apart from California.

-

The executive will be responsible for leading E&S primary and excess casualty.

-

The settlement requires Dellwood’s Price to write an apology to Peter Zaffino.

-

He will lead AIG’s business across Latin America and the Caribbean.

-

Hussey will take over the role left vacant when Luis Sonville moved to AJ Gallagher late last year.

-

AIG, HDI Global and others have settled. Chubb’s fight continues.

-

The unit grew Q1 NWP by 23% overall, led by a 27% growth in casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The California wildfires in January accounted for $460mn of Q1 cat activity.

-

A positive outcome could significantly curb insurers’ exposure to the loss.

-

The insurer also pointed to accelerating growth, M&A to come, and a sub-30% ER.