Top Section

Talent Tracker review: Staff turnover in 2025 16% below 2024 levels

Specialty was the busiest segment but still recorded a YoY drop of seven points.

-

Market participants on programs/MGU business in particular feel there's more capacity than 12 months ago.

-

Based in San Francisco, the executive specializes in venture capital and AI companies.

Research

Research

Carriers underweight in E&S could lead the charge in the next round of M&A.

Investors recalibrate their expectations for the segment as the soft market approaches.

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

A favorable nine months for the industry does not solve its underlying problems.

Opinion

Opinion

-

Chubb’s informal approach for AIG makes what was once unthinkable thinkable

Adam McNestrie and Ben Wylie -

AIG’s John Neal break-up throws the CEO succession wide open

Adam McNestrie and Ben Wylie

Latest news

Latest news

A quick roundup of today’s need-to-know news, including 1.1 casualty renewals.

The US insurer squeezed its retention in a renewal where cat treaty retentions are widely holding steady.

The SPV will underwrite a “broad and highly diversified” portion of Amwins’ ~$6bn delegated authority premiums.

Valor Equity led the raise, which included Lightspeed and General Catalyst.

Featured

Featured

Featured

Municipalities increasingly seeking cyber insurance as buyer’s market persists

Lower rates, more favorable policies and improved public cyber infrastructure are all contributing to the trend.

Most Read

Perspectives

Perspectives

When owners are not paying attention, discipline and governance are not top priorities.

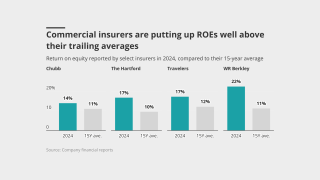

Unpacking how much excess capital there really is and dissecting the source of its returns.

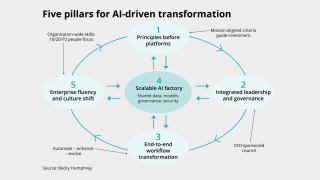

Here’s the five-pillar playbook for insurers ready to move from pilots to profit.

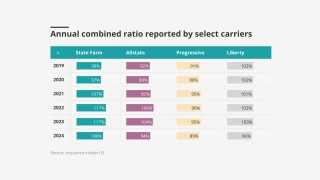

Despite elevated ROEs, insurers have remained disciplined.

Interviews

Louisiana Insurance Commissioner Tim Temple outlined key priorities for 2026 in an interview with Insurance Insider US.

The commissioner said more work needs to be done, but big companies are interested in coming back.

The CEO said that new funding will be used to expand its underwriting capabilities.

Earlier this week, The Baldwin Group said it will merge with CAC Group in a deal valued at $1.026bn.

Ad slot #2

Analysis

Analysis

The deal valued the tech-driven broker at over ~21x 2025 adjusted Ebitda, suggesting a hefty premium.

MGAs going public is now a viable option, but dominating a market comes first.

NY lawmakers are preparing a legislative package to address insurance costs in the Empire State.

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

Insider on Air

Insider on Air

In Partnership with

AXIS

Michael McKenna, Head of North America Specialty Insurance, AXIS, outlines the key trends shaping the industry as 2025 comes to a close and underscores that talent acquisition and rapid technology integration will be critical for specialty insurance in 2026.

In Partnership with

AXIS

Looking ahead to 2026, Michael Silas, Head of Global Credit, AXIS, sees mildly positive global growth driven by tech and infrastructure, but says credit sentiment remains cautious and reinsurers must still price to long‑term tail risk.

In Partnership with

Apollo

With real-time data and analytical tools giving underwriters a clear view of pricing adequacy, mix and attachment points, and allowing faster corrective action when rates fall below acceptable thresholds, insurers are shifting into a new paradigm for soft markets, said James Slaughter, Group CUO, Apollo, during an interview at the Insurance Insider’s London Market Conference.

In Partnership with

Fidelis Partnership

Insurers can turn the global energy transition into both a commercial opportunity and a force for societal good, said Charlie Heathcote, Head of Sustainability, the Fidelis Partnership, during an interview at the Insurance Insider’s London Market Conference

Conferences & awards

New York Conference 2026 | Add to calendar

April 23 2026

Convene, 101 Park Avenue, New York

Insurance Insider Honours 2026

2 September 2026

London

Insurance Insider US Honors 2026 | Add to calendar

September 30 2026

Ziegfeld Ballroom, New York

Upcoming webinars

-

In Partnership with Moody's

Ad Slot #2