Allstate

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

The promotions are part of the carrier's strategy to increase property-liability market share.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

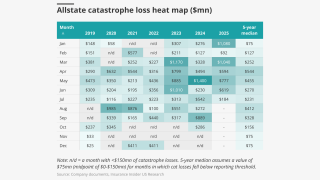

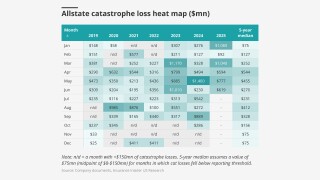

The research team presents the June cat heatmap.

-

The losses were below May’s $777mn, but almost 3x higher than for June 2024.

-

Allstate attributed the bulk of its losses to three major wind and hail events.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

Two wind and hail events were responsible for 60% of the total.

-

Insurers haven’t announced concrete steps – yet.

-

But automotive repair costs are likely to increase faster than home repair.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier surpassed the retention on its annual aggregate reinsurance cover for the year to March 31.

-

January cat losses continue to run higher than prior years, with no help from latest wildfires.

-

The carrier estimated January cat losses of $1.08bn, or $849mn after-tax, including the fires.

-

The investment firm’s holdings were down to $59mn at the end of Q4.

-

The carrier has not added new business in the state since 2007.

-

The carrier has been reducing its presence in the state since 2007.

-

The move will expand Nationwide’s stop loss insurance sales to SMEs.

-

The estimate includes $102mn from Milton and $114mn Helene development.

-

The activist investor’s position at the end of Q3 was valued around $116.3mn, SEC filings show.

-

Insurers are fighting to recoup claims they have paid out.

-

Fifteen events caused estimated losses of $306mn.

-

The news team runs you through this week’s key M&A deals.

-

Independent litigation threatened a $4bn settlement with wildfire victims.

-

Total catastrophe losses stemmed from 20 events and were estimated at $587mn.

-

NatGen allegedly collected $500mn associated with the fraud.

-

A quick roundup of today’s need-to-know news, including the DoJ/NatGen lawsuit and RenRe's earnings call.

-

The victims claim insurers shouldn’t get settlement cash before they’re made whole.

-

A quick round-up of today’s need-to-know news, including Ryan Specialty, Marsh, Allstate.

-

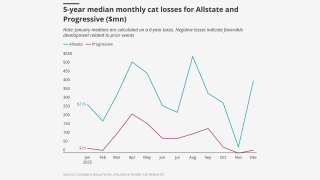

Allstate’s total pre-tax cat losses for H1 2024 were $2.85bn versus an estimated $4.39bn in H1 2023.

-

Investor skepticism visible in stock prices and short interest data over first half of 2024.