American Financial Group

-

The company has now posted rate increases for 37 consecutive quarters.

-

Social inflation is driving non-renewals, while CoRs are up for P&C and casualty.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The latest E&S player planning to IPO remains a “show me” story.

-

Older accident years, targeted markets business contributes to adverse development.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

A majority of losses come from property-oriented businesses and inland marine.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

No named storms exceeded AFG’s $70mn cat retention.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

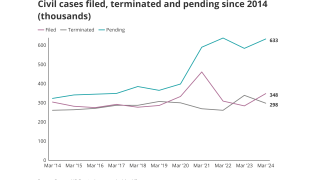

Civil case, nuclear verdict and claims count data show worrying trends.

-

The executive noted 2024 marks AFG's 12th year of rate increases in the line.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Treaty costs were slightly lower than for 2023 in risk-adjusted terms.

-

Insurance Insider US runs you through the earnings results for the day.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

Berding will retain his current role as president of American Money Management Corporation, AFG’s investment management services subsidiary.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The commentary follows AFG’s Q1 2023 earnings announcement on Tuesday, in which the carrier reported a 5.2-point deterioration in its P&C operations combined ratio to 89.2%.

-

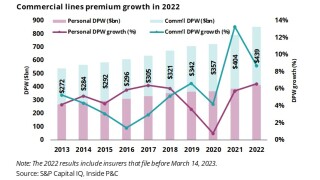

The latest statutory data release shows commercial carriers continued to benefit from the extended pricing cycle and exposure growth propelled by inflation, although growth slowed year-on-year.

-

Public D&O and higher excess liability are two areas where the company is “not quite getting” to where it wants to be in terms of rates, co-CEO Carl Lindner said.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The property and transportation division’s CoR deteriorated 9.5 points to 90% in the fourth quarter, driven by its crop insurance operations.

-

Amid record high economic inflation, continuing supply chain issues and proliferating nuclear verdicts, carrier CEOs have emphasized the need to keep rate above loss costs during Q3 conference calls.

-

On a call with analysts, Lindner said AFG is assuming commercial auto liability loss cost trends at 7%.

-

The company’s top line grew 18.7% to $3.15bn, primarily due to growth in the crop insurance business.

-

Loss cost trends have been approximately 5% for AFG’s specialty P&C businesses, excluding workers' compensation, and approximately 3% overall throughout 2022.

-

The company’s top line grew 9.6% to $2.1bn, but the speed of growth was smaller compared to Q1.

-

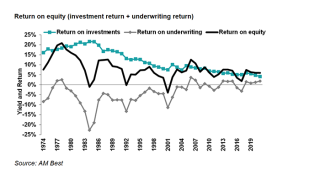

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

The firm anticipates renewal rates to rise between 5% and 7% in its specialty P&C operations overall and 6%-8% excluding workers’ comp.

-

Specialty P&C NWP in Q1 rose up 13.5% year-over-year to almost $1.4bn, accelerating from a 4.4% increase in Q4.

-

The insurer said it still had financial flexibility to grow even after making the dividend of roughly $170mn.

-

Co-CEO Carl Lindner said his company has made “some adjustments” in staff compensation in response to higher inflation rates.