Aon

-

The executives are based in Seattle and New York.

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

The executive most recently served as the company’s chief broking officer.

-

California may not be the only state to see non-economic damage caps in medmal get challenged.

-

Sources said the executive will report to Julian Pratt in South Florida.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

CEO Greg Case said data center demand could generate over $10bn in new premium volume in 2026.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The broker will join Ron Borys’ financial lines team.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The executive was formerly EVP and central regional leader at Aon.

-

The executive has been at the broker for over 20 years.

-

The executive has worked for Aon for almost two decades.

-

Cyberattack/data breach remains in the top slot.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The executive will join Howden’s new US retail broking operation.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The platform aims to “bend the loss curve”.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

Aon acquired NFP from Madison Dearborn in April last year in a $13.4bn deal.

-

The broker has filed a motion to dismiss the lawsuit by Marsh.

-

After spending 20 years at Aon, Goodman will start a senior executive position with Guy Carpenter.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

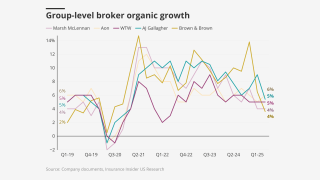

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

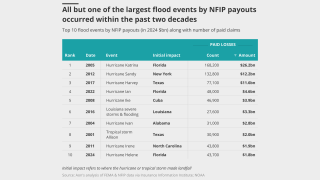

As the US recovers from a major flood event, the vast majority of Americans remain uninsured.

-

The NFP acquisition was a “tailwind for organic growth, not a key driver”, said CFO Edmund Reese.

-

The broker’s EPS beat consensus at $3.49 for the quarter.

-

The former Lloyd’s CEO is also eligible for a target $5mn annual equity award.