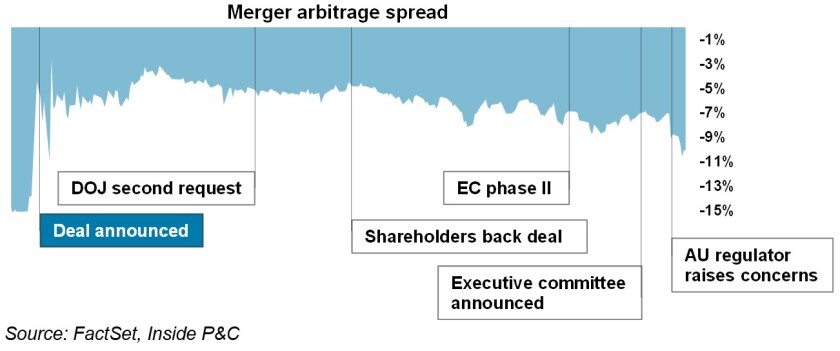

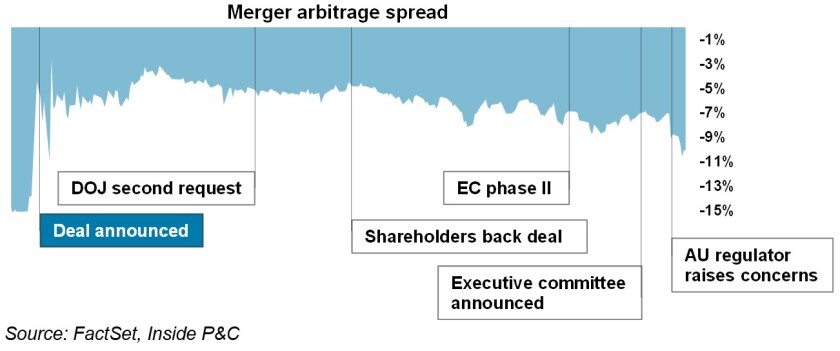

What this means is if you buy Willis stock and short Aon at these prices, should the deal close you will make 10.3%

Aon-Willis merger arb spread in focus as it breaches 10%

What this means is if you buy Willis stock and short Aon at these prices, should the deal close you will make 10.3%