This begets three questions for followers of insurance companies:

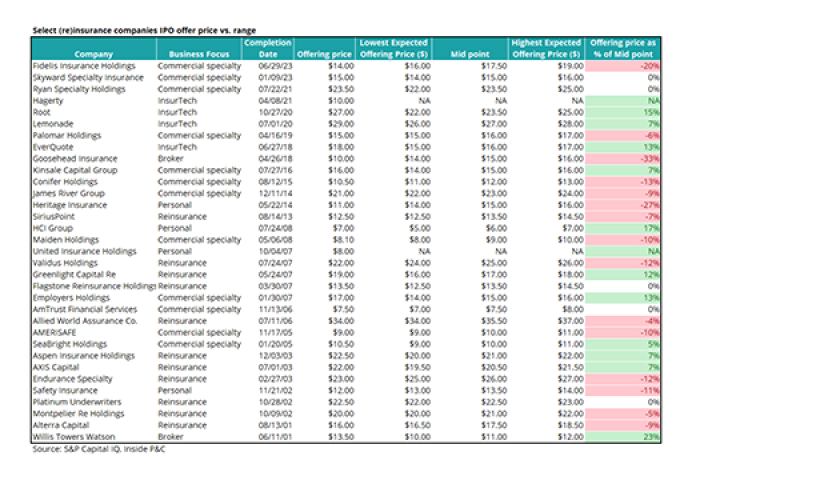

1. Do insurance stocks list above/below their expected range when they IPO?

2.

This begets three questions for followers of insurance companies:

1. Do insurance stocks list above/below their expected range when they IPO?

2.