The specialty market is also witnessing a moment where it seems to be all “treats” for writers of this business as well as for stock investors. It’s the golden age of E&S, after all.

Last week, Hamilton filed its S-1 indicating its plan to IPO to raise capital and provide an exit path to selling shareholders. But Hamilton, apart from its specialty focus, also has a partially differentiated investment strategy. Talk about not one but two treats!

Late last year, Skyward IPO’d, followed by Fidelis this year. Skyward was a traditional specialty story, and the stock has nearly doubled since its debut, while Fidelis’ stock, which was a more complicated story with its MGU angle, has remained flat since its IPO.

Hamilton’s IPO comes at an interesting time in the marketplace. When the news emerged that the company was considering options, editor-at-large Adam McNestrie covered some of the challenges Hamilton faced in pursuing an exit for existing shareholders.

At that time, the debate was around what exit options a carrier with a differentiated investment strategy could evaluate, and the associated pros and cons.

Among the three options on the table at that time – a merger, a strategic sale, or an IPO – the latter was the only viable option. We have often discussed the challenges involved with a merger or a sale due to the asymmetric information a (re)insurance buyer faces, with the Two Sigma relationship complicating the issue further.

So, bearing in mind these pressures, Hamilton’s hand was likely forced towards the public markets. Our note will delve deeper into Two Sigma’s performance over time.

The past two years have been phenomenal in the specialty space. In fact, E&S providers can’t stop highlighting how much rate and new business they are getting, and are sometimes being forced to turn away.

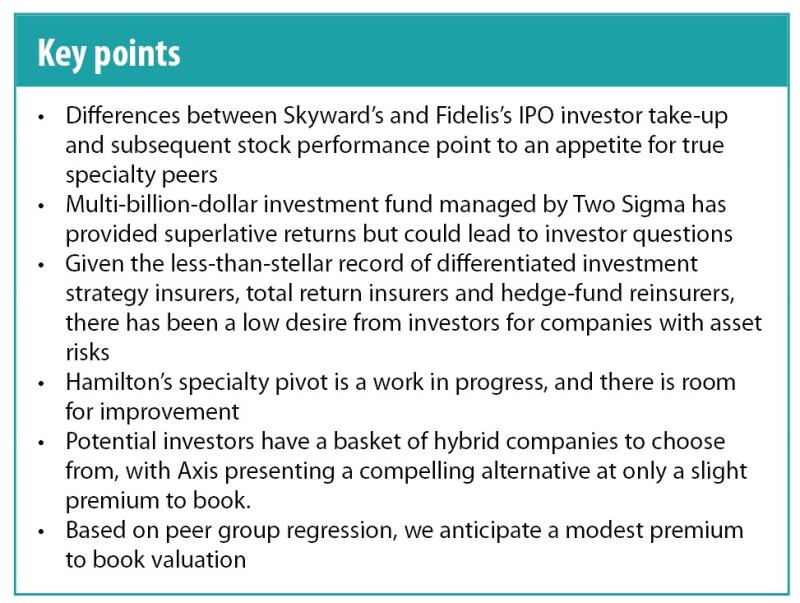

This brings us to Hamilton’s business mix discussion. The chart below, from the S-1 data, summarizes Hamilton’s book with various key breakdowns. Left to right we have Bermuda vs. International, then insurance vs. reinsurance, then class of business.

The business is slightly more concentrated internationally than in Bermuda with just under half being reinsurance. Though Hamilton is a specialty player, the book is nearly half casualty, with less than a third specialty, as defined by the company.

Investors understand the need to weight a business simply being called specialty vs. that business truly performing like specialty.

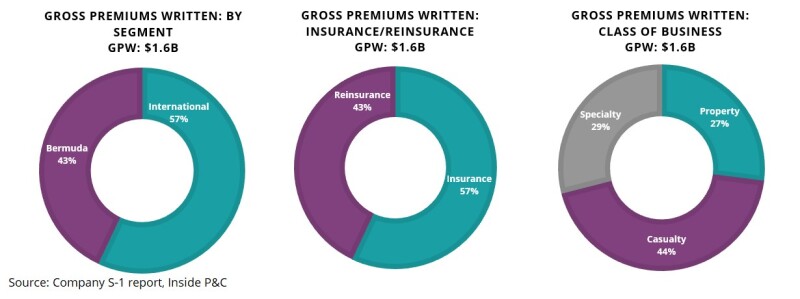

Moving on to the recent results shown in the S-1, the table below summarizes Hamilton’s performance over the past few years, as well as the last two comparable six-month periods.

These results point in two directions, which makes it a bit tricky to get a handle on. Specialty pricing is clearly giving a big boost to top line, and the loss ratios are healthy. Yet we have to weight this against consistent underwriting losses from 2020-2022, driven by catastrophes.

The underlying combined ratios are strong and show consistent improvement, but it is hard to determine how much of this is driven by pricing momentum vs. tightening underwriting.

On a shorter-term basis, as our note will show, Hamilton’s results have only improved recently, which brings into question the true earnings power of the franchise. We also compare reported performance over time.

Later in the note, we also look at the peer group which includes several established and newer specialty and reinsurance names, and highlight the gap between the two.

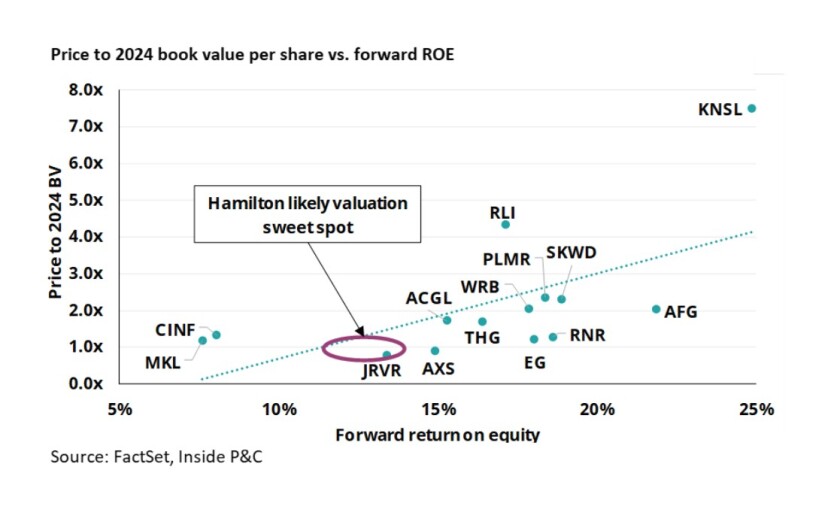

In terms of valuation, one could use Validus’ sale to Renaissance Re as another barometer, but that multiple of 1.4x is a high-water mark more applicable to established franchises. Our analysis later will show that the price-to-books and ROEs are all over the place for the specialty and reinsurance cohort. A low-double digit ROE would translate into a modest premium to book based on our regression analysis.

But investors also have the option of evaluating Axis, which trades at a relative discount, comes without a differentiated investment strategy and has continued to execute its turnaround.

Firstly, the Two Sigma relationship adds value but also creates a perception barrier

Hamilton has a unique strategic investment management relationship with Two Sigma Investments. For the uninitiated, Two Sigma is a hedge fund/asset manager which uses tech or quant-based stock picking for its strategies.

Hamilton has an investment in the Two Sigma Hamilton Fund, managed by Two Sigma. This rolling three-year commitment automatically renews every year until a non-renewal notice is served. Under the agreement, Hamilton is required to maintain the lesser of $1.8bn or 60% of Hamilton’s net tangible assets in its Two Sigma Fund. Of course, as Hamilton grows, this dollar amount has declined as a percentage of total assets, and stood at close to 50% at year-end 2022.

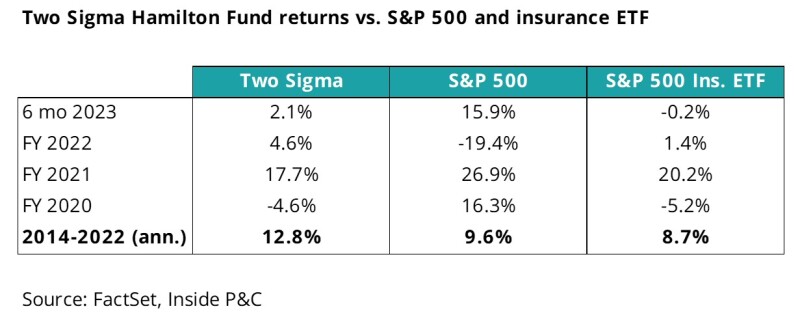

The table below shows Two Sigma’s returns vs. the S&P 500 and the S&P Insurance ETF. There is no denying the fact that it has added value over the long term, even in comparison to the solid returns of the wider market.

However, this relationship itself is going to create question marks among investors who would ask if Hamilton is a total return insurer. David Brown, Hamilton’s chairman, is on record as noting that the company is in fact not a total return insurer.

That said, Brown himself would be familiar to insurance investors as a former CEO of Flagstone Re. In a past life I covered Flagstone, Max Capital, Third Point Re, Greenlight Re etc.

Several of these companies came to market with the premise of a differentiated investment strategy. Unfortunately, that didn’t work out, with Flagstone and Max getting acquired, and on the hedge fund re side, Third Point merged with Sirius while Greenlight pivoted in its writings to try to move beyond the hedge fund re nomenclature.

The point is that investors are only willing to tolerate risk on the liability side of the balance sheet via underwriting. For many investors, a differentiated investment strategy means having to monitor a third-party investment management’s style on top of continually evaluating their own investment decisions.

With many differentiated return or total return insurers mostly struggling to deliver on their initial promises of strong returns, the desire to avoid owning this type of companies has only grown. Hence the need to explain the Two Sigma relationship and its long-term impact on Hamilton, and why the relationship is different from some of the other strategies investors might consider. In our view, management has its work cut out explaining this difference.

Secondly, specialty business needs to generate specialty returns

Over the past decade or so we have seen the migration of several franchises towards a specialty franchise label. Generally, specialty firms, often E&S carriers, cater to unusual risks and niche market products.

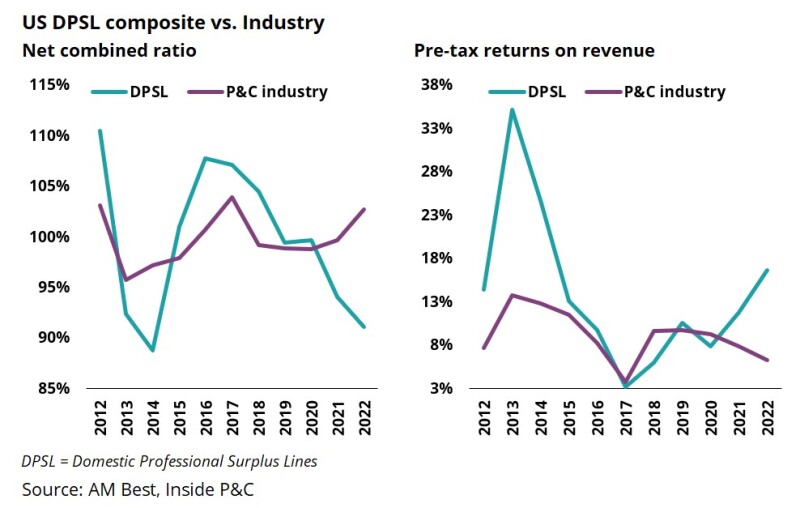

In recent years, surplus lines have had phenomenal underwriting results, along with double-digit top-line growth, so it makes sense to lean into the specialty side. Note the significant gap between specialty and the industry in the charts below, with the specialty combined ratio dropping as the industry’s rises on the left, and the reverse trend in returns on the right.

As outsiders, it’s often unclear how to distinguish a middle market commercial insurance policy from a true specialty product.

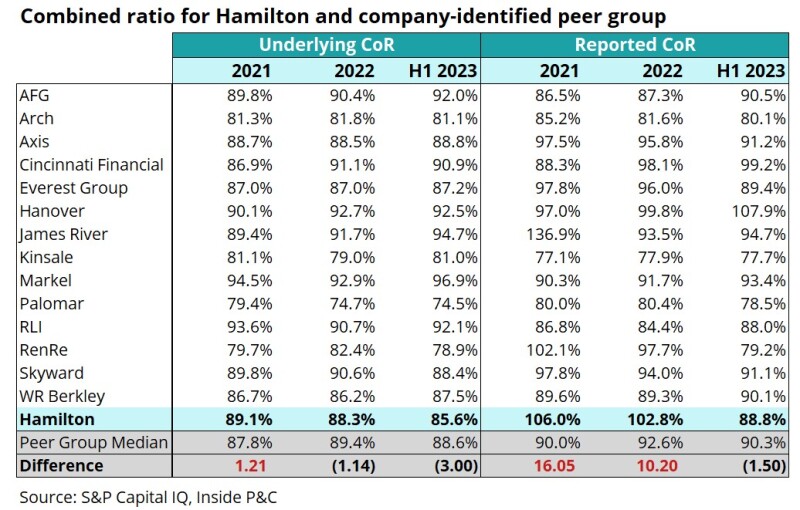

In its S-1, Hamilton has identified 14 peer companies. The chart below shows the combined ratio performance on an absolute basis as well as an adjusted basis for the names they selected. We can see Hamilton’s reported results have been materially worse than the peer group and have only improved for the first half of 2023.

Excluding catastrophe losses and prior-period development, Hamilton’s results are modestly better than its peer group. Those results could play into how investors end up pricing this offer.

Thirdly, valuations have trended up for specialty players, but a wide range exists

In our early Q3 earnings recap note, we illustrated that long-term value creators such as WR Berkley and RLI had seen meaningful share price appreciation after their earnings, compared to a lackluster move from a large commercial player such as Travelers.

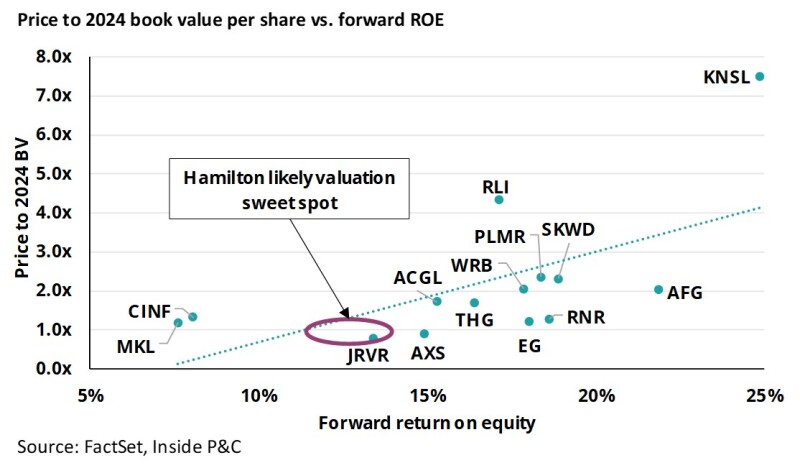

The chart below lists various peers but does exclude international peers such as Beazley and Lancashire to keep all the numbers on a similar basis. Assuming low-double-digit ROEs would imply a valuation in the 1x-1.2x range.

Do note that investors also have the option of evaluating Axis, which has continued to execute on its turnaround and trades at a discount to several peers.

In summary, a pent-up demand for pure-play specialty players will work in Hamilton’s favor. However, this will end up weighing against an OK-ish record with its continuing specialty pivot and the complexities of its Two Sigma relationship.