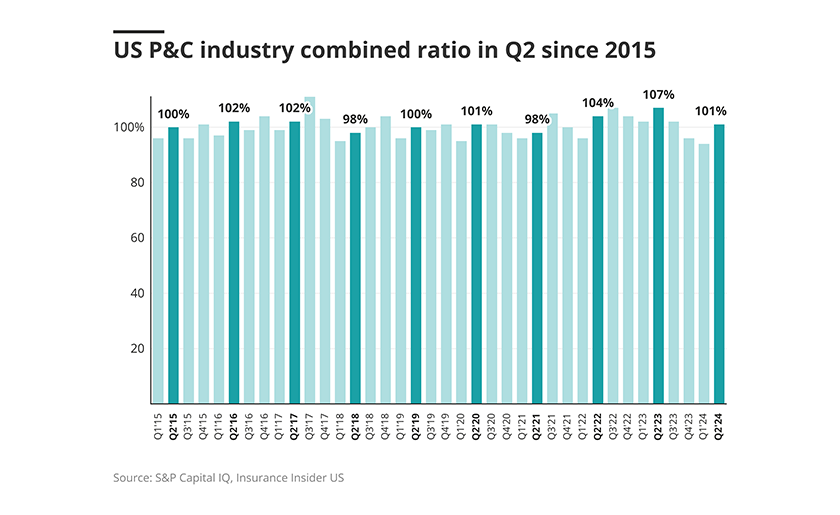

Second quarter statutory data is out, and the P&C industry as a whole has shown some improvement in underwriting performance, but not enough to tip it into profit-making territory.

While the industry combined ratio of last quarter was the best for a first quarter in more than a decade, this quarter has not been nearly as strong. While 101% is a sharp and notable improvement from 107% seen in Q2 of last year, the market remains at an underwriting loss for Q2, as it has since 2021.

The second quarter saw a relative lack of peak-peril cat events. The sector continues, however, to see elevated severe convective storm activity which can fall unevenly on the industry.

However, we aren’t nearly at the end of hurricane season, so we remain cautious on how the industry’s results might look in the event of a major catastrophe event.

Shifting the focus from the P&C industry to commercial lines specifically, we can see that year-over-year improvement in the quarterly result has somewhat slowed when compared to last quarter.

The Q2 industry average loss ratio has fallen 1.6pts compared to Q2 of last year, despite some notable increases among the top 10 largest writers.

WR Berkley stands out from the crowd, performing 9 percentage points worse compared to the prior-year period. On the company’s recent earnings calls, management has flagged heightened catastrophe losses, social inflation, and difficulty in getting the rate necessary to keep up with loss cost trends.

Another notable company among the top 10 commercial underwriters is Liberty Mutual, which has had higher than average direct incurred loss ratios for the last five quarters. The firm has also seen its loss ratio rise substantially on a year-over-year basis, even as the industry slightly improved during the same period. As we explore below, the firm’s significant deterioration in general liability performance may be a factor in this overall worsening in loss ratio.

Loss ratios in most segments continued to improve year on year, but workers’ compensation and commercial auto have deteriorated

Last quarter saw nearly every major line of P&C insurance improve compared to last year, save for general liability and several smaller lines, such as medical professional liability. Many trends have continued this quarter, with huge improvements seen in personal and fire and allied lines. Even general liability, which has been a pain point for the industry, has seen improvement.

On the other hand, commercial auto and workers’ compensation have both seen year-on-year increases in their loss ratios for Q2. While commercial auto has been known as a problematic line recently, worsened results in workers’ comp is a slight cause for concern. As discussed in our half-year review, good results from workers’ comp have routinely been a source of reserve releases used to offset adverse development in more volatile lines.

Significant noise can be seen at the company level, with many companies performing far better or worse than industry averages

Last quarter, Chubb was the only company among the top 10 with an increased loss ratio year-over-year, which we saw as a potential bellwether for the rest of the cohort (Zurich was not a part of the top 10 in Q1 2024).

We again see that Chubb is an outlier, and we remain concerned about this fact in terms of industry read-across, as Chubb has been historically early to identify negative industry trends. However, we should note that Chubb’s loss ratio result is still much better than most of the cohort.

Last month, we discussed how reserve releases from workers’ compensation were being used to offset adverse development in more problematic liability classes, and how those releases were salvaging an otherwise concerning reserving situation. However, as premium growth in workers’ compensation has slowed in recent years, insurers seem to be increasing their loss picks for the segment.

Zurich, the largest writer of workers compensation insurance, had a particularly sharp increase in its loss ratio for the business year-on-year for Q2 – at 26.3 points.

AIG, on the other hand, saw its workers’ comp loss ratio fall massively due to reserve releases, making its year-over-year loss ratio change for this quarter look particularly strong.

Last quarter, we noted that general liability was the only major P&C line to worsen when compared to the previous year.

As a sort of “catch-all” term that encompasses product liability, other liability, and commercial multi-peril lines of business, general liability encompasses much of the commercial lines segment. Some notable points of data seen here include The Hartford’s near 19-point improvement in its Q2 loss ratio, and Liberty Mutual’s 23-point increase.

The strongest performing segment of the P&C market this quarter has been fire and allied lines, which reported a 16.9-point year-on-year improvement to 49.3%. The allied lines umbrella encompasses many forms of property lines, including commercial property - a line which has been benefiting from the earn-through of years of rate hardening and corrective underwriting actions, placing the class in a far better position to absorb any cat volatility.

Commercial auto has been considered as a problematic line due to a variety of issues ranging from high employee turnover, claim severity, and claim frequency. It’s no surprise, then, that the line’s loss ratio has increased when compared to Q2 of last year.

Major writers of the line such as Old Republic and Zurich have seen their loss ratios continue to worsen, continuing trends seen in last quarter. Notably, Progressive (the largest writer of commercial auto by far) has seen significant improvement in the performance of their business in the segment.

In summary, while there have been material improvements for many companies and for the industry as a whole, unprofitable underwriting ratios and the continuing decline of certain key lines remain causes for concern.

The decline of workers’ compensation results is a red flag, as the line has previously been used as a source of releases to compensate for more volatile lines. Additionally, property-focused sectors such as fire and allied have seen significant loss ratio improvement for Q2, as corrective action on rates and underwriting earn through – providing a more robust premium base to absorb any cat volatility.

In our appendix, we include the data sets for personal lines classes for reference – personal auto, homeowners’ insurance and medical professional liability.

Appendix