With the four biggest Bermudians reporting their Q2 results earlier this week, strategic differences are becoming apparent as we move to the next stage of the pricing cycle.

In our note last month on P&C stock performance, we pointed out that reinsurers/hybrids were a consistent underperformer when compared to other industry segments.

As discussed in that note, the main four Bermudian reinsurers – Arch, Axis, Everest and RenaissanceRe – have fallen substantially behind the rest of the P&C pack in terms of price to forward earnings and market capitalization growth. The group is also behind the rest of the industry in terms of price-to-book valuation.

When we look back at recent history, it's not hard to understand why this hasn’t been the best year to be a Bermudian carrier.

Leadership shifts at Arch and Everest bookended 2024 for the cohort, with the latter's CEO, Juan Andrade, exiting just ahead of a massive $1.7bn reserve charge. Soon after, reinsurers heavily exposed to property-catastrophe lines were hit by massive wildfires in Southern California that lasted for most of January.

This quarter’s earnings results for these four carriers show generally strong results despite the headline issues faced by the segment earlier this year. Each one beat their consensus EPS estimates for the quarter, with most also showing higher favorable reserve development and lower catastrophe losses compared to Q2 2024.

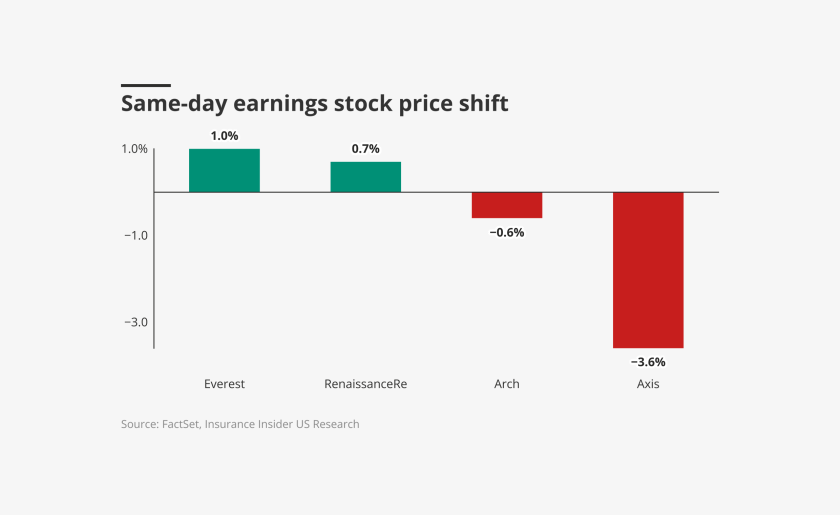

Investor reactions to earnings were mixed. The same-day stock price shift from each company’s earnings release is shown below.

Slowing reinsurance premium growth was a defining theme of this earnings season for the cohort, as most of the Bermudians have started to rebalance from casualty and towards cat reinsurance. Cat has been perceived as a particularly attractive line of business due to surging rates and attachment points, which have occurred throughout the US but have been most pronounced in Florida. The notable exception to this shift is Axis, which has run-off its property reinsurance book.

Primary insurance, which three of the four Bermudians participate in, has been more of a mixed bag. Year-over-year growth trends in insurance are somewhat inverse of those seen in reinsurance, with carriers pivoting away from property and towards casualty and specialty lines of business.

Value creation analysis shows Arch leading the pack, while Everest and Axis remain behind due to reserving troubles caused by poorly executed pivots towards insurance in the 2010s. We have analyzed the impact of those reserving struggles in our previous note on 2024 GAAP reserves for the cohort.

Growth slows in reinsurance as Bermudians shift to cat and Axis runs off its property book

Reinsurance is the Bermudian cohort’s origin story and generally defines their niche within the US insurance market.

With that in mind, year-over-year net written premium growth in reinsurance has slowed for almost every carrier. The exception is Axis, which has negative reinsurance growth, but slightly less negative year-over-year than it was in Q2 2024.

For Everest and RenRe, this decline is largely attributable to an intentional shift away from casualty reinsurance. RenRe saw a 19% premium decline in general casualty related to the company’s desire to reduce general liability exposure, while Everest CEO Jim Williamson noted that the company had “shed approximately $800mn of casualty pro rata business since the beginning of 2024”.

Arch, Everest, and RenRe have instead moved towards expanding their cat underwriting operations, particularly in Florida. Attractive risk-adjusted returns have drawn carriers towards the line for the past few years, though rates peaked in 2023-2024 and the space has recently become more competitive. Outside of cat underwriting, Arch and RenRe have also mentioned some contraction in other property reinsurance lines.

Axis is open about its low reinsurance growth expectations for this year, being highly selective in casualty and running off its property business entirely. What growth remains is concentrated within profitable segments of credit and surety, and overall net written premium growth for Axis reinsurance continues to be negative for the fourth Q2 in a row. The company has also brought attention to the fact that timing issues caused its reinsurance renewals to appear lower than usual this quarter.

Arch grew more than the rest of the cohort, due to continued premium growth in both casualty and cat reinsurance, though its other property reinsurance book shrank year-over-year.

The chart below shows the net written premium growth trend over time.

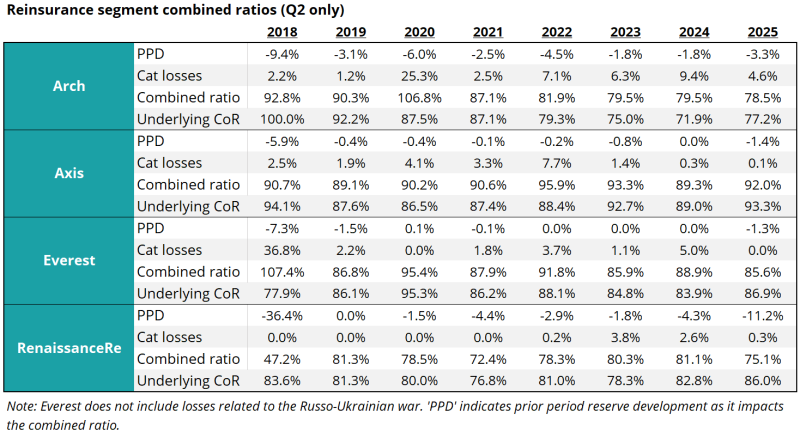

The chart below shows reinsurance combined ratios, in detail, for second quarters from 2018 on.

Underlying reinsurance combined ratios have risen for every carrier in the quarter, though most remain comfortably below 90%. Axis sports the highest underlying combined ratio at 93.3%, which is at least partially due to the company’s reinsurance book containing very little property reinsurance.

Arch’s underlying combined ratio increased by the greatest amount, which CFO Francois Morin attributed to the impacts of the Air India tragedy and “a couple of refineries that exploded”. The company’s reinsurance combined ratio continues to remain well below that of the other Bermudians, however.

Insurance results have been a mixed bag

None of the three hybrids have made their pivot in exactly the same way. Axis has run-off most of its property reinsurance business as it shifts towards becoming primarily a specialty insurer, while Everest has aimed to flex its reinsurance weighting depending on the market cycle.

Arch is currently at more of a 45/48/7 split between insurance/reinsurance/mortgage compared to the mid 2010s, when insurance was the bigger piece at approximately two-thirds of overall premiums.

Recently, the company concluded its acquisition of Allianz’s MidCorp & Entertainment Business, which has continued to rebalance its business mix.

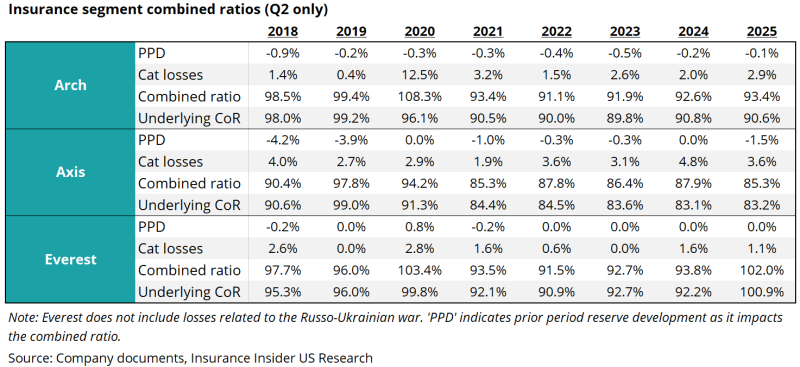

When we look at Q2 insurance results for these three carriers, we find a similarly uneven set of numbers. Arch’s insurance growth has increased substantially, though this can largely be attributed to the aforementioned MidCorp acquisition in Q3 of last year.

Declining growth for Everest was attributed to shrinkage in casualty lines, more than offset by growth in specialty (surety, trade credit and political risk, etc) and A&H. The company is in the process of remediating its casualty portfolio.

Excluding Arch’s MidCorp acquisition, Axis had the highest rate of insurance net written premium growth due to expansion in multiple lines and decreased rates of cession to other reinsurers.

An examination of profitability shows no more consistency. Arch and Axis have had relatively unchanged underlying combined ratios, with the latter also enjoying some reserve releases.

Everest, on the other hand, has had its insurance underlying combined ratio increase by more than 8 points. On Thursday’s earnings call, Williamson attributed this to conservative loss picks amid social inflation issues and portfolio actions taken to improve reserving quality.

Value creation shows the lingering troubles left by the hybrid pivot

In last quarter’s Q1 earnings recap, we saw that the hybrid cohort’s operating RoE declined substantially, which we primarily attributed to the quarter’s exceptionally high catastrophe losses.

The table below shows three-, five-, 10- and 15-year value creation CAGRs for the Bermudians, as well as each company’s current price-to-book multiple.

Arch leads the group, which is unsurprising given the company’s lucrative mortgage insurance business and relative successes in both insurance and reinsurance cycle management.

Behind in 10-year value creation is Axis, which faced substantial troubles with its pivot towards a hybrid model prior to the entry of current CEO Vince Tizzio, which led to a major reserve charge in 2023. Investor confidence and enthusiasm for the franchise has been largely restored as evidenced by its rising price-to-book value, but the earlier years continue to drag on long-term value creation metrics.

Everest faces a similar reality. Its value creation has lagged due to reserve adjustments last year, as well as in 2020 and 2018.