AssuredPartners

-

The executive will officially start in mid-November.

-

The deal’s benefits headlined AJG’s investor day presentation.

-

The completion is also good news for Marsh, Aon, WTW and other potential buyers in US retail.

-

The broker approved a grant of $316mn in equity awards payable in staggered amounts over the coming five years.

-

AJ Gallagher has responded to a request for additional information under the HSR filing.

-

The merger is on track to close in H2 2025, CEO Pat Gallagher said.

-

The hires form part of WTW’s build-out of its US aviation practice.

-

Gallagher already has HSR approval for the $1.2bn Woodruff Sawyer acquisition.

-

The company said it now expects the transaction to close in H2 2025.

-

AJ Gallagher expects to complete the $13.5bn acquisition of AssuredPartners in Q1.

-

The appointment comes a month after AP’s $13.5bn sale to Gallagher.

-

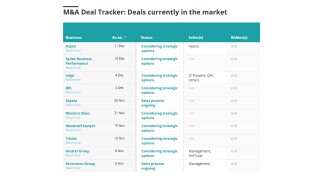

Insight into the current state of the insurance M&A market, powered by the Insurance Insider US M&A Deal Tracker.

-

The deal is financially attractive, but risks diluting the jewel that is Gallagher’s US mid-market business.

-

The executive said the combined entity could execute 100-110 tuck-in M&A deals a year.

-

The deal represents a 14.3x Ebitda multiple and strengthens Gallagher’s mid-market position.

-

The deal dramatizes the jammed PE deals conveyor, with the playing field tilted towards strategics.

-

If the deal is finalized, it will represent the largest in the acquirer’s history.

-

This follows yesterday’s appointment of Sean Smith as company president.

-

This publication previously revealed that private equity firm GTCR was seeking to place the broker into a continuation vehicle.

-

The move comes less than a year after AssuredPartners’ sale process reached a stalemate.

-

Brady Gallagher becomes M&A director for the brokerage’s retail operations.

-

Current regional sales leader Weiss will succeed Deal in the role.

-

Challenges include integration, delevering, winning staff over and building a compelling equity story.

-

Hank Dominioni will focus on Hartford, Torrington and greater Connecticut.

-

The firm may be a victim of its own success and size but a challenging macro landscape is also presenting obstacles for levered brokers as The Squeeze 2.0 looms.

-

Sources said that the likeliest path for the business now is to prepare itself for an IPO, which would probably be unfeasible before 2025.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Sources said the mid-market retailer has retained Morgan Stanley and Goldman Sachs to advise, and is open both to PE suitors and trade bidders.

-

The question of how to finance the private brokers no longer begins and ends with a PE flip.

-

The companies filed the motion with prejudice, barring them from bringing the same arguments to another US court in the future.

-

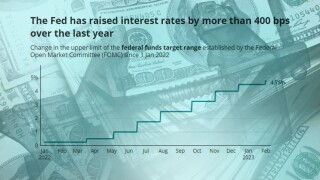

Increased cost of capital is cooling tuck-in M&A, encouraging a pivot to organic growth and forcing greater creativity around financing.

-

The proposed change could disrupt M&A at brokers, shift the calculus in favor of team lifts and dial up C-suite focus on becoming an employer of choice.

-

A tougher environment for debt financing and a potential recession will reverse some of the remarkable tailwinds of recent years.

-

The broker continues its growth plan with a new specialty, wholesale and program administration company.

-

Following the deal, Fred Church’s staff of 160 employees will remain operating under the leadership of president and chairman Mike Reilly.