-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The packages contained client lists and records saved as “TOP SECRET” on a former employee’s computer.

-

WTW still has meaningful capital to deploy next year but will provide details on its next earnings call.

-

Newfront’s business units will be combined with Risk & Broking and Health, Wealth & Career.

-

The move comes over a year after Aon completed its $13bn purchase of NFP.

-

Investors recalibrate their expectations for the segment as the soft market approaches.

-

The case is the latest in a series of lawsuits alleging Alliant raided MMA for talent.

-

Onex CEO Bobby Le Blanc will retire from Ryan Specialty’s board of directors.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Earlier this week, The Baldwin Group said it will merge with CAC Group in a deal valued at $1.026bn.

-

He and Fletcher stand accused of aiding Willis Re in an unlawful team lift.

-

Sources said the deal will value the US M&A insurance broker at over $500mn.

-

The hire advances Howden’s growth push in the US.

-

Baldwin said the $1bn merger with CAC accelerates the firm's specialization plans by at least five years.

-

The deal is slated to close in the first quarter of 2026.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

Marsh has accused its former execs of flouting a preliminary injunction.

-

The retail heavyweight uses around 1,000 trading partners to access the wholesale channel.

-

Last month, Insurance Insider US revealed that MMA was set to buy Atlas following a sale process.

-

The executive was most recently head of US casualty at Aon.

-

In September, Insurance Insider US revealed that the firm had instructed a recruiter to search for Kinney’s successor.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The subsegment is the latest commercial auto sector to feel the heat of litigation losses.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

Many carriers are still pricing above technical rate, but could reassess their strategies after Q1.

-

The executives are based in Seattle and New York.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Paddy Jago was also chairman at Willis Re and North America CEO for P&C at Aon.

-

GC continues to pursue Willis Re and individuals in court.

-

Senior Willis Re recruit Jim Summers denied Kevin Fisher had a role at the start-up.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

Parties will now brief on a request for a preliminary injunction on an expedited timeline.

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

GC accused Willis, Lucy Clarke, Jim Summers and John Fletcher of unlawful recruitment.

-

Softening rates amid worsening loss costs paints an uncertain future for the industry.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

Finance and insurance hiring is 27% below 2022’s peak, compared with 37% nationwide.

-

A motion by defendants to dismiss the case was also denied.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

Average revenue per agency acquired YTD in 2025 was $2.35mn, down 13% year-over-year.

-

The growth and profitability survey predicts 8.5% median growth for 2025.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

The executive most recently served as the company’s chief broking officer.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The dismissal comes after the judge in the case had stayed it just a day earlier.

-

Industry sources said they expect most larger firms will be able to meet the requirements.

-

Sources said that the platform drafted in Ardea Partners to advise on the recap.

-

A New Jersey judge also refused to grant WTW’s request for a restraining order.

-

California may not be the only state to see non-economic damage caps in medmal get challenged.

-

Earlier this year, this publication revealed that Atlas was considering a potential sale.

-

InsurTech funding was down 7.3% from $1.09bn in the prior quarter.

-

Sources said the executive will report to Julian Pratt in South Florida.

-

Marsh is also suing a second tier of former Florida leaders.

-

The deal would follow AJG’s regional acquisitions of THB Chile, Brazil’s Case or the Colombian retail book of Itau.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

HNW family offices are now among investors considering the US MGA segment.

-

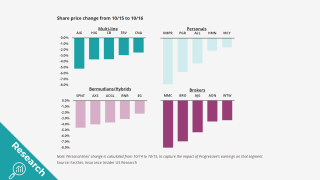

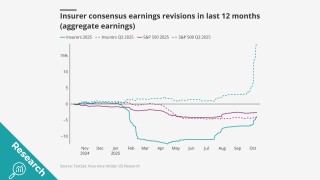

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The broker continues to expect 20% to 30% property rate reductions, as well as increased market competition.

-

Gallagher said that the firm is ready to engage in large deals again after the acquisition of AP.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The broker is monitoring whether the economic environment will limit discretionary spending.

-

The broker will join Ron Borys’ financial lines team.

-

The broker said it was on track to hit its financial goals despite macro uncertainty.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

Rate pressure on wind and quake partially offset overall Q3 programs growth.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broker said WTW hasn’t shown it was irreparably harmed by the defection.

-

APIP is one of the world’s largest property programs.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Sources said that the executive will join the reinsurance brokerage next year, after his garden leave expires.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Howden is facing fallout from its push into the US retail market via mass hires.

-

A quiet wind season is also expected to further soften the property market.

-

Bonnet has spent more than four years at WTW in increasingly senior roles.

-

Sources said the PE-backed platform retained IAP to advise on the process.

-

The hire comes a few months after Nick Greggains was promoted to CEO.

-

The London-based executive will relocate to Daytona Beach, Florida.

-

Early Q3 earnings reports point to worsening market conditions.

-

The portfolio encompasses $5bn+ of subject premium across ~75 programs.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The broker will report to Howden US CEO Mike Parrish.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

The selloff may hint at headwinds for equity investors.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

An average of 81% of property accounts renewed flat or down.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

The facility provides coverage for property, terrorism, energy, construction and utilities risks.

-

Private capital–backed buyers accounted for 73% of the 513 transactions this year.

-

The broker’s new business and client services division is targeting $400mn of savings.

-

Earlier this week, the broking house announced a rebrand to Marsh.

-

Dale Krupowicz was also named head of operations for the segment.

-

The motion claims the New York court has no jurisdiction in the case.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

After six years as CFO, Mark Craig is taking on the position of chief investment officer.

-

Neil Ross was also appointed CUO for the broker’s MGA.

-

Guy Carpenter will rebrand as Marsh Re, as a new central tech/operations unit is created.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

Founder Chad King will transition to chairman but continue leading M&A efforts.

-

The layoffs will mostly affect workers in Michigan.

-

WTW claims at least two $1mn accounts were also unfairly lost to Howden.

-

The broker is understood to manage Brown & Brown’s account at Howden.

-

Jeremiah Bickham will be a strategic adviser until the end of the year.

-

JP Morgan and RBC are advising the brokerage on its options ahead of an eventual IPO.

-

The executive was formerly EVP and central regional leader at Aon.

-

Insurers are pleased, brokers are looking for trade-offs, and everyone’s talking about Howden.

-

Insurer results and 1.1 reinsurance renewals will shape the trajectory of 2026.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

The executive has been at the broker for over 20 years.

-

The unit’s co-heads, Braithwaite and Apostolides, left the firm in the summer.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

Alliant is in the process of moving the ~$1bn of business it places with Howden to other wholesalers.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The executive will officially start in mid-November.

-

The broker will now have access to an M&A war chest for inorganic growth.

-

Sources said Marsh Specialty UK growth leader Lizzy Howe will lead the operation.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The deal will give the broker access to an M&A war chest to fuel inorganic growth.

-

The firm posted trailing 12-month organic growth of 23% YoY supported by a three-pillar strategy.

-

The executive has worked for Aon for almost two decades.

-

Landa was part of the team lift led by Michael Parrish, who is CEO of the US retail arm.

-

The business is beginning to integrate following a $9.8bn acquisition.

-

Industry stocks were firmly behind the S&P 500 in Q3.

-

She previously served as Hub’s North American casualty practice leader.

-

The Bermuda-based executive joined the Ardonagh Group’s reinsurance broking arm in March 2023.

-

Superintendent Harris is stepping down this month after four years of service.

-

Cyberattack/data breach remains in the top slot.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

Verisk's recent deals and its interest in cyber-analytics firm CyberCube show M&A in the segment has ticked up.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Marlon Williams will focus on the placement of reinsurance and retro business.

-

The hire comes as Guy Carpenter fills the void created by the Willis Re raid earlier this year.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

The New York City gala paid tribute to the industry’s top talent.

-

The executive joins the company after 17 years at Aon.

-

Sources said the start-up has two $10mn+ Ebitda platform deals lined up.

-

The executive has also held senior positions at Lockton and Marsh.

-

The executive will join Howden’s new US retail broking operation.

-

Global pricing is now 22% below the mid-2022 peak.

-

The executive met with UK colleagues to discuss plans for the US business.

-

Markel’s Bryan Sanders is receiving the Lifetime Achievement Award for his service to the industry.

-

The succession could take some time, and the current CEO could also move to exec chairman.

-

Lockton Re has predicted major growth in the global cyber insurance market.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

Most Recent

-

Looking to stay up to date with the latest insurance broker news? As a trusted source in the industry, Insurance Insider US delivers in-depth coverage of the latest broker news, market movements, and key insights that matter most to your business. Our team brings you the exclusive, data-driven reporting and analysis you need to fuel your business. Subscribe today to get the latest broker news delivered directly to your inbox.