Brown & Brown

-

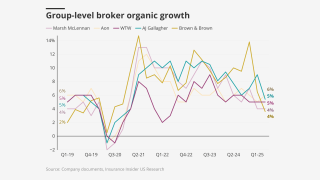

Investors recalibrate their expectations for the segment as the soft market approaches.

-

The retail heavyweight uses around 1,000 trading partners to access the wholesale channel.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

Rate pressure on wind and quake partially offset overall Q3 programs growth.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The London-based executive will relocate to Daytona Beach, Florida.

-

The broker is understood to manage Brown & Brown’s account at Howden.

-

The business is beginning to integrate following a $9.8bn acquisition.

-

The executive has been serving as COO since February.

-

The move includes One80 Intermediaries, formerly part of Risk Strategies.

-

Not everyone will emerge unscathed as brokers navigate the slow-growth environment.