Capital raising

-

The PE firm held 3.1% of the company’s shares, but will now hold none.

-

InsurTech funding was down 7.3% from $1.09bn in the prior quarter.

-

The $21/share pricing falls in the middle of the expected range.

-

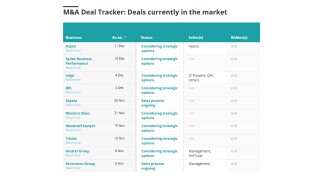

Insight into the state of the insurance M&A market, powered by Insurance Insider US’s comprehensive deal database.

-

It is understood that Sutton National is the fronting carrier sitting behind the facility.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

The portfolio encompasses $5bn+ of subject premium across ~75 programs.

-

Earlier this year, Insurance Insider US revealed that the PE firm was looking to extend its investment.

-

JP Morgan and RBC are advising the brokerage on its options ahead of an eventual IPO.

-

Proceeds will be used to pay off debt maturing at the end of the year and to support new market growth.

-

Return horizons are shifting, and entrepreneurial underwriters should start looking at longer tail business.

-

Tangram will become the inaugural portfolio company of Balavant Insurance.

-

Fleming’s attempt follows those of other legacy carriers that have had recent successes raising capital.

-

The fundraising focus comes after it was acquired by The Baldwin Group in Q1.

-

The fundraising round brought in $50mn for the insurer.

-

It is understood that CyberCube has been considering a sale of the business.

-

Sources said that the start-up will be fronted by Bain-backed Emerald Bay.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

Company alum David Murie will lead the new business unit.

-

In an interview, the firm’s CEO spoke about the CV deal, growth and its M&A pipeline.

-

The program is set to begin binding this month.

-

The MGA will expand its US reach in apartments, condo associations and single-family rentals.

-

The novel product appears to have been pitched to multiple clients.

-

The Bermuda SPI will write a quota share of SageSure’s captive Anchor Re.

-

Morgan Stanley first invested in Cover Whale in May 2024 with structured debt.

-

Softer market conditions are likely to create a wave of consolidation favoring large brokers.

-

The IPO was priced at $21 per share, up from the previous target range of $18-$20.

-

The IPO price is expected to be $18-$20 per share.

-

This is up from the $300mn in capacity the MGA secured in 2024.

-

The company resumed work on a public offering in September.

-

The deal, revealed by this publication in December, values the firm at $14bn.

-

Sources said NY-based Lee Equity is seeking to extend its investment in the TPA heavyweight.

-

Slide is putting faith in tort reforms and will lean into Florida, CEO Lucas said.

-

The Florida homeowners’ InsurTech went public today at $17 per share.

-

The exchange is backed by $100mn in funding from CD&R and others.

-

GCP retains a controlling interest in the Californian retail brokerage.

-

White Mountains invested $150mn in the retail platform earlier this year.

-

The Series C brings the company's valuation to $2.1bn, its highest to date.

-

The offering comes after Acrisure’s $2.1bn convertible pref share raise.

-

The deal values the company, formerly PCF, at roughly $5.7bn.

-

BP Marsh has subscribed for a 49% shareholding in the start-up MGA.

-

Starr joins a panel that includes capacity from Axis and Skyward.

-

The $2.59bn renewal is up 45% from last year.

-

Acrisure recently raised $2.1bn from investors in its latest step towards an IPO.

-

Fox highlighted the increasing role of alternative capital and creative financial vehicles.

-

Additional investors include Fidelity, Apollo Funds and Gallatin Point.

-

The program will succeed the previous buyback launched in 2023.

-

Proceeds will expand the company’s reinsurance protection in Florida and South Carolina.

-

The CEO said Ascot would deploy capital where it sees opportunities.

-

Insurance Insider US revealed last year that Intercare had retained MarshBerry to explore strategic options.

-

Insurance Insider US revealed last week that Hub had secured a ~16.5x Ebitda valuation in its “private IPO”.

-

The initial offering includes 6,875,000 shares of common stock.

-

The IPO was announced at the end of April, targeting ~$2.6bn-$2.9bn.

-

The specialty carrier is braving volatile macroeconomic conditions in a second effort to list.

-

The move will allow clients to take on larger and more complex projects

-

We assess the Bermudian’s standing amid waning investor sentiment and economic uncertainty.

-

The initial offering will include 6,875,000 shares of common stock.

-

The carrier is offering shares priced at $29-$31.

-

Sources said JP Morgan and RBC are advising the brokerage.

-

The Floridian is expecting to have around 40,000 policies in force by year-end.

-

Sources said the firm retained Ardea to run the process.

-

The fund apparently plans to purchase life insurance policies as investments.

-

The deal echoes Lightyear’s earlier investment in Inszone Insurance.

-

The firm acted as the front for Trouvaille Re, the E&S property sidecar for MGA AmRisc.

-

NY-based PE firm BBH Capital has exited its minority investment following the recap.

-

Sources said the Ethos-led group will take roughly a 40% stake.

-

This publication revealed last October that BroadStreet was seeking investors.

-

Insurance Insider US examines potential tariffs’ impact on the PE-backed brokers amid the jammed conveyor belt.

-

The company is expanding availability of its large enterprise offerings.

-

Trouvaille II raised $580mn for 2025, compared to $325mn in 2024.

-

Insurance Insider US revealed last December that the firm had retained RBC to run a strategic process.

-

The MGA will grow in specialty lines via talent recruitment and M&A coupled with technology enablement.

-

The start-up is closing a Series A fundraise.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

The funding round valued the company at around $850mn.

-

The unfunded commitment related to the investment was $24.4mn in 2024.

-

There were no signs of deceleration in claims and insurance services M&A during February.

-

The brokerage had secured a $340mn facility with JP Morgan, Fifth Third Bank and RBC in August 2023.

-

Acrisure may be the first heavyweight broker to go, with Hub, BroadStreet and Howden also contenders.

-

The business is targeting an enterprise value in excess of $30bn, sources said.

-

Last July, this publication revealed that the agency had retained Piper Sandler to run a process.

-

The $2bn+ raise would likely rest on the base case of an IPO in the medium term.

-

Sources said that with the equity refinancing, Alliant secured an enterprise value of ~$25bn.

-

The firm has commenced writing collateralized retro and reinsurance, but its rated launch is still pending.

-

The new, publicly listed specialty program group will be led by Luke Ledbetter.

-

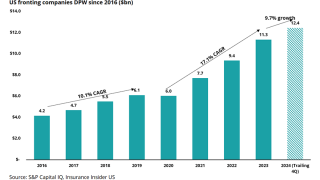

Fronting growth fell by half in 2024 due to uncertain loss climate and high cost of capital.

-

Insight into the current state of the insurance M&A market, powered by the Insurance Insider US M&A Deal Tracker.

-

The Montreal broker will use the funds to expand its Canadian operations.

-

Sources said the ~C$55mn Ebitda business retained RBC to run the strategic review.

-

In March, Insurance Insider US revealed that Arden had retained Dowling Hales to find an investor.

-

The start-up has secured BMA approval as it looks to a 1 January kick-off.

-

Insight into the current state of the insurance M&A market, powered by the Insurance Insider US M&A Deal Tracker.

-

In late August, Insurance Insider US revealed that Leavitt was looking for a minority investor.

-

It is understood that the TPA is working with Waller Helms on the process.

-

Carlyle re-launched efforts to find minority investor last June.

-

Sources said that the AmTrust-backed fronting carrier has retained Evercore to run the process.