CNA

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive was formerly EVP and central regional leader at Aon.

-

The promotions will enhance underwriting capability across key segments.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Cardinal E&S expands the carrier's underwriting capabilities and makes it more competitive relative to peers.

-

Goldman will join Ascot next month to take on the newly created role.

-

Major insurance industry groups and companies have recently pressed lawmakers to include the provision.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Rate meanwhile continues to be an area of focus in the lines most impacted by social inflation, the CEO noted.

-

The decision reflects CNA’s “consistently positive” operating performance.

-

Excess casualty rates were up 10% and have been double-digit all year, the executive said.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Sinclair had $50mn in coverage through five separate cyber policies.

-

Hurricane Milton losses are currently estimated at $25mn-$55mn.

-

Overall long-run loss cost trends are unchanged at around 6.5%.

-

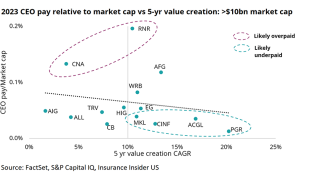

Analysis shows several CEOs with pay diverging from the trendline.

-

Robusto will take an executive chairmanship position on the insurer’s board of directors.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Long-run loss cost trends in the US are at 6.5% as a result.

-

Commercial auto and medmal had slight unfavorable developments in 2023.

-

Underwriting and investment income rose for P&C business.

-

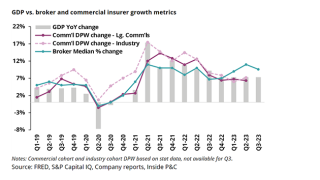

Broker and commercial carrier trends separate as inflation slows but rates stay elevated.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The Inside P&C news team runs you through the earnings results for the day.

-

CNA continued to push for rate in lines of business affected by social inflation in Q3, as CEO Dino Robusto said the carrier was “pleased that there is an increasing awareness for this need in the marketplace”.

-

The carrier reported better investment returns, improvements in underlying P&C performance and lower cat losses.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

This resulted in a rate decline of 1% in the company’s specialty business, compared to a 7% increase in the prior-year period.

-

The Inside P&C news team runs you through the earnings results for the day.

-

CNA said in a filing with the SEC that the $1.8mn will be paid in two installments, in addition to certain health and welfare benefits.

-

The firm reported flat reserve developments from its specialty and commercial P&C units in Q1, while a year ago the specialty segment posted a $10mn release.

-

The company’s rate increase in Q4 was 18% for its national accounts property portfolio, clocking in six points higher than Q3.

-

CEO Dino Robusto hailed “strong underwriting profitability” and voiced optimism about opportunities in 2023.

-

The executive will oversee the insurer’s management liability, financial institutions, and healthcare businesses.

-

The executive added that the carrier already has some of its professional liability programs in surplus lines.