Commercial E&S

-

The retail heavyweight uses around 1,000 trading partners to access the wholesale channel.

-

Casualty rate increases largely stabilized in Q2 and Q3 at 5%-10% for general liability.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

Jason Keen joined Everest in 2022 as head of international.

-

APIP is one of the world’s largest property programs.

-

Haney will remain on board as a senior adviser.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Old Republic said the acquisition is expected to close in 2026.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Howden is facing fallout from its push into the US retail market via mass hires.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

Since Simon Wilson was elevated to insurance CEO, the firm has been refocusing its underwriting.

-

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

Mike Mulray joins from Everest, where he was EVP president of North America insurance.

-

The division mostly places higher up the tower, where many insurers have taken action to address SAM losses.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

The specialty insurer was recently acquired by Korean carrier DB Insurance.

-

The two executives join from Markel and Arch, respectively.

-

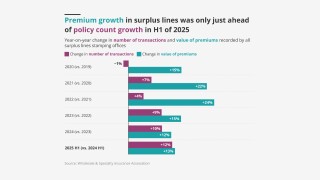

Trailing three month premiums were up 7.2% versus 13.1% in August.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

A process has not been launched and a firm timeline for a liquidity event has not been agreed.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The practice group will enhance the company’s existing offerings in E&S.

-

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

Florida led deregulation by eliminating the diligent effort rule in June.

-

One of the options being explored is setting up a dedicated company for the wholesale vertical.

-

The new MGU is expected to formally launch before the annual WSIA marketplace in San Diego.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

Third Point purchased 50,000 shares of the E&S insurer, which represents roughly 0.1% of its shares outstanding.

-

Casualty premiums grew 56.7% year on year in Q2 2025.

-

Appointments include leadership in transportation, energy, marine and others.

-

She joins the specialty insurer after working at Hamilton as CUO.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

-

Commercial liability and commercial property coverage continued to dominate the E&S market.

-

California posted a 47% jump YoY, from a 28.4% rise in June.

-

In liability, the carrier is steering away from where inflation has been volatile.

-

Brown & Brown fell 10% and Ryan Specialty 8% as investors digest the deteriorating outlook.

-

The segment is also seeing double-digit loss cost inflation.

-

Renewal rates fell, despite elevated catastrophe losses.

-

The company also encouraged insurers and brokers to support the initiative.

-

Cardinal E&S expands the carrier's underwriting capabilities and makes it more competitive relative to peers.

-

Nominee Neil Jacobs was warned cuts will cause ‘rising home insurance rates’.

-

The executive joined The Hartford when it acquired Navigators in 2019.

-

Florida recorded premium growth in June after declines in May and April.

-

The exchange is backed by $100mn in funding from CD&R and others.

-

Markel is simplifying its structure from six US wholesale and two US retail regions to four integrated US regions.

-

The aggregate gross proceeds from the offering are expected to be $113.3mn.

-

The NYC taxi insurance market is on the brink of collapse. Regulatory relief has been nowhere to be found.