Fidelis Insurance

-

Several Lloyd’s syndicates are also now providing cover for the federal insurer.

-

The London-based MGA will begin underwriting its international book next month.

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The reinsurance loss ratio improved by over 20 points with no notable cat losses for the quarter.

-

This will be Fidelis’ first office in North America and will be led by former Navigators Re head Ivan Vega.

-

The business said it was experiencing strong momentum on the Island.

-

Besides Russia-Ukraine losses, the Air India crash losses totaled $26mn.

-

Net adverse development for the quarter increased 30% year on year to $89.2mn.

-

Nadia Beckert was promoted to Bermuda CUO in March.

-

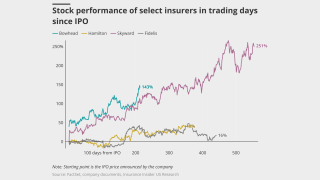

The latest E&S player planning to IPO remains a “show me” story.

-

She will continue to work with the executive team on key projects and initiatives.

-

The company has settled, or is in the settlement stage, for 80% of the exposure.

-

The Bermudian's first quarter cat losses totalled $333.3mn, compared to $103mn a year ago.

-

Erik Manning is joining the business from BMS as head of ceded reinsurance.

-

Sills’ background, a strong backing, and laser-sharp E&S focus make Bowhead stand out.

-

Nadia Beckert joined the carrier as an underwriter in 2021.

-

The firm projects losses from the fires at between $160mn-$190mn.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

In tandem, it pegged its net cat loss estimate from California wildfires at $160mn-$190mn.

-

After one good year, giving back margin now will be “inexcusable”, the executive said.

-

The partnership is Fidelis Insurance Group’s first third-party capacity deal.

-

Cat losses increased 14.6% to $91.6mn, driven by Hurricane Helene and Storm Boris.

-

The executive spent 18 years in various finance roles at Arch.