Homeowners' insurance

-

The legal setback came as publication of a FEMA reform report was postponed.

-

Trump’s shadow loomed over the beachside sessions.

-

MGAs going public is now a viable option, but dominating a market comes first.

-

The Republican said his office has launched an investigation into the denials.

-

NY lawmakers are preparing a legislative package to address insurance costs in the Empire State.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

Plaintiffs claim climate-induced cat losses have spurred increases in premiums.

-

The carrier said it anticipates a better market due to recent reforms.

-

The peril has been historically difficult to model compared to others.

-

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

Similar bills targeting fossil fuel firms have been introduced in other states.

-

The MGA is exploring new product lines including condos and renters, CEO John Chu said.

-

Senators asked for data on fraud but weren’t given any.

-

The deal to reopen the government also extended the NFIP.

-

Chief risk officer Shannon Lucas will move to COO as part of the shakeup.

-

The company anticipates a considerable bump in book value after IPO of subsidiary Exzeo.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

Slide does expect a “meaningful” amount of takeouts for this month and next.

-

The insurer reached highs of over 1.4 million policies in September 2023.

-

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

Exposure for California’s Fair plan has jumped, as insurers drop policyholders.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

The regulations are designed to address long-term solvency concerns.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

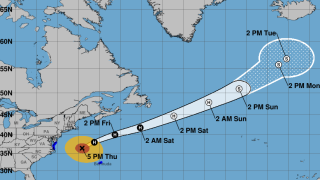

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

The company sees itself in a “very strong position” in the state.

-

A former NOAA climatologist who left the agency is running the new operation.

-

A quiet wind season is also expected to further soften the property market.

-

SageSure’s recent M&A in Florida was driven by being selective with policies and smart about claims costs.

-

Critics claim the dispute system denies consumers' key legal rights.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

A US district judge ruled a delay could put human life and property at risk.

-

The governor has yet to sign a pending bill to create a public cat model.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

New home sales could be impacted by a prolonged stalemate.

-

Seller White Mountains will retain a roughly 15% fully diluted equity stake.

-

Proceeds will be used to pay off debt maturing at the end of the year and to support new market growth.

-

The business has been ~70% owned by White Mountains since January 2024.

-

Neptune’s stock price jumped 25% on the first day of trading.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

A report by the ratings agency challenges current industry wisdom.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

The fundraising round brought in $50mn for the insurer.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The company generated $71.4mn in revenue for H1 2025.

-

The bi-partisan legislation would make FEMA a cabinet-level agency.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

The data modeling firm said losses previously averaged $132bn annually.

-

The violations included not using properly appointed adjusters and failing to pay claims.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

Storm surge of two to four feet could affect the North Carolina coast.

-

The program is aimed at affluent homes valued between $1mn and $6mn.

-

Life-threatening surf and rip currents are expected on the east coast of the US.

-

This is the first rate filing to use the recently approved Verisk model.

-

The insurer said it expects to begin writing business by the end of the month.

-

The company plans to launch in New York and New Jersey next year.

-

Floir has greenlit at least 14 new companies for operation in Florida in the last few years, contributing to the competition.

-

A shift to back to the admitted property space and MGAs choosing ignorance are other possible scenarios.

-

As the fires spread, the priority shifted from saving structures to saving lives.

-

Despite being hailed as an asset, executives said the current situation is not ideal for either valuation or competitive purposes.