Header

Your dedicated content hub

Fuel a smarter strategy with our actionable market intelligence

Latest News

Latest Intact News from Insurance Insider US

Competitor news

What Your Competitors are Reading

Competitor news

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

State regulators have largely avoided enforceable AI regulations, but bad news could change that.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

The regulations are designed to address long-term solvency concerns.

-

Erbig joins after more than 20 years in finance-related positions at Liberty Mutual.

-

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Selective’s CEO earlier attributed Q3 adverse development to the NJ market.

-

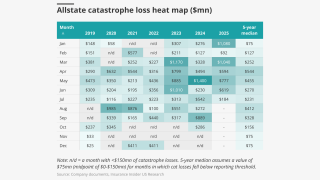

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

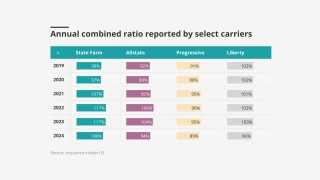

Early Q3 earnings reports point to worsening market conditions.

-

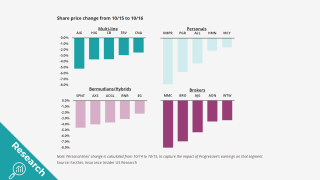

The selloff may hint at headwinds for equity investors.

-

The firm also expects to increase share repurchases in Q4 to roughly $1.3bn.

-

The carrier reported favorable reserve development of $22mn compared to $126mn in Q3 last year.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

The division mostly places higher up the tower, where many insurers have taken action to address SAM losses.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

When owners are not paying attention, discipline and governance are not top priorities.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

The promotions are part of the carrier's strategy to increase property-liability market share.

-

The risk also ranked as a top three concern for companies of all sizes.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

The ratings agency cited enhanced scale and diversification through organic growth.

-

Cat losses in July were below historical trends, but all eyes are on peak hurricane season.

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The firm’s subsidiary in India paid $1.47mn in bribes to officials at state-owned banks and raised revenue of $9.2mn.

-

Auto, umbrella and excess lines recorded mid-double-digit rate increases in Q2.

Insider On Air: Our Webinars & Podcast Channel

Behind the Headlines Podcast

-

In Partnership with Moody'sJoin Insurance Insider for a free webinar, offered in partnership with Moody’s, at 10:30 EST/15:30 GMT on 22 January

-

How do struggling governments across the globe tackle stagnating economic growth?

-

In Partnership with Swiss ReThe global construction industry continues to expand, says Jimmy Keime, Head of Engineering and Nuclear, for Swiss Re.

From our other titles

From our other titles

From our other titles

From Insurance Insider

Insider Outlook: Year in Review

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months.

In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

From Insurance Insider US

Commercial lines rate increases slow to 3.8%: WTW

The figure is down from 5.9% in Q2 2024.

From Insurance Insider

LIVE from Monte: Mereo CEO Croom-Johnson

While investors recently have favored the “instant gratification” of supporting brokers and MGAs, start-up reinsurer Mereo CEO David Croom-Johnson said he thinks capital will “fall back in love” with balance-sheet companies who deliver consistent profitable results.

From Insurance Insider ILS

Hannover Re outlines ILS plans as Ludolphs to retire at end of 2026

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

From Insurance Insider

LIVE from Monte: Paul Campbell, Global Growth Officer for Aon’s strategy & technology group

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

From Insurance Insider US

Brown & Brown appoints Hearn to lead global operations

The executive has been serving as COO since February.

Insurance Insider provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.

Insurance Insider ILS provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.