Header

Your dedicated content hub

Fuel a smarter strategy with our actionable market intelligence

James River News

James River in the News

Competitor news

What Your Competitors are Reading

Competitor news

-

The platform will debut in Germany before an accelerated global rollout in 2026-27.

-

The CEO thanked his friends and colleagues and said he was “going quiet”.

-

The executive most recently served as the company’s chief broking officer.

-

California may not be the only state to see non-economic damage caps in medmal get challenged.

-

Sources said the executive will report to Julian Pratt in South Florida.

-

Success in the soft market will be had when careful preparation meets opportunity.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

Both the primary and reinsurance segments benefitted from a light cat year.

-

The executive will fill the role previously held by Howden’s Figliozzi.

-

CEO Greg Case said data center demand could generate over $10bn in new premium volume in 2026.

-

The broker grew earnings per share by 12.1% during the quarter.

-

The broker will join Ron Borys’ financial lines team.

-

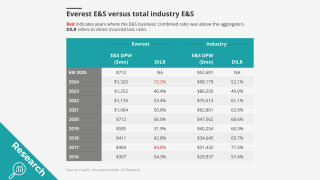

A re-focus on reinsurance nearly brings Everest back where it started.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

Sources said that the businesses in Canada and LatAm were part of Everest’s original plans to sell its retail book.

-

AIG has agreed to pay Everest $10mn per month for nine months for transition services.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

Despite the pricing pressure, margins for the line of business remain attractive, he added.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

Jason Keen joined Everest in 2022 as head of international.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

Ben Hanback joins from Aon, where he spent almost a decade.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

Clear Blue originally filed the suit in late 2023, alleging reckless conduct and misrepresentation.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The executive was formerly EVP and central regional leader at Aon.

-

The executive has been at the broker for over 20 years.

-

The executive has worked for Aon for almost two decades.

-

The move is the latest in a series of casualty leadership shake-ups at the insurer.

-

Cyberattack/data breach remains in the top slot.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

The executive will join Howden’s new US retail broking operation.

-

He will spearhead the division’s launch slated for 2026, which will be the first product launch for ICW Group’s specialty unit.

-

The executive will initially focus on casualty fac business incoming as the result of the Markel renewal rights deal.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

The program, expected to start doing business next month, will be wholesale-only.

-

The Berkshire subsidiary is seeking coverage for a $22mn antitrust loss.

-

The affirmations reflect Everest’s strong underwriting diversification.

Insider On Air: Our Webinars & Podcast Channel

Behind the Headlines Podcast

-

In Partnership With PwCAn expected $600 billion of capital flowing into the financial services industry in the coming years is focused on innovation, and can reshape the insurance industry, said Arthur Wightman, territory leader, PwC Bermuda, during an interview at the PwC's Insurance Summit.

-

In Partnership With PwCAn expected $600 billion of capital flowing into the financial services industry in the coming years is focused on innovation, and can reshape the insurance industry, said Arthur Wightman, territory leader, PwC Bermuda, during an interview at the PwC's Insurance Summit.

-

In Partnership With AonThe continued growth in cat bonds and third-party investment brings new options for risk transfer, diversifies investor pools and boosts returns, said Andy Marcell, CEO, Aon Global Solutions, during an interview at the PwC Insurance Summit.

From our other titles

From our other titles

From our other titles

From Insurance Insider

Insider Outlook: Year in Review

From cat losses from wildfires and hurricanes to litigation battles to the shifting commercial insurance landscape — these are the stories that defined our industry in the last 12 months.

In celebration of Insurance Insider US Honors Awards, please enjoy our Year in Review video.

From Insurance Insider US

Commercial lines rate increases slow to 3.8%: WTW

The figure is down from 5.9% in Q2 2024.

From Insurance Insider

LIVE from Monte: Mereo CEO Croom-Johnson

While investors recently have favored the “instant gratification” of supporting brokers and MGAs, start-up reinsurer Mereo CEO David Croom-Johnson said he thinks capital will “fall back in love” with balance-sheet companies who deliver consistent profitable results.

From Insurance Insider ILS

Hannover Re outlines ILS plans as Ludolphs to retire at end of 2026

Hannover Re Capital Partners is in talks with two investors for 1 January launch.

From Insurance Insider

LIVE from Monte: Paul Campbell, Global Growth Officer for Aon’s strategy & technology group

Paul Campbell details how the most profitable insurers act during a soft versus hard market.

From Insurance Insider US

Brown & Brown appoints Hearn to lead global operations

The executive has been serving as COO since February.

Insurance Insider provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.

Insurance Insider ILS provides robust insights, sharp analysis and exclusive news on the global insurance-linked securities market.