-

The company announced four internal promotions this week.

-

The move comes over a year after Aon completed its $13bn purchase of NFP.

-

Highly concentrated, overly leveraged fronts could repeat the Unicover-Reliance story.

-

Only GL and workers’ comp had renewal rate increases compared to Q2.

-

The insurer says defendants billed “exorbitant” fees for non-existent services.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

A favorable nine months for the industry does not solve its underlying problems.

-

The executive was most recently head of US casualty at Aon.

-

The executives are based in Seattle and New York.

-

Loss ratios in troubled casualty lines ticked down year-over-year despite worsening loss costs.

-

Casualty rate increases largely stabilized in Q2 and Q3 at 5%-10% for general liability.

-

The executive joins from RenaissanceRe.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Workers’ compensation was the only line that saw a YoY decrease.

-

The fashion brand says the insurer failed to defend it in multiple lawsuits.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

The defendant held a $1mn general liability policy with Kinsale.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

Tompkins Insurance is a subsidiary of Tompkins Financial Corporation.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

The appointments are aimed at offering a clearer team structure.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Old Republic said the acquisition is expected to close in 2026.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

MultiStrat, the founder of casualty ILS, is focusing on committed capital to grow, said Bob Forness, CEO, MultiStrat.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.

-

The protection covers the US insurance book for the 2024 and prior accident years.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

An average of 81% of property accounts renewed flat or down.

-

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

The decision impacts 5% of the reinsurer’s North America P&C facultative premiums.

-

Brian Church has spent 20 years at Chubb.

-

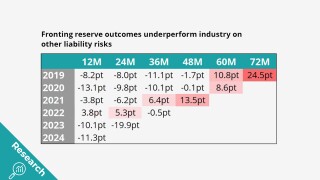

Fronting doesn’t look any better when it’s broken down by segment.

-

The mood in Orlando was sunny among cedants and reinsurers alike, but there are clouds on the horizon.

-

E&S is most exposed to growth normalization, private credit is hunting P&C and fronting is deadlocked on exits.

-

Insurers are pleased, brokers are looking for trade-offs, and everyone’s talking about Howden.

-

The unit’s co-heads, Braithwaite and Apostolides, left the firm in the summer.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

The broker will now have access to an M&A war chest for inorganic growth.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Trailing three month premiums were up 7.2% versus 13.1% in August.