-

A string of high-profile bankruptcies has put more scrutiny on the once marginal sector.

-

The move comes after the company posted 52% YoY top-line growth in Q3.

-

The company announced four key leadership appointments on Wednesday.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

Veradace claims the deal benefits Tiptree management at shareholder expense.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

The broker will join Ron Borys’ financial lines team.

-

The global insurer will need to convince investors on the quality of the book.

-

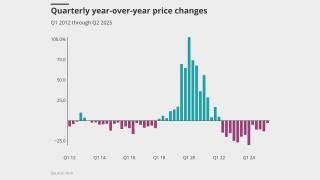

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

Northeast Insurance said 55 claims were brought under the Child Victims Act.

-

The new chief executive has served on PI’s board since 2018, including as chair.

-

The broker will report to Howden US CEO Mike Parrish.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The $20bn+ TIV data center is seen as the leading edge of significant new demand.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

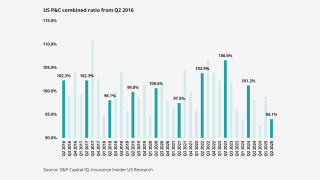

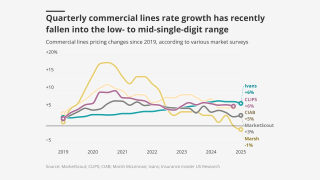

Rates are finally flattening, but it’s unclear if stabilization is enough for insurers’ bottom line.

-

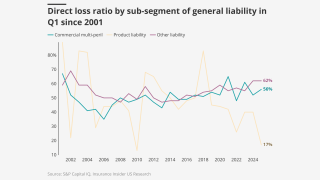

The other liability loss ratio continued to rise as workers’ comp and commercial auto reversed course.

-

The state’s Supreme Court upheld two lower court decisions finding no liability.

-

Company alum David Murie will lead the new business unit.

-

Appointments include leadership in transportation, energy, marine and others.

-

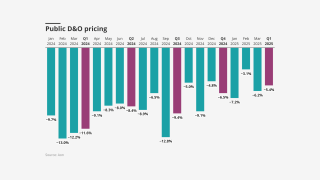

The executive said the floor on D&O pricing is in sight.

-

The move will impact around $50mn of gross written premiums in total.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.

-

The professional lines market remains ‘challenging’ overall, however.

-

The company has struggled in reinsurance, while large claims dragged down D&O results in Q2.

-

Pricing was “virtually flat” in the second quarter.

-

The broker has noted that double-digit reductions are increasingly available in property.

-

A growing divide in business courts could impact future D&O underwriting, sources said.

-

The insurers sent denial letters to the tech company as lawsuits and damages pile up well into the multi-millions.

-

The insurer denies it is responsible for the actor’s legal fees.

-

The company also encouraged insurers and brokers to support the initiative.

-

The VC firm has been incorporated in Delaware since its founding in 2009.

-

The executive previously held roles at Capgemini, The Hartford and AIG.

-

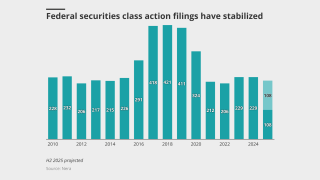

At the year’s mid-point, there were 111 new SCAs filed in federal courts.

-

The executive has experience as both an attorney and a broker.

-

Property rates are coming under further pressure, while liability is being buoyed by ongoing challenging loss trends.

-

He joined RPS in 1999 after a year-long stint as regional manager of Executive Risk.

-

High general liability losses are cause for concern despite modest improvements in other lines.

-

Catastrophe losses in Q1 exceeded $50bn, the second highest on record.

-

The reinsurer confirmed Andrew Phelan’s exit, as of 15 May.

-

Companies often purchase policies with limits far exceeding their actual exposure needs.

-

Rate cuts are slowing as insurers agonize over claims trends, but capacity is high.

-

Competition and ample capacity are pushing premiums lower.

-

Large account and E&S property have gotten competitive faster than expected.

-

Strong underwriting performance and aggressive repricing of risks in most lines has aided stability.

-

The executive has previously held roles at CRC Group, Allianz and Nationwide.

-

“Models aren't going to tell you what the emergent risks today are,” Dolan said.

-

In casualty, getting significant blocks of capacity remains a major challenge.

-

The program is designed to address a changing risk environment.

-

The reinsurer said the market was unprofitable and pricing needed to increase immediately.

-

The executive will begin serving as Hiscox USA’s CUO as of May 5.

-

The deal is expected to close in the second quarter.

-

The only major product line to see rate increases was casualty.

-

The insurer's professional liability reinsurance book shrank by around 25%.

-

The role will unify the P&C and professional and executive risk practices.

-

The two internal hires have been with BHSI for around five years.

-

The company has hired Axa XL’s Irvine to lead the new platform.

-

He will oversee Ascot’s US and Bermuda insurance and reinsurance companies.

-

The executive was most recently chief revenue officer at Aon.

-

Capital funding new litigation dropped 16% YoY, however.

-

The MGA will likely expand its D&O book as well, but excess casualty will grow faster.

-

PartnerRe's $5mn commitment will enable the MGA to expand its D&O line size.

-

A new report warns that underwriters must consider political uncertainty and macroeconomic trends.

-

The executive will continue as head of BHSI’s E&P lines business.

-

Inflation, tariffs and climate change are all making for an uncertain 2025.

-

ProAssurance brands will be transitioned to The Doctors Company in "all/most markets" over time.

-

Markel had announced the exit from the line of business in the US last year.

-

The market is up against emerging risks and a whole heap of uncertainty.

-

At the PLUS D&O symposium, executives raised concerns over tariffs and the role of reinsurance.

-

D&O liability premiums have declined by double digits in seven of the last eight quarters.

-

Technology is key to streamlining the value chain and mitigating loss ratios.

-

Cyber premiums dropped 1.8%, while commercial auto was up 8.9%.

-

The broker said clients could expect to see double-digit rate decreases this year.

-

The suit accuses CEO Brian Cornell and other Target executives.

-

The carrier’s US platform will continue to be led by long-time executive Sal Pollaro.

-

The average change for primary policies with the same limit and deductible was a 3.5% decrease.

-

Anti-DEI shareholder activist groups are targeting directors and officers with increasing threats of litigation.

-

The MGA and 49% owner SiriusPoint could bring in a new investor.

-

Sources said Dowling Hales is advising the professional lines quoting platform on the process.

-

The program will offer limits up to $5mn.

-

The move comes after Argo Pro announced it will exit professional lines.

-

The executives will report to Jenise Klein, CUO for North America.

-

Challenges in claims frequency and carrier competition are likely to remain.

-

‘Emotionally driven’ claims by non-profits underscore their unique D&O exposures, according to Travelers' Nicole Murphy.

-

A Delaware judge ruled that a “bump-up” exclusion was inapplicable.

-

Around $155m of the businesses in-force gross premium will be transferred to Core Specialty.

-

Federal court securities class actions hit a four-year high last year.

-

Frequency and severity of claims is starting to rise, and comes after sharp softening of rates.

-

IAP served as financial adviser to Atri in the transaction.