-

Fontana 2.0 will encompass a more flexible investment strategy than the 2022 vehicle.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The appointments are aimed at offering a clearer team structure.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Reinsurer executives during a Aon reinsurer panel stressed that the industry worked hard on setting the right structure.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

The fundraising focus comes after it was acquired by The Baldwin Group in Q1.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The CEO said the carrier will prioritise margin over top-line growth.

-

The vehicle will support Ascot’s casualty business in the US and Bermuda.

-

The executive left Lockton Re in June after almost six years.

-

Laure Forgeron has worked at the Swiss carrier since 2009 in numerous senior positions.

-

The changes affect operations in Switzerland, Bermuda and the US.

-

The broker built out Lockton Re’s US casualty and professional lines treaty book.

-

The firm expects to replace the volume with Innovations-channel business.

-

Hamilton also expects rising demand and stable supply for June 1 renewals.

-

Jack Kuhn, President of Westfield Specialty, discusses the shifting market cycles and changing landscape at RISKWORLD 2025.

-

The reinsurer also promoted Ethan Allen to chief program officer.

-

The only major product line to see rate increases was casualty.

-

The vehicle will take a quota share of all of the risks underwritten by Ryan Specialty’s MGA arm.

-

The executive has managed both casualty and personal lines reinsurance books.

-

The executive was Everest CEO from 1994 to 2013 and has served as board chair since 1994.

-

Instead, the reinsurer plans to write more casualty business through its innovations book.

-

Industry sources estimate the market to be around $3bn.

-

The firm projects losses from the fires at between $160mn-$190mn.

-

Many cedants secured aggregate and subsequent coverage at 1 January.

-

Concern over rate adequacy remains, but reinsurers are delving deeper into data rather than walking away.

-

The agency’s outlook for global reinsurance remains at Positive.

-

The carrier’s Q3 net income will be around $100mn, far below consensus.

-

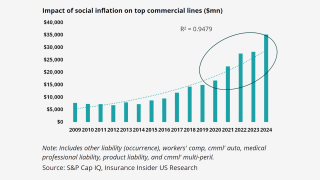

The broker said the casualty segment is approaching an “inflexion point”.

-

Legal trends, the primary pricing micro-cycle and other factors all play into an opaque outlook.