-

Sources said the deal will value the US M&A insurance broker at over $500mn.

-

Insurance Insider US reviews Euclid’s process and recent events in US MGA and retail broking.

-

The broker said R&W rates rose to 2.8% in Q2 vs 2.5% in Q1.

-

Longbrook Insurance will write multiple lines of business.

-

It is understood that the MGA wants to start with renewable energy and transactional liability.

-

Bonnet has spent more than four years at WTW in increasingly senior roles.

-

The company is looking to grow through its new MGA incubator program.

-

Other MGAs in the transactional-liability class are also expanding into the US.

-

The MGA secured a “significant strategic investment” from Zurich earlier this year.

-

The as-yet unnamed platform will have to compete in a crowded market for M&A and lift-out opportunities.

-

This follows the news that AmTrust will spin off some of its MGA businesses.

-

The MGA business was valued at an enterprise valuation of upwards of $1.1bn, sources said.

-

The executive joins from MSIG USA.

-

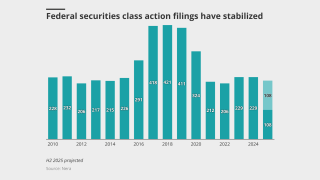

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

Sources said that the NY-based TL underwriter has retained Piper Sandler to run the process.

-

Hasnaa El Rhermoul will be SVP at Ethos Transactional, sources said.

-

This publication revealed two years ago that EQT could lodge a $1bn claim.

-

The executive said the floor on D&O pricing is in sight.

-

This is the New York-based firm’s first acquisition since launching in 2024.

-

Michael Mora was appointed North America CEO just over a year ago.

-

In March 2024, Cowen was appointed to lead Chubb’s new international transactional liability platform.

-

Underhill spent nine years at BHSI as global head of transactional liability.

-

The Inflation Reduction Act 2022 established new tax credits to incentivize investment in renewables.

-

Last month, Insurance Insider US revealed that former GTS Americas head Scott Pegram had left the company.

-

With the added capacity, the MGA can offer up to $35mn per risk.

-

In North America, the median W&I claim payment in 2024 was $5.5mn, the highest on record.

-

Scott Pegram had been at Liberty Mutual for over six years in various senior roles.

-

Volante’s syndicate may still support select transactional liability risks, but it will not have an in-house team.

-

Chubb told insurers to look inward in the fight against LitFin, but insurers are also tied to that industry.

-

The trend is expected to be most pronounced in the Middle East, the survey found.

-

Starr joins a panel that includes capacity from Axis and Skyward.

-

The executive is departing for a role at Birch Risk.

-

The executive joined the MGA in January 2024 and has spent his entire insurance career within the TL space.

-

Michael Brooks, SVP, head of transactional liability, will be taking over temporarily.

-

The executive was most recently chief revenue officer at Aon.

-

Capital funding new litigation dropped 16% YoY, however.

-

In January, Archer expanded its capacity with Lloyd’s backing.

-

The MGA will be trying to replace the transactional liability capacity in the coming weeks.

-

Kritzman has been with TMHCC for more than seven years.

-

The traditional R&W product is seeing an increasing number of large losses.

-

The insurer acknowledged additional claims in 2025 would be “reasonably possible”.

-

Other backers include Arch Specialty, Allianz, Allied World and HDI.

-

Sources said the MGA secured support from MS Transverse, Axis, AmTrust and Summit for TL business.

-

Ballan has prior experience at Liberty Mutual, Alliant Insurance and Davis Polk & Wardwell.

-

Sources said that Archer Transactional and BlueChip Underwriting will continue operating with existing paper providers.

-

There has been increased W&I appetite in South American jurisdictions.

-

Liberty GTS saw a 21% YoY decrease in R&W notifications across all its regions in 2023.

-

The deal is the latest in a string of investments by the MGA platform.