-

A motion to dismiss argues the case should not have been filed in federal court.

-

Carriers underweight in E&S could lead the charge in the next round of M&A.

-

A memo to staff said the executive will be “pursuing new opportunities outside of our company”.

-

London-based Tristram Prior will transfer to Bermuda to lead the line of business.

-

Trump’s shadow loomed over the beachside sessions.

-

WTW still has meaningful capital to deploy next year but will provide details on its next earnings call.

-

Global insurance premiums reached an all-time high of $15.3bn by year end 2024.

-

The CEO said that new funding will be used to expand its underwriting capabilities.

-

The case is the latest in a series of lawsuits alleging Alliant raided MMA for talent.

-

Onex CEO Bobby Le Blanc will retire from Ryan Specialty’s board of directors.

-

The acquisition brought four collector vehicle MGAs to the carrier’s existing collector vehicle portfolio.

-

The transaction is expected to close early in the first quarter of 2026.

-

Sources said the deal will value the US M&A insurance broker at over $500mn.

-

The company has been growing rapidly since the summer, with at least 300 currently employed.

-

The MGA said payments to affected customers began shortly after the event.

-

Texas was up over 25%, though California and Florida both recorded reductions.

-

Insurance Insider US reviews Euclid’s process and recent events in US MGA and retail broking.

-

The executive will report to Katalyx president and CEO Praveen Reddy.

-

Marsh is also seeking expedited discovery in a related talent poaching case.

-

The executives are based in Seattle and New York.

-

The executive was previously the cyber practice lead for Ryan Financial.

-

Light cat losses at year-end portend capital deployment and return decisions in 2026.

-

The PE firm held 3.1% of the company’s shares, but will now hold none.

-

The city said it was self-insured at the time of the attack.

-

Sizable reserve releases offsetting casualty reserve charges cannot last forever.

-

The valuation for the Jay Rittberg-led program manager is understood to be $1bn+.

-

The move comes after the company posted 52% YoY top-line growth in Q3.

-

The capacity deal comes over a year after Dual recruited Marilena Rodriguez Forero as CEO for the region.

-

Building electrical capacity quickly requires carriers to do due diligence on who’s behind the new power plants.

-

The tech error, now resolved, halted traffic to sites like X and ChatGPT.

-

The executive joined the company from Zurich last year.

-

The agency cited moderating premium growth and selective underwriting capacity as factors behind the revision.

-

The broker said R&W rates rose to 2.8% in Q2 vs 2.5% in Q1.

-

Bryant has spent over 30 years with the specialty carrier.

-

After outsized losses, the (re)insurer still sees opportunity in a softening market.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The reinsurance loss ratio improved by over 20 points with no notable cat losses for the quarter.

-

Average revenue per agency acquired YTD in 2025 was $2.35mn, down 13% year-over-year.

-

Longbrook Insurance will write multiple lines of business.

-

The move comes after the withdrawal of a complaint in the Delaware court.

-

The CEO thanked his friends and colleagues and said he was “going quiet”.

-

Veradace claims the deal benefits Tiptree management at shareholder expense.

-

The executive most recently served as the company’s chief broking officer.

-

The newly installed US vice chair explains why inefficiency drove her from legacy firms.

-

It is understood that the MGA wants to start with renewable energy and transactional liability.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The executive noted that an influx of new entrants in the E&S market is increasing competition.

-

The loss would be one of the largest ever for mining underwriters.

-

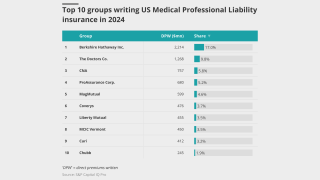

California may not be the only state to see non-economic damage caps in medmal get challenged.

-

From the carrier perspective, alignment of interests was a recurring theme.

-

The company is also prepared for potential M&A activity.

-

The executive said the firm has grown its casualty business by 80% from 2022.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Adeptive co-founder and CUO Jeff Bright will lead the MGU’s US strategy.

-

The chief executive said he doesn’t expect to see a price drop anytime soon.

-

Marsh is also suing a second tier of former Florida leaders.

-

Casualty rates in Q3 rose 6.1% driven by increases in commercial auto, energy and excess liability.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

HNW family offices are now among investors considering the US MGA segment.

-

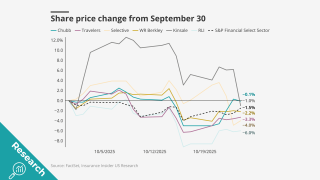

Fears of the oncoming soft market are causing a sector rotation away from P&C.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

It is understood that Sutton National is the fronting carrier sitting behind the facility.

-

The acquisition will expand PHLY’s presence in the niche market.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

It is understood the permanent reinsurance capital vehicle is called Highline Re and will sit behind fronting carriers.

-

The search for a CFO had been underway since last July.

-

The broker continues to expect 20% to 30% property rate reductions, as well as increased market competition.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

Dairy and livestock products within the agricultural unit were main growth drivers in Q3.

-

The FIO said it will work with regulators on coverage for digital assets.

-

The insurer continues to exit or reduce unprofitable lines and slowed growth as a result.

-

CFO Vogt added that the vehicle’s impact from earned premiums should ramp up from 2026 through 2029.

-

Greenberg has strong links with IQUW management, and praised the firm’s leadership and cultural fit.

-

The revised outlooks reflect the difficult moment as Everest moves away from retail.

-

The reductions reflect a mix of programs being handed off and MGAs proactively switching.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The LA fires were a microcosm of “everything we do well when things go bad”.

-

Erbig joins after more than 20 years in finance-related positions at Liberty Mutual.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

BP Marsh has agreed the sale of its 28.2% shareholding as part of the deal.

-

The executive joined the Dallas-based insurer as CUO in 2023.

-

Normalized growth and peak multiples confirm we are headed towards a Darwinian race.

-

The specialty carrier’s share price fell nearly 7% on the day of the call.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

September’s medical care index increase follows a 0.2% drop in August.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The range allows “for information that could emerge beyond what is known today”.

-

Haney will remain on board as a senior adviser.

-

The appointments are aimed at offering a clearer team structure.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

WTW’s Jessica Klipphahn will take over as head of North America mid-market.

-

Old Republic said the acquisition is expected to close in 2026.

-

The company saw growth accelerate in its property and casualty segments.

-

Dealmaking took centerstage, but other discussed topics were growth, talent and capacity.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

Sources said that Piper Sandler is advising the Dallas-based program manager on the process.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

A quiet wind season is also expected to further soften the property market.

-

Bonnet has spent more than four years at WTW in increasingly senior roles.

-

There’s nothing medical about SAM claims.

-

Sources said the PE-backed platform retained IAP to advise on the process.

-

The CEO also said that the “bloom is off the rose” in the E&S property market.