Reinsurers

-

The deal to reopen the government also extended the NFIP.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The charity said that improved ecosystems could help protect from disasters.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The carrier’s top line grew to $1.4bn in the first half of 2025.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

The carrier is continuing to reposition its portfolio to drive more consistent returns.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

Widespread underinsurance and low exposures will limit losses.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

The FIO said it will work with regulators on coverage for digital assets.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The regulations are designed to address long-term solvency concerns.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

Jason Keen joined Everest in 2022 as head of international.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

This publication revealed the move earlier this year.

-

September’s medical care index increase follows a 0.2% drop in August.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The reinsurer also hired Martin Bages as Latin America and Caribbean head.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

An average of 81% of property accounts renewed flat or down.

-

Private capital–backed buyers accounted for 73% of the 513 transactions this year.

-

The decision impacts 5% of the reinsurer’s North America P&C facultative premiums.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

A US district judge ruled a delay could put human life and property at risk.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

The governor has yet to sign a pending bill to create a public cat model.

-

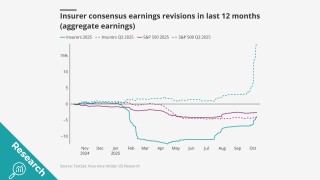

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The mood in Orlando was sunny among cedants and reinsurers alike, but there are clouds on the horizon.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

The move marks Acrisure Re’s first investment in Latin America.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.