Reinsurers

-

The deal to reopen the government also extended the NFIP.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The charity said that improved ecosystems could help protect from disasters.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

The carrier’s top line grew to $1.4bn in the first half of 2025.

-

Insurance penetration varies, but hotels have “near-total” coverage and strong limits.

-

The storm devastated Jamaica and Cuba, but insurance penetration on the islands is low.

-

T&Cs, as well as exclusions, remain largely unchanged, the executive said.

-

The carrier is continuing to reposition its portfolio to drive more consistent returns.

-

Interim CUO Nick Pritchard turned in his notice in August of this year.

-

The global insurer is buying access to distribution and underwriting at a carrier with a 27% GWP CAGR.

-

Widespread underinsurance and low exposures will limit losses.

-

The Bermuda carrier brought a winding-up petition earlier in October.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

Gray specializes in contract bonds for mid-sized and emerging contractors.

-

The FIO said it will work with regulators on coverage for digital assets.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

The CEO noted that 45% of Everest’s US casualty book did not renew this quarter.

-

The property segment reported a combined ratio of 15.5% for the quarter, versus 60.3% a year ago.

-

The regulations are designed to address long-term solvency concerns.

-

The company’s stock fell nearly 9% as the market digested news of an ADC, renewal rights deal and reserve charge.

-

The global insurer will need to convince investors on the quality of the book.

-

Jason Keen joined Everest in 2022 as head of international.

-

The global insurer will pick up a $650mn portfolio of US casualty business.

-

AIG will fold the portfolio into its existing business, leaving the liabilities and legal entities with Everest.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

This publication revealed the move earlier this year.

-

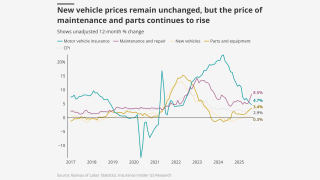

September’s medical care index increase follows a 0.2% drop in August.

-

A canvassing of the cyber market suggests the impact will be negligible.

-

The reinsurer also hired Martin Bages as Latin America and Caribbean head.

-

AWS suffered a large-scale service disruption originating in northern Virginia.

-

An average of 81% of property accounts renewed flat or down.

-

Private capital–backed buyers accounted for 73% of the 513 transactions this year.

-

The decision impacts 5% of the reinsurer’s North America P&C facultative premiums.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

A US district judge ruled a delay could put human life and property at risk.

-

The carrier has been exploring launching into P&C organically or via acquisition.

-

The MGA is also looking to build out its US mid-market professional liability expertise.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The mood in Orlando was sunny among cedants and reinsurers alike, but there are clouds on the horizon.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

The move marks Acrisure Re’s first investment in Latin America.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

It is understood around $1bn of premiums could be ceded to the proposed vehicle.

-

Expansion into adjacent markets, capital return and M&A among top means of capital deployment.

-

The carrier has renewed and extended its capacity arrangement with the MGA.

-

New home sales could be impacted by a prolonged stalemate.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

The New York City gala paid tribute to the industry’s top talent.

-

Lower rates mean lower investment incomes and higher book values for insurers.

-

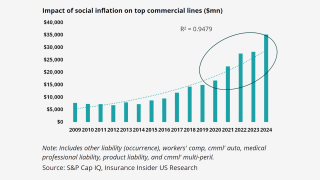

Juries don’t significantly differentiate in cases involving severe injury.

-

Economic volatility, including from tariffs and rising interest rates, is reshaping risk profiles for specialty insurers.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The risk also ranked as a top three concern for companies of all sizes.

-

The low degree of overlap between the combining portfolios benefits both parties.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

While the Fed is more concerned with jobs, other macroeconomic concerns trouble the industry.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The practice group will enhance the company’s existing offerings in E&S.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The carrier’s US and Europe claims teams will report to Dominic Clayden.

-

The deal is expected to result in $700mn in combined GWP in Florida upon completion.

-

Ransomware claims have made up the majority of recent large losses.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

Sources said that the carrier has held preliminary talks with private debt investors.

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

Reinsurers and their cedants are feeling their books are in better shape, although the market is still uneven.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Ryan Alternative Capital Re was launched in partnership with Axis Capital.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

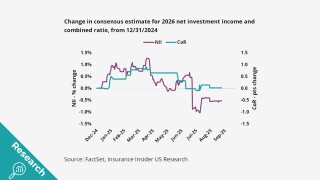

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

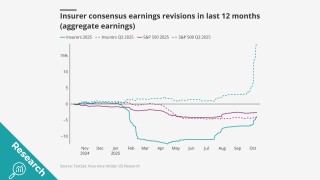

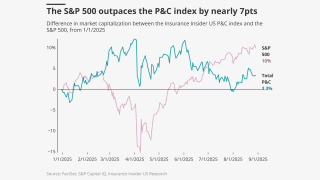

P&C stocks recovered faster than the S&P 500 following a late July dip, but a gap remains.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

The data modeling firm said losses previously averaged $132bn annually.

-

James River said the court was right to dismiss the fraud case.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

After the LA wildfires in Q1, carriers got some relief in Q2 ahead of wind season.