Risk Strategies

-

The business is beginning to integrate following a $9.8bn acquisition.

-

The move includes One80 Intermediaries, formerly part of Risk Strategies.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The Risk Strategies parent company had also been the subject of bids from Marsh and Howden.

-

The $10bn acquisition of Risk Strategies is the biggest broker deal relative to size we have seen.

-

The acquirer will carry out a ~$4bn equity placement to help finance the transaction.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

Sources said that negotiations are proceeding well with a path to do a cash deal.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The UK broker is still in talks with Mubadala about a standalone investment in the business.

-

Insurance Insider US examines potential tariffs’ impact on the PE-backed brokers amid the jammed conveyor belt.

-

Sources said Brown & Brown has an advantage as it entered the process several weeks ago.

-

Sources said the Evercore-run Risk Strategies process has drawn the interest of Brown & Brown.

-

The announcement comes amid discussions regarding a potential merger with Howden.

-

Challenges will include boosting the target’s organic growth, Building the Machine, and prepping for an IPO.

-

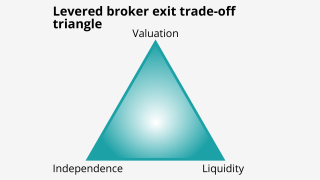

Some will play “pretend and extend”, but others will sell to strategics or take the steep climb to an IPO.

-

In June, Insurance Insider US revealed that the ~$550mn Ebitda business is working with Evercore to bring in a new ~30% backer.

-

Sources said that Evercore has been retained to run the strategic process for the ~$550mn Ebitda business.

-

Heron has over 25 years of brokerage experience, mostly in real estate roles.

-

Peter Fallon is retiring at year’s end after two decades with the firm.

-

Drew Carnase joined Risk Strategies two years ago and will be based in Boston, focusing on scaling and optimizing the commercial lines operations.

-

The companies will operate under common ownership of their private equity sponsor, Kelso & Company.

-

The executive joined Risk Strategies in 2014 through the acquisition of DeWitt Stern, where she served since 2000 and held a fine arts VP role.

-

This latest incremental financing is Golub Capital's 13th transaction with Risk Strategies since 2015.