Sompo

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

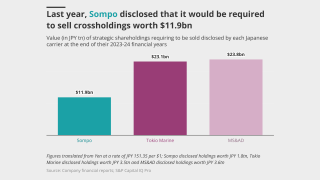

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

Analysis of market conditions, reserves show that this might not lead to an overnight consolidation boom.

-

Group CEO Mikio Okumura cited “solutions that have not been fulfilled”.

-

Sources see Aspen as the right fit for Sompo, with Apollo getting a full cash exit.

-

The lawsuit has been filed as sales talks with Sompo yielded a deal.

-

The Japanese company announced the $3.5bn deal today, three months after the Bermudian completed its IPO.

-

The Japanese carrier has agreed to buy Aspen for a realization of $3.5bn.

-

The all-cash deal values the Bermudian’s stock at a 36% premium.

-

This publication first reported deal talks last week.

-

The insurer has chosen a “take two” deal after buying Endurance, betting again on Bermuda.

-

This publication revealed yesterday that the two were in detailed takeover talks.

-

This publication revealed yesterday that Sompo is currently in negotiations with Aspen.

-

Sources said that detailed discussions have taken place, with a clear path to a deal.

-

The executive was previously head of excess casualty, North America.

-

This in turn gives carriers on a tower a little more liberty and less risk to optimize claim outcomes.

-

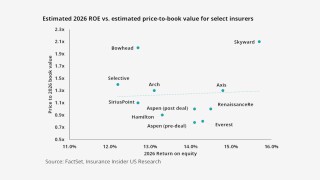

Conditions are coalescing for an uptick in carrier M&A after many subdued years.

-

The executive held senior roles at Allied World, Lockton and the Corporation of Lloyd’s.

-

The hire comes as the UK-based InsurTech continues its expansion plans in the US.

-

The carrier is also seeing growth opportunities across the West.

-

The Bermudian’s reserves will be on watch when its Japanese parent reports earnings.

-

David Bigley will also continue as head of property and catastrophe reinsurance.

-

The new platform includes over 400 workers’ compensation classes, including contractors, healthcare, hospitality, manufacturing and transportation.

-

Lamba joins as head of reinsurance, Canada, while Sheehan joins as senior vice president, head of North America accident and health reinsurance.

-

The executive will be responsible for the growth of the hospitality insurance portfolio and for providing service to current and prospective clients in this segment.

-

Sompo International has promoted Margaret Hyland to president of its North American reinsurance division. She replaces Steven Hanke, who is leaving for a “leading brokerage firm”, according to a statement.

-

Based in Boston, the executive will report to Sompo International CEO James Shea.

-

Dixon will report to North America CEO Christopher Sparro.

-

In her role as NA COO, Guyler-Alaniz will report to Leighton, but in her international responsibilities she will report to AgriSompo chairman and CEO Bob Haney.

-

Based in Boston, Willett will report to Jonathan Monks, Sompo’s EVP head of distribution, business development and client engagement for North America.

-

The storm is not expected to be a threat to the order of Jebi or Hagibis.

-

Based in North Carolina, the executive brings around two decades of P&C experience to the retail brokerage.

-

The platform will be launched with the support of listed energy company NextEra, with paper provided by its captive Palms Insurance.

-

The long-serving AIG executive has been on the boards of McGill and Partners and JLT since retiring.

-

Conditions for SPAC D&O are likely to remain turbulent, amid the heightened SEC scrutiny and uncertainty concerning claims resolution.