Start-ups

-

Longbrook Insurance will write multiple lines of business.

-

Sources said that the New York-based InsurTech retained Evercore to advise on the process.

-

It is understood that the MGA wants to start with renewable energy and transactional liability.

-

The UK-based insurer’s Florida Re secured state regulatory approval in June.

-

From the carrier perspective, alignment of interests was a recurring theme.

-

The company is looking to grow through its new MGA incubator program.

-

MGAs that are good operators will stick out compared to the rest.

-

A Lloyd’s consortium led by Beat Syndicate 4242 backs the MGA.

-

Return horizons are shifting, and entrepreneurial underwriters should start looking at longer tail business.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The MGU is entering the often-difficult habitational GL space with an initial E&S offering.

-

Tangram will become the inaugural portfolio company of Balavant Insurance.

-

It represents the platform’s formal entry into the commercial E&S market and will be led by EVP Neil Lipuma.

-

Altamont Capital MD Sam Gaynor said the goal is to have fewer programs that can each grow to a significant size.

-

The new MGU is expected to formally launch before the annual WSIA marketplace in San Diego.

-

Sources said that the start-up will be fronted by Bain-backed Emerald Bay.

-

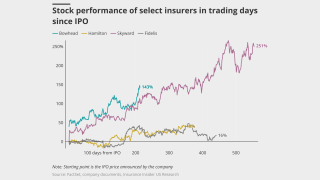

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The firm will target mid-market risks with TIVs of $25mn-$1bn.

-

The expansive European broker is targeting Mike Parrish’s team and former McGriff staff.

-

In The Car offers embedded auto insurance by integrating policies into dealership management systems.

-

The Bermuda-based team is led by John Fletcher.

-

BP Marsh has subscribed for a 49% shareholding in the start-up MGA.

-

The Miami-based underwriter will write lines of up to $5mn per risk for cyber and tech E&O.

-

The latest E&S player planning to IPO remains a “show me” story.

-

Former Aviva and AIA CEO Mark Wilson will lead the new initiative.

-

Planning for the carrier was halted in January due to the CEO’s health issues.

-

The Floridian is expecting to have around 40,000 policies in force by year-end.

-

The ex-Ategrity CEO launched Pivix Specialty in September 2024.

-

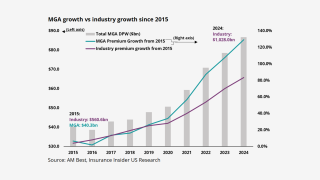

MGA growth is still strong but has passed its 2022 peak.

-

In a post on LinkedIn, Steve Arora said investor appetite “just wasn’t there”.

-

The fund apparently plans to purchase life insurance policies as investments.

-

The program is being launched through subsidiary Southern Marine.

-

K2 Cyber is entering an increasingly crowded cyber market.

-

The MGA will grow in specialty lines via talent recruitment and M&A coupled with technology enablement.

-

Sills’ background, a strong backing, and laser-sharp E&S focus make Bowhead stand out.

-

The start-up is closing a Series A fundraise.

-

The InsurTech was also removed from under review, negative.

-

The start-up has achieved an A- credit rating from AM Best.

-

The homeowners’ carrier has secured Floir approval.

-

WTW sold Willis Re to Gallagher in 2021 for $3.5bn.

-

The start-up has secured BMA approval as it looks to a 1 January kick-off.

-

The business will trade via London, the US and Canada.

-

Nationwide vet Mike Miller is launching the MGA, which focuses on the E&S market.

-

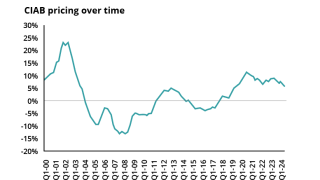

Interest in these vehicles has increased recently, but market softening could throw a curve ball at growth.

-

Elixir has an initial focus on cyber but will look to expand into other lines, including E&O and D&O.

-

Floir approved nearly 650,000 policies for takeout from Citizens for October and November.

-

The underwriting venture, Florida Re, will target both US and LatAm markets.

-

Neil Strong, Richard Holden and Jonathan Reiss have also joined as the leadership team is built out.

-

Conditions are coalescing for an uptick in carrier M&A after many subdued years.

-

This follows AIG’s voluntary dismissal of claims against Dellwood’s top execs.

-

AM Best assessed Dellwood’s balance sheet strength as “very strong”.

-

A standalone syndicate could offer capital, trading, and licensing advantages.

-

The start-up's founder set out the new broker’s strategy, M&A goals and structure.

-

Cyrus Walker will also serve on the new retail broking venture’s board of directors.

-

PE house Vistria will back the buy-and-build strategy in the independent agency space.

-

The front has lined up its first 10 programs and is confident it will get at least seven or eight of them.

-

Earlier this week, this publication revealed that Axis and Accelerant will support the recently launched MGA.

-

The M&A insurance MGA also secured support from Accelerant.

-

The firm launched late last year in the US with a $250mn capital injection, and has also acquired a UK platform.