Tokio Marine

-

The acquisition brought four collector vehicle MGAs to the carrier’s existing collector vehicle portfolio.

-

The carrier is currently focused on ~$1bn bolt-on acquisitions.

-

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

The insurer’s system has now been out of commission for over two weeks.

-

She joins from Liberty Mutual, where she spent almost three years in various senior roles.

-

The team is led by ex-Liberty Mutual executive David Perez who was hired for the launch in October.

-

The market is also facing potential losses from injuries to NFL stars.

-

The LA wildfires, however, will be the firm’s largest event to date.

-

The specialty insurance platform has now exceeded $3.1bn in premiums.

-

The executive, Mike Schell, has over 50 years of industry experience.

-

Kritzman has been with TMHCC for more than seven years.

-

Stuart Heath will retain his current role of head of delegated property.

-

John Csik is retiring as president after nearly 40 years with the company.

-

After recording triple digit growth in 2020-2022, the US cyber market grew just 1.6% in 2023.

-

He will oversee the launch of Tokio Marine’s new excess casualty line.

-

Conditions are coalescing for an uptick in carrier M&A after many subdued years.

-

A roundup of today’s need-to-know news, including leadership changes at Chubb.

-

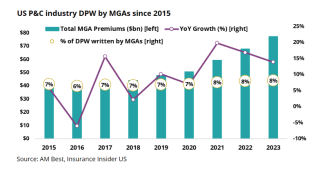

MGAs outpaced the P&C industry for years, but growth has begun to stagnate.

-

TMHCC said the appointments underline its "commitment to innovation, market expansion and customer service".

-

Tokio Marine's international co-head Williams is handing the role to TMK CEO Irick.

-

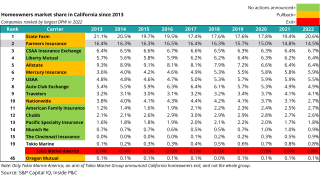

Sources said that TMA ran a profitable book in California that included personal auto and homeowners’ policies.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The carrier is one of a number of small firms with heavy concentration in Hawaii.

-

Farmers Insurance becomes the latest major national carrier to pump the brakes in California, limiting new business to only 7,000 policies per month, signaling further problems in the state’s homeowners’ market.