-

The outlook flags “large uncertainties” amid possible El Niño through summer 2026.

-

MGAs going public is now a viable option, but dominating a market comes first.

-

The highest portion of losses was experienced in Alberta.

-

Admitted carriers on the other hand are still exercising caution as regulatory reforms take hold.

-

An “extraordinary” proportion of storms reached Category 5 status this year.

-

Many carriers are still pricing above technical rate, but could reassess their strategies after Q1.

-

Light cat losses at year-end portend capital deployment and return decisions in 2026.

-

The peril has been historically difficult to model compared to others.

-

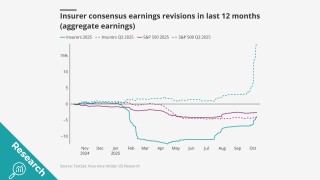

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

The deal to reopen the government also extended the NFIP.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The credit can now be applied to mitigation against operational losses.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Widespread underinsurance and low exposures will limit losses.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

Exposure for California’s Fair plan has jumped, as insurers drop policyholders.

-

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

A former NOAA climatologist who left the agency is running the new operation.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Critics claim the dispute system denies consumers' key legal rights.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

A US district judge ruled a delay could put human life and property at risk.

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.