-

The peril has been historically difficult to model compared to others.

-

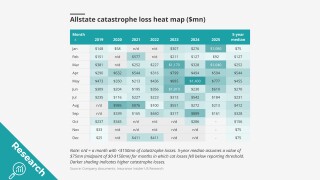

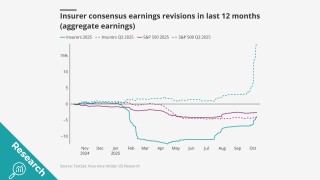

Insurers with SCS exposure reaped fewer benefits but still improved over Q3 2024.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

The deal to reopen the government also extended the NFIP.

-

The executive said inflation isn’t completely gone but is now “more understood”.

-

The credit can now be applied to mitigation against operational losses.

-

The Marsh-placed account renews its all-risks cover on 16 November.

-

Widespread underinsurance and low exposures will limit losses.

-

While attritional losses were up for the quarter, those in the carrier’s core business declined.

-

Many commercial risks will have London coverage, but insured values are relatively low.

-

The NFIP expiration and a successful Neptune IPO got attention, but some reinsurers moved earlier.

-

Exposure for California’s Fair plan has jumped, as insurers drop policyholders.

-

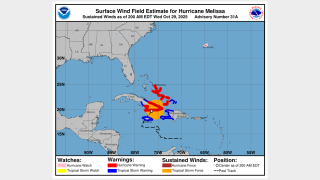

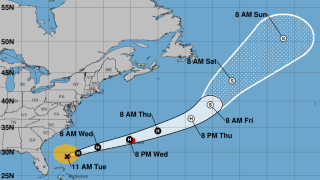

Hurricane warnings are in place for Guantanamo, Holguin and Las Tunas.

-

Economic losses from the Cat 5 storm could run 30%-250% of the country’s GDP.

-

A US landfall is not expected, but the storm could hit the Bahamas by Friday.

-

The storm could bring flooding to Jamaica, Cuba and Haiti.

-

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

A former NOAA climatologist who left the agency is running the new operation.

-

Cat losses in Q3 were light as peak hurricane season passes without incident.

-

Critics claim the dispute system denies consumers' key legal rights.

-

Nine-month insured losses still exceeded $100bn due to California wildfires.

-

Though wildfire losses are up, total losses are the lowest since 2015.

-

A US district judge ruled a delay could put human life and property at risk.

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

The governor has yet to sign a pending bill to create a public cat model.

-

Lighter cat losses a plus, while top-line, organic growth and reserving concerns persist.

-

Jonathan Rinderknecht was arrested Tuesday on destruction of property charges.

-

The insurer of last resort currently has $2.15bn of cat bond protection on risk.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

Expansion into adjacent markets, capital return and M&A among top means of capital deployment.

-

The ratings agency cited a reduction in exposure to nat cat risk as a reason for the change.

-

Home buyers looking to close on a mortgage could find the private market an attractive alternative.

-

Winds have strengthened to 80 mph, and the hurricane is expected to intensify further over the next 48 hours.

-

The jump in the latest estimate could be due to damage to seasonal properties only being recently discovered.

-

The NHC also warned that a hurricane watch could be required in Bermuda as early as Monday afternoon.

-

According to McKinsey, the projected spending on data centers is expected to hit $6.7tn by 2030.

-

The tropical cyclone is expected to be named Imelda.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

Despite the formation of Gabrielle, there is "a very high probability" of a below-average season.

-

The risk also ranked as a top three concern for companies of all sizes.

-

Whether in property or casualty, areas of the market will be profitable even with new entrants, the executive said.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

Cat losses in August were below historical trends, but we are not in the clear just yet.

-

Following the Golden Age of Specialty, franchise quality will play a bigger role in determining success.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The specialty MGA said it didn’t experience direct losses from the LA wildfires.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

A report by the ratings agency challenges current industry wisdom.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Models anticipate a busier second half, particularly in the next few weeks.

-

The wildfire MGA is expecting to write higher value homes soon and may expand into new states.

-

Ransomware claims have made up the majority of recent large losses.

-

The company saw a 53% decrease in cyber claims after a surge in 2024.

-

The fundraising round brought in $50mn for the insurer.

-

Supply for property outstrips demand, but the casualty market is “bifurcated”.

-

The bi-partisan legislation would make FEMA a cabinet-level agency.

-

Despite rate reductions accelerating, the sector-wide combined ratio is set to remain below 90% through 2027.

-

The rest of 2025 appears poised to remain favorable for insureds, however.