-

Newfront’s business units will be combined with Risk & Broking and Health, Wealth & Career.

-

Sources said that the New York-based InsurTech retained Evercore to advise on the process.

-

InsurTech funding was down 7.3% from $1.09bn in the prior quarter.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The carrier is consolidating its venture capital activity into asset manager MEAG.

-

The insurer has been under review with positive implications since March.

-

Full-stack carriers fail to outclass incumbents with no clear platform differentiation.

-

The lawsuit is the latest development in the multi-billion dollar reinsurance scandal.

-

The company plans to launch in New York and New Jersey next year.

-

The tech could quickly open the door to disruptors, and firms with poor data management will lose out.

-

More investment in early stage firms is an indicator of bullish market, says Gallagher’s Johnston.

-

Its partnership channel grew three times in new writings year-over-year.

-

CEO Rick McCathron also said the company is seeking to diversify its portfolio.

-

The company reduced its proportional quota share program from 55% to 20% cession.

-

The executive has been with the company for roughly one year.

-

The cyber business will continue to operate as a standalone entity.

-

The company said the reduction was due to years of steady improvements.

-

The Florida homeowners’ InsurTech went public today at $17 per share.

-

The carrier is pricing shares at the upper end of the range announced this month.

-

This is up from last year’s $1bn protection for its Florida treaty.

-

The deal triples Hippo’s new homeowner leads and extends Baldwin’s MGA capacity.

-

The Floridian is the third insurance company to go public in 2025.

-

The Series C brings the company's valuation to $2.1bn, its highest to date.

-

A week ago, this publication revealed that Slide was pressing ahead with its IPO plans with an S-1 filing.

-

He will also invest in the company.

-

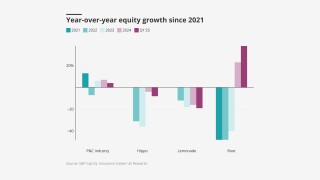

Shares were down as much as 20% after Hippo posted a $48mn loss.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Nordic operations have capacity provided by Allianz Commercial.

-

The sale price represents Elephant’s approximate net asset value.

-

The specialty insurance platform has now exceeded $3.1bn in premiums.

-

The executive will also oversee premium audit and customer service.

-

The InsurTech was also removed from under review, negative.

-

It makes sense for Next to secure a sale as an exit strategy in an increasingly challenging funding environment.

-

Ahead of the deal, Ergo owned a 29% stake in Next, which generated top line of $548mn last year.

-

The funding round valued the company at around $850mn.

-

Hippo estimated its pre-tax cat loss from the LA wildfires at $42mn.