-

Plaintiffs claim climate-induced cat losses have spurred increases in premiums.

-

The subsegment is the latest commercial auto sector to feel the heat of litigation losses.

-

Many carriers are still pricing above technical rate, but could reassess their strategies after Q1.

-

The carrier said it anticipates a better market due to recent reforms.

-

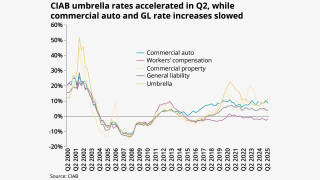

Casualty rate increases largely stabilized in Q2 and Q3 at 5%-10% for general liability.

-

Despite a softening market, underwriters were still able to attain up to 10% above technical pricing.

-

With property getting more competitive, FM pursued an opportunity for growth in E&S with Velocity.

-

Softening rates amid worsening loss costs paints an uncertain future for the industry.

-

The agency cited moderating premium growth and selective underwriting capacity as factors behind the downgrade.

-

The broker said R&W rates rose to 2.8% in Q2 vs 2.5% in Q1.

-

The growth and profitability survey predicts 8.5% median growth for 2025.

-

Workers’ compensation was the only line that saw a YoY decrease.

-

Rate decreases are often in double digits, but high loss trends and systemic risk persist.

-

The insurer reached highs of over 1.4 million policies in September 2023.

-

Some disagreement remains in where rate declines have been swiftest and how much further they could go.

-

The specialty carrier’s share price fell nearly 7% on the day of the call.

-

Workers’ comp rates dropped again, but the decline slowed from last quarter.

-

September’s medical care index increase follows a 0.2% drop in August.

-

While limited to only some accounts, it’s a sign of the intense competition in the segment.

-

Property insurance rates declined by 9%, the same as in the prior quarter.

-

Property pricing fell by 8%, while casualty rate increases tapered to 3%.

-

MGAs that are good operators will stick out compared to the rest.

-

Property, cyber and workers’ comp rates were all down mid-single digits, offsetting casualty hardening.

-

Rachel Turk was speaking on an Aon Reinsurance Renewal Season panel.

-

An average of 81% of property accounts renewed flat or down.

-

As the Great Japanese M&A Contest develops, the executive said inorganic expansion is “a top priority”.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Shared and layered accounts are seen as reaping the biggest benefits.

-

Growth concerns were top of mind at this year’s conference.

-

Property underwriters are ‘competing fiercely’ to access mining risks.

-

As both carriers and reinsurers deal with softening markets, all eyes are on hurricane-prone areas.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

Insurers continue to compete on price, especially in the SME sector.

-

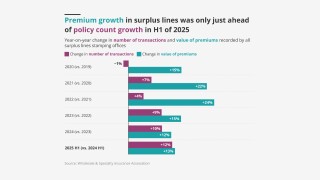

Trailing three month premiums were up 7.2% versus 13.1% in August.

-

Juries don’t significantly differentiate in cases involving severe injury.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

Rates continue to be favorable for buyers across major lines of coverage.

-

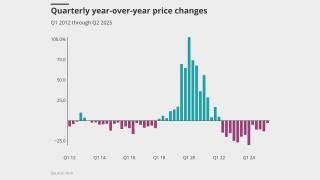

Global pricing is now 22% below the mid-2022 peak.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

-

Litigation funders are promoting “aggressive” tactics in the UK, Holland and Israel.

-

Despite high profile losses, there’s ample capacity in marine and aviation, while PV has seen healthy profits.

-

All rates were up on a year-over-year basis, except for workers’ compensation.

-

Rates will remain elevated in a period of structurally higher risk premia.

-

Growth in the SME sector could help stabilize the market, however.

-

The rest of 2025 appears poised to remain favorable for insureds, however.

-

California, Florida and Texas all saw decreases in monthly premium growth.

-

Some 32% of survey respondents expect property cat rates to fall by more than 7.5%.

-

Rates are finally flattening, but it’s unclear if stabilization is enough for insurers’ bottom line.

-

Last year marked the second consecutive year in which carriers made a positive return.

-

Capacity has gone up slightly, with new entrants and incumbents feeling better about their books.

-

The program is aimed at affluent homes valued between $1mn and $6mn.

-

GL and workers’ comp, however, may benefit from a more competitive environment.

-

Ongoing pricing headwinds stand to weigh on carriers’ returns and valuations.

-

This is the first rate filing to use the recently approved Verisk model.

-

Commercial auto saw the largest rate change, which was down about a half point by the end of July to 7.96%.

-

July’s medical care increase was up from June’s o.6%.

-

Price decreases became lower throughout Q2, however, averaging 3% in April, 2.3% in May and 1.6% in June.