-

NY lawmakers are preparing a legislative package to address insurance costs in the Empire State.

-

The carrier said it anticipates a better market due to recent reforms.

-

Similar bills targeting fossil fuel firms have been introduced in other states.

-

Senators asked for data on fraud but weren’t given any.

-

Whether Clement's promotion was influenced by an inappropriate relationship is in scope.

-

He will be replaced at a time when Fema is considering structural reforms.

-

The deal to reopen the government also extended the NFIP.

-

The Caymans-based reinsurer’s Q3 CoR was 86.6%, down 9.3 points YoY.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

Industry sources said they expect most larger firms will be able to meet the requirements.

-

California may not be the only state to see non-economic damage caps in medmal get challenged.

-

State regulators have largely avoided enforceable AI regulations, but bad news could change that.

-

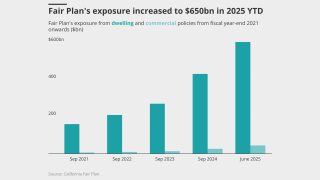

The insurer reached highs of over 1.4 million policies in September 2023.

-

The FIO said it will work with regulators on coverage for digital assets.

-

The regulations are designed to address long-term solvency concerns.

-

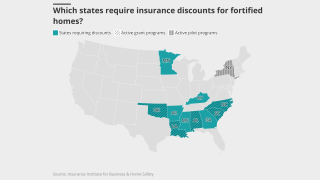

The bill includes provisions to encourage retrofitting homes in high-risk areas.

-

September’s medical care index increase follows a 0.2% drop in August.

-

A former NOAA climatologist who left the agency is running the new operation.

-

Critics claim the dispute system denies consumers' key legal rights.

-

The insurer booked a $950mn policyholder credit expense in September.

-

State Farm is under investigation as its premiums have been rising “drastically".

-

Activists from the left and the right are focusing on insurance, often on the same issues.

-

A US district judge ruled a delay could put human life and property at risk.

-

The federal panel hasn’t finalized a timeline for formulating the new rules.

-

The governor has yet to sign a pending bill to create a public cat model.

-

The state’s AG said the case threatens continued offshore oil and gas operations.

-

The executive said record operating income and returns don’t indicate Chubb is “beleaguered”.

-

The request cites use of Verisk’s forward-looking wildfire model.

-

New home sales could be impacted by a prolonged stalemate.

-

Superintendent Harris is stepping down this month after four years of service.

-

The executive has been with ASG since it was formed in 2016.

-

California’s insurance regulator has Fair Plan depopulation, cat models on his mind.

-

The insurance industry’s lower reliance on foreign skilled workers softens the blow.

-

Sources said momentum around resiliency laws is growing at the state and local level.

-

The proposed changes aim to establish clear guidelines for intervenors.

-

As data privacy litigation increases, insurers increasingly lean on exclusions.

-

The measures also seek to encourage greater wildfire mitigation efforts.

-

The affirmations reflect Everest’s strong underwriting diversification.

-

IBHS CEO Roy Wright says insurers need a comprehensive approach to resilience.

-

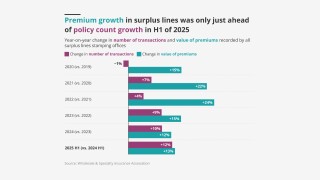

Winners and losers will emerge more clearly, with less opportunity to ride the market wave.

-

A report by the ratings agency challenges current industry wisdom.

-

The annual meeting took place in Pasadena, California, miles from the site of LA wildfires.

-

Florida led deregulation by eliminating the diligent effort rule in June.

-

The carrier notified California regulators that it would stop renewing plans starting last month.

-

The ratings outlook has also been revised to stable from negative.

-

Lawyers said uncertainty raises litigation risks, and signals from the federal government aren’t expected to help.

-

The bi-partisan legislation would make FEMA a cabinet-level agency.

-

The action follows Sompo’s $3.5bn all-cash acquisition of Aspen Insurance.

-

Ratings agency said the Sompo deal could have positive financial and operational benefits for the Bermudian.

-

The violations included not using properly appointed adjusters and failing to pay claims.

-

Lawmakers are seeking input on risk evaluation, limits and other concerns.

-

The group claims the White House is undermining disaster preparedness.

-

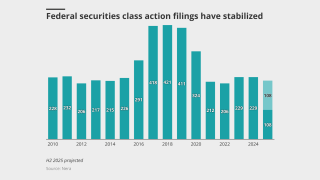

The Delaware high court’s reasoning could find application in other cases.

-

This is the first rate filing to use the recently approved Verisk model.

-

July’s medical care increase was up from June’s o.6%.

-

The model becomes the second in the state to get approval to affect ratemaking applications.

-

This follows last month’s takeout of 12,000 Citizens policies.

-

Roughly half a year since the LA fires, brokers said there’s hope things are turning around.

-

A growing divide in business courts could impact future D&O underwriting, sources said.

-

The company adjusts its rate options to expand California business under the new cat model.