AIG

-

Purtill became interim CFO in January after AIG terminated Mark Lyons, saying the executive violated his confidentiality/non-disclosure obligations to the firm.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

AIG offered 65 million existing shares of common stock, or about 10% of approximately 648 million total shares outstanding.

-

The carrier is offering 65 million shares of common stock, out of approximately 648 million total shares outstanding.

-

Marcial will take over the position left vacant after the departure of Juan Costa, who moved to Berkshire Hathaway as casualty VP in Atlanta.

-

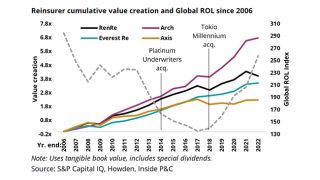

The recent deal is accretive at 18% and will allow RenRe to take further advantage of the hard market.

-

The group exited an off-strategy business at an attractive valuation – now it must give a clearer indication of where it is going.

-

The carrier intends to use the cash raised as part of its consideration for Validus.

-

Proxy advisers had called for shareholders to reject the pay deals, which feature a $50mn pay award for CEO Peter Zaffino.

-

The Dan Loeb-controlled investment firm reduced its position in AIG to 2.95 million shares, or ~0.4%, in Q1, from or 5.1 million shares, or around 0.7%, at the end of Q4.

-

Speaking about the recently spun-out HNW MGA, Zaffino said AIG expects to bring on additional capital providers to the subsidiary through H2 2023.