AIG

-

Activist investors are successfully learning how to navigate a regulated industry.

-

At the carrier’s AGM, more than a quarter of votes were cast against a non-binding resolution to approve compensation arrangements.

-

AIG-owned surplus lines insurer Lexington is bringing to market a combined professional and general liability policy offering "dual tower aggregate limits" aimed at healthcare facilities in the small to medium-sized enterprise (SME) segment.

-

The pivot to profitable growth will be a topic to watch as investors patiently wait for this execution to deliver real margin improvement.

-

The CEO of general insurance says AIG achieved average rate increases of 41% for cyber business at Q1.

-

The carrier’s North American commercial lines unit grew net written premiums by 29% to $2.7bn.

-

Binding insurers include Chubb and AIG, with reinsurance from Munich Re.

-

She has held several casualty underwriting leadership positions at the company, where she has worked since 2009.

-

The underwriting executive has worked at the carrier since 2006.

-

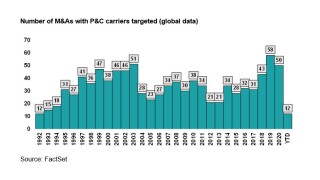

The next few years could prove to be more active in consolidation than normal for underwriters.

-

The remarks come in the context of a dispute over ballot access in Georgia, as corporations speak out.

-

Claude Wade spent six years at Marsh in various COO roles, at a time when Zaffino was CEO.

Related

-

Hallworth to succeed Wade as AIG’s chief digital officer

August 18, 2025 -

AIG becomes minority equity investor in Salford City FC

August 12, 2025 -

Former Lexington and Ironshore CEO Kelley dies

August 08, 2025