AIG

-

Pre-adverse development cover, the carrier saw impact from directors’ and officers’ and mergers and acquisitions-related business.

-

The insurer said it had shaved about 7 percent off overall reinsurance costs.

-

The carrier cut gross limits for the class of business by $40bn during the quarter.

-

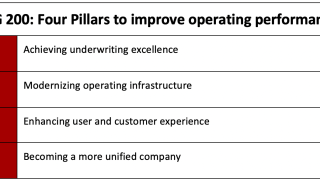

We revisit key issues at stake at a crucial point of AIG's operating turnaround.

-

According to sources, AIG underwriters globally have been told not to write new construction risks in Latin America.

-

AIG's head of global specialty business Peter Bilsby has left his post and will be replaced on an interim basis by global head of energy and construction Gordon Browne.

-

AIG’s decision to exit the surety market illustrates that the re-underwriting wheels continue to turn at the carrier as it looks to dampen underwriting volatility and move away from its previous “large-limits strategy”.

-

Sources said Island Express Helicopters holds a $50mn hull and liability insurance policy.

-

The AIG executive urged carriers to be "part of the solution" and help customers transition to cleaner energy.

-

The Asia Pacific CEO’s departure from the general insurance division follows the exit of Chris Townsend earlier this month.

-

Speculation linking AIG with a bid for Voya highlights the competing operating and capital allocation challenges facing company in 2020.

-

The US insurer was one of several firms believed to have courted the retirement plan provider last year.

Related

-

Hallworth to succeed Wade as AIG’s chief digital officer

August 18, 2025 -

AIG becomes minority equity investor in Salford City FC

August 12, 2025 -

Former Lexington and Ironshore CEO Kelley dies

August 08, 2025