AJ Gallagher

-

The broker upgraded its Q1 outlook with more optimism on later quarters, and increased confidence on margins and M&A.

-

According to the Capitol Form, antitrust regulators will consider the deal's impact on the world’s fourth largest insurance broker AJ Gallagher

-

The broker could be preparing to raise capital to invest in upcoming M&A deals.

-

Gallagher Re has hired Andrew Rothseid to the new role of head of legacy within its structured solutions practice.

-

The intermediary will join Gallagher's Southwest region under Scott Firestone.

-

A fair amount of what was reported was "old news", but the two brokers did offer some worthwhile takeaways.

-

The broker also said that its reinsurance business was growing at double digits, with margins in excess of 30%.

-

The growth figure was in line with Q3, but remained below pre-pandemic highs.

-

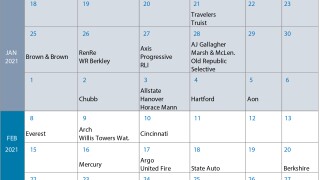

Inside P&C’s research team examines some of the areas that will be closely watched during the results season.

-

The California-based program administrator specializes in workers’ comp and specialty property programs.

-

The agency specializes in placing cover for the healthcare, real estate and construction industries.

-

The broker's investor day included an encouraging 2021 growth outlook and signs of more recurring margin benefits.

Related

-

AJ Gallagher completes AssuredPartners acquisition

August 18, 2025 -

Agency deal roundup: USI, Lockton, Gallagher and Higginbotham

August 08, 2025