AJ Gallagher

-

Paul spent five years at Gallagher Re in addition to 10 years at Guy Carpenter.

-

The Plane Talking report said the longevity of the ‘buyers’ market’ is in question.

-

In all, primary insurance renewal premiums have risen 6% so far in Q3.

-

Former Artex managing director Jasmine DeSilva will run the segment.

-

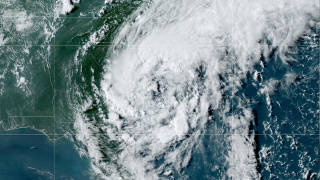

Francine is expected to make landfall in Louisiana tomorrow.

-

The executive was previously Guy Carpenter’s head of sales in New York.

-

-

Sources said that Guy Carpenter has promoted Jennifer Paretchan to succeed Mowery.

-

Debby should be a “very manageable” storm for the (re)insurance market, it said.

-

Annual InsurTech funding volume for H1 was $2.2bn, just below $2.3bn for H1 2023.

-

The broker said that rising reinsurance costs after the Baltimore Bridge collapse could put a brake on softening in 2025.

-

CFO Doug Howell said the company has invested around $700mn in M&A this year.

Related

-

Frequency covers and attachment points focus of 1.1 talks: Gallagher Re

September 02, 2025 -

AJ Gallagher completes AssuredPartners acquisition

August 18, 2025 -

Agency deal roundup: USI, Lockton, Gallagher and Higginbotham

August 08, 2025