American Coastal

-

The violations included not using properly appointed adjusters and failing to pay claims.

-

Floir has greenlit at least 14 new companies for operation in Florida in the last few years, contributing to the competition.

-

Rates continue to fall across the state but are firmer in the southeast region.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

In February, the company announced it received regulatory approval for the deal.

-

The CEO expects to see a larger shift between condos and apartments in 2026 and 2027.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

His predecessor Peed remains with the firm as executive chairman.

-

The new agreement provides $40mn of aggregate limit excess of zero.

-

The Floridian also announced the completion of its first-ever takeout from Florida Citizens.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Floridian insurer anticipates that it will remain profitable in Q3 and Q4 despite hurricane activity.

-

The Floridian anticipates Hurricanes Debby and Helene to incur losses of $3.8mn in Q3 2024.

-

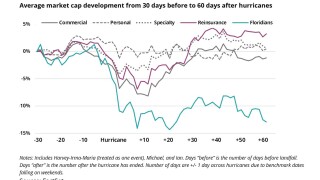

Shares gained after Hurricane Milton did less damage than anticipated.

-

Milton threatens to make landfall in Florida shortly after Helene.

-

The storm brought a lot of rain, but the Floridian doesn’t provide flood insurance.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

AmCoastal also cut its board down to five members, including two new appointments.

-

The company plans to reduce its quota share to 20% from 40%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The closing of the Interboro sell-off was postponed to nearer the end of the year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The transfer is intended to allow Brad Martz to “focus on his position as president of American Coastal,” the company said in a regulatory filing.

-

The agreement provides coverage for in-force, new and renewal business, with up to $100mn of limit excess of $10mn per occurrence.

-

A non-binding term sheet was signed on October 6, whereby the buyer will acquire 100% of Interboro’s issued and outstanding securities in exchange for cash.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The Inside P&C news team runs you through the earnings results for the day.

-

ACIC’s program offers sufficient coverage for approximately a one-in-167-year event and a one-in-100-year event followed by a one-in-50-year event in the same season, the company said.

-

Forecasts for “near-normal” activity may mean the chance at a reprieve for the Florida market, but a history of underestimates warrants caution.

-

The company now expects to file the quarterly report on or before May 22.

-

The company is also nearing completion of Interboro Insurance Company’s program renewal.

-

United said it will require additional time to finalize its financial statements and disclosures “related to subsequent events”.

-

Executives were speaking after the company reported a combined ratio of 308.8% for the fourth quarter, a 200-point hike from the prior-year period.

-

United Insurance Holdings said it had fully exhausted its personal lines reinsurance cover on the event, rendering its personal lines carrier insolvent.

-

The move follows the company’s loss estimate increase to $1.54bn from a preliminary estimate of $1bn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm will exhaust its personal lines reinsurance coverage on the storm, pushing its personal lines carrier into insolvency, with commercial claims doubling.

-

The moves follow RenRe’s positive feedback on January 1 renewals, and UPC selling most of its outstanding policies in Florida to InsurTech Slide.

-

The transaction provides relief for policyholders and agents, but especially for those policyholders whose policies expire past UPC’s June 1 deadline.

-

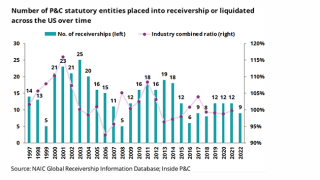

Receivership has been historically lower in the past 20 years, but trouble in Florida breaks away from the overall P&C industry trend.

-

The carrier had earlier signalled that uncertainty over reinsurance would affect its ability to write new business.

-

KBRA also affirmed the A- ISFR for subsidiaries American Coastal Insurance Company and Interboro Insurance Company.

-

In late August, UPC signaled that it will pull out of personal lines in Florida, Texas, Louisiana and New York.

-

Expanded state reinsurance support and legal reforms will be top priorities as Florida insurers face another retention loss.

-

The executive added that the company's expected retention from a second event is estimated at $31.8mn.

-

UPC’s closing price hit the bottom of $0.99 per share on Sept 6 and has remained below the $1.00-threshold ever since.