American Coastal

-

The violations included not using properly appointed adjusters and failing to pay claims.

-

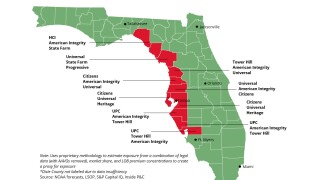

Floir has greenlit at least 14 new companies for operation in Florida in the last few years, contributing to the competition.

-

Rates continue to fall across the state but are firmer in the southeast region.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The total cost excluding a 15% quota share was $201.85mn, with rates down 12.2% from last year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

In February, the company announced it received regulatory approval for the deal.

-

The CEO expects to see a larger shift between condos and apartments in 2026 and 2027.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

His predecessor Peed remains with the firm as executive chairman.

-

The new agreement provides $40mn of aggregate limit excess of zero.

-

The Floridian also announced the completion of its first-ever takeout from Florida Citizens.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The Floridian insurer anticipates that it will remain profitable in Q3 and Q4 despite hurricane activity.

-

The Floridian anticipates Hurricanes Debby and Helene to incur losses of $3.8mn in Q3 2024.

-

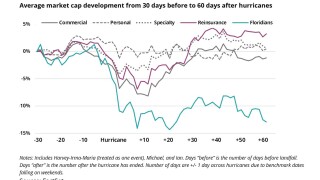

Shares gained after Hurricane Milton did less damage than anticipated.

-

Milton threatens to make landfall in Florida shortly after Helene.

-

The storm brought a lot of rain, but the Floridian doesn’t provide flood insurance.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

AmCoastal also cut its board down to five members, including two new appointments.

-

The company plans to reduce its quota share to 20% from 40%.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The closing of the Interboro sell-off was postponed to nearer the end of the year.

-

The Insurance Insider US news team runs you through the earnings results for the day.

-

The transfer is intended to allow Brad Martz to “focus on his position as president of American Coastal,” the company said in a regulatory filing.

-

The agreement provides coverage for in-force, new and renewal business, with up to $100mn of limit excess of $10mn per occurrence.

-

A non-binding term sheet was signed on October 6, whereby the buyer will acquire 100% of Interboro’s issued and outstanding securities in exchange for cash.

-

The Inside P&C news team runs you through the earnings results for the day.

-

The Inside P&C news team runs you through the earnings results for the day.

-

ACIC’s program offers sufficient coverage for approximately a one-in-167-year event and a one-in-100-year event followed by a one-in-50-year event in the same season, the company said.

-

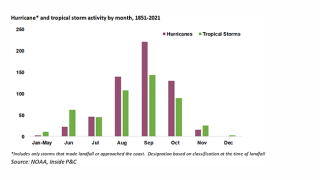

Forecasts for “near-normal” activity may mean the chance at a reprieve for the Florida market, but a history of underestimates warrants caution.

-

The company now expects to file the quarterly report on or before May 22.

-

The company is also nearing completion of Interboro Insurance Company’s program renewal.

-

United said it will require additional time to finalize its financial statements and disclosures “related to subsequent events”.

-

Executives were speaking after the company reported a combined ratio of 308.8% for the fourth quarter, a 200-point hike from the prior-year period.

-

United Insurance Holdings said it had fully exhausted its personal lines reinsurance cover on the event, rendering its personal lines carrier insolvent.

-

The move follows the company’s loss estimate increase to $1.54bn from a preliminary estimate of $1bn.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm will exhaust its personal lines reinsurance coverage on the storm, pushing its personal lines carrier into insolvency, with commercial claims doubling.

-

The moves follow RenRe’s positive feedback on January 1 renewals, and UPC selling most of its outstanding policies in Florida to InsurTech Slide.

-

The transaction provides relief for policyholders and agents, but especially for those policyholders whose policies expire past UPC’s June 1 deadline.

-

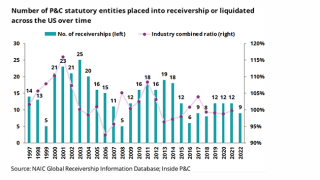

Receivership has been historically lower in the past 20 years, but trouble in Florida breaks away from the overall P&C industry trend.

-

The carrier had earlier signalled that uncertainty over reinsurance would affect its ability to write new business.

-

KBRA also affirmed the A- ISFR for subsidiaries American Coastal Insurance Company and Interboro Insurance Company.

-

In late August, UPC signaled that it will pull out of personal lines in Florida, Texas, Louisiana and New York.

-

Expanded state reinsurance support and legal reforms will be top priorities as Florida insurers face another retention loss.

-

The executive added that the company's expected retention from a second event is estimated at $31.8mn.

-

UPC’s closing price hit the bottom of $0.99 per share on Sept 6 and has remained below the $1.00-threshold ever since.

-

The insurer has received roughly 19,000 claims to date and estimates it will receive 27,000 to 30,000 claims.

-

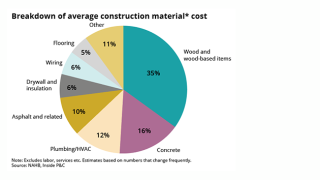

As the loss numbers for Hurricane Ian begin to come into focus, three topics to watch are impact from demand surge, litigation trends, and rate activity.

-

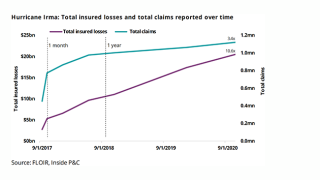

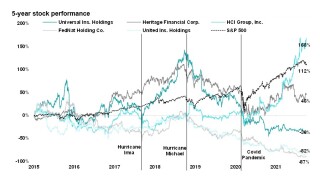

Hurricane Ian’s total effect is still unknown, but lessons from Hurricane Irma give insight into potential outcomes.

-

If current forecasts prove accurate, this will be a pivotal moment for the already off-balance Florida cohort and could result in a new market landscape.

-

In late August, UPC signaled that it will pull out of personal lines in Florida, Texas, Louisiana and New York.

-

With the most active hurricane month just a week away, the moment of truth has finally come for the already strained Floridians.

-

On August 1, Demotech downgraded UPC's financial stability rating by two notches to M from A.

-

It is unclear if policies transferred by UPC to other entities through quota shares and renewal rights deals are covered by federal mortgage institutions.

-

The insurer also completed the reorganization plan to consolidate its four Florida domiciled insurance carriers into two.

-

Just last week, the insurer launched a strategic review as the latest insurance carrier to run into challenges operating in the state’s homeowners’ market.

-

There is no guarantee that the process will yield a particular transaction.

-

Kiln and UPC partnered to form the insurer in 2018, but it was merged into American Coastal earlier this year

-

The sector was hit by a rough first half of 2022, with more to come in the second half of the year.

-

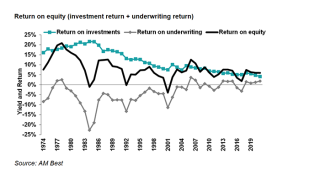

Insurers could face pressure if interest rate and recession fears intersect with worsening loss cost trends.

-

The consolidation plan, subject to regulatory approval, seeks to create a more efficient operating structure for United going forward.

-

The firm said its results reflect its aim to return to profitability in 2022.

-

The Inside P&C research team looks forward to the big issues of the new year.

-

The Florida-headquartered carrier blamed litigation rates and rising reinsurance costs for the move.

-

Inside P&C's Research team looks at the prospects of Florida's wave of new arrivals.

-

Coupled with aggregate cover the company has in place, United said Thursday that exposure to cat events for the remainder of its current reinsurance program would be $9mn.

-

She previously worked as VP underwriting for IAT insurance group, a Florida based property-casualty carrier.

-

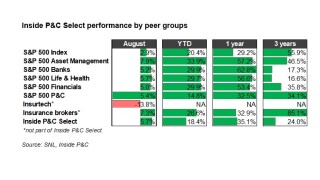

The Inside P&C Select Index outperformed the S&P 500 (5.7% to 2.9%) in August, despite Hurricane Ida making landfall.

-

The Florida-based carrier is now scaling back personal lines exposure and raising rates after reporting a $25mn Q2 loss.

-

The carrier reduced its catastrophe retentions and increased quota share reinsurance protection.

-

In a filing, the company said he was leaving the post “to pursue another opportunity”.

-

UPC’s early look at its expected cat toll for Q2 – typically a quiet period for cat events – could be a signal that the quarter was busier than usual for weather events.

-

Following strong year-to-date performance, P&C stocks were down in June after a change of tone in a Fed meeting.

-

The carrier cut back its treaty limit by around 13% and lowered its deductible.

-

UPC also said it had retained Raymond James to explore a sale of Interboro, in a bid to deleverage its capital.

-

This came as the insurer said its reinsurance programme was oversubscribed and it expected rate increases to be in a mid single digit range.

-

United Insurance Holdings reported a core after-tax loss of $19.4mn for the first quarter of 2021, as elevated natural catastrophe claims from Winter Storm Uri and a $30mn reserve charge weighed on the carrier’s results.

-

UIHC attributed the reserve charge to a “significant increase” in litigated claims volume in the quarter.

-

Senator Jeff Brandes and local insurance law experts tell this publication that the state’s insurance market will be hugely vulnerable without reform.

-

CEO Dan Peed says the company will develop direct-to-consumer products and work on improving the carrier’s underwriting performance.

-

Catastrophes increased the carrier’s losses and LAE for the quarter by 41.7% year on year.

-

The Floridian’s new joint venture is called Journey Specialty Insurance Company.

-

The Floridian carrier has agreed terms for a new reinsurance treaty that increases its cession rate by eight points to 30.5%.

-

Chris Dittman will add the new title to his existing role as chief risk officer.

-

The figure compares with around $50mn in pre-tax cat losses in Q3 2019 from Hurricane Dorian and other events.

-

The insurer reported favorable reserve development and ceded $30mn of minor weather losses to reinsurers.

-

The insurer benefited from both lower loss and expense ratios.

-

The moves follow last month’s announcement that R Daniel Peed would become CEO following John Forney’s departure.