Amwins

-

The valuation for the Jay Rittberg-led program manager is understood to be $1bn+.

-

The HNW MGA previously had an exclusive distribution agreement under a partnership signed in July 2024.

-

Quota share is less common in the medmal space, where layered and shared structures have been dominant.

-

The mayor-elect has promised to build 200,000 new units in New York City.

-

The Jay Rittberg-led program manager kicked off a strategic process in August.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

The executive has been with the brokerage since 2004.

-

The program will provide excess casualty coverage across a broad range of industries.

-

The Insurance Insider US news team runs you through this week’s key agency M&A.

-

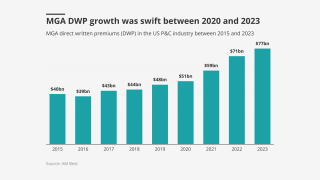

After a period of business building, MGAs will likely spend more time optimizing.

-

David Lavins had previously headed up subsidiary MGA Amwins Access.

-

This is the second acquisition Amwins has announced this year.

-

Rates are now falling, but submissions are still rising, according to wholesale brokers.

-

Brokerage co-presidents Jeff McNatt and Sam Baig discussed the E&S market, rates and M&A.

-

The MGA will become part of binding authority unit Amwins Access.

-

The broker’s state of the market report noted that property pricing has stabilized.

-

James Drinkwater is to serve as vice chair and executive chairman at Amwins Global Risks.

-

The 2025 State of the Market report also touched on E&S and MGA growth.

-

Earlier this month this publication revealed that the brokerages were in advanced talks to secure a deal.

-

Sources said the brokers are in the final stages and could seal a deal in the next couple of weeks.

-

Nick Abraham will succeed Nathan Mathis as CEO of the firm's London-based specialty distributor.

-

Amwins anticipates market softening will continue, absent loss ratio concerns.

-

A deal would mark Amwins’ second LatAm sale, after Lockton acquired THB Brazil last May.

-

Former NTUM president Justin Joyce will lead the ANTU binding unit.

-

Beckham will succeed Ben Francavilla, who is retiring.

-

The subsidiary generated 2023 gross revenue of $34mn and adjusted Ebitda of ~$5mn.

-

A deal would mark Amwins’ second LatAm sale, after this publication revealed that Lockton acquired THB Brazil last May.

-

In the newly created position, Kunert will lead efforts to build out and manage Amwins' formal claims infrastructure.

-

Armijo will replace Bob Petrilli, who is retiring after serving as president since August 2018.

-

Cat-exposed accounts will still face higher rates and more restrictive terms, however, as carriers continue to manage their aggregate, according to Amwins’s “State of the Market 2024” report.

-

This is the first time since 2015 the company has offered a broad-based liquidity opportunity to its employee shareholders, which is around 20% of its entire staff base.

-

After the transaction completes, the employee shareholder group will own 40% of Amwins and remain the company's largest single shareholder.

-

The broker’s “State of the Market: Real Estate” report says little change is expected in the property insurance marketplace for the rest of the year, but talk of more moderate rate increases in 2024 is “gaining momentum” specific to loss-free, properly valued and attractive accounts.

-

Ali previously led Amwins Specialty Casualty Solutions, a full-service MGA specializing in niche workers' compensation, casualty and professional liability products.

-

The partnership demonstrates MS&AD Insurance Group Holdings’ commitment to the North American market, according to a joint statement.

-

He was previously CEO at consulting firm Andros Risk Services and has written two books on D&O insurance.

-

In connection with the transaction, Amwins and Flexpoint will each appoint a representative to the SageSure board of managers.

-

The executive will manage a team of 80 professionals that serve clients through more than 20 programs focusing on niche markets.

-

High capacity and an ongoing faith in the financial system have mitigated against instant action from insurers.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The wholesaler had already paid out a cumulative $2.1bn of dividends to investors since 2018.

-

Amwins Global Risks has hired Carlos Herrera as a Latin America-focused reinsurance P&C senior vice president (SVP), based in Miami.

-

Rhodian facilitates capacity and technology relationships for new MGAs.

-

In the firm’s 2023 State of the Market report, it covered multiple classes, warning that for property (re)insurance in particular, inflation will likely continue to inflict pressure.

-

Inside P&C’s news team runs you through the key highlights of the week.

-

The CEO noted that retailers seeking to enter the wholesale segment through M&A risk losing staff amidst a talent shortage in the insurance industry.

-

The two products offer coverage for high-value residentials in a state where frequency of wildfire is highest in the US.

-

The deal enables its retail brokers to offer cyber liability coverage for small and medium-sized businesses with fewer security tools in place.