Aon

-

The question of how to finance the private brokers no longer begins and ends with a PE flip.

-

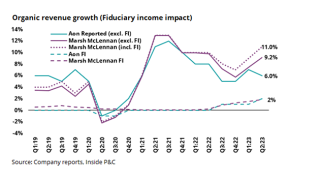

Differences in business mix and definitions yield differing trajectories for brokers, but in the absence of a recession, we may see continued margin improvement.

-

Some 81.5% of policies renewed with the same limit and deductible, marking a return to historic levels after bottoming out in Q3 2020. Among those policies, the average price decrease was 13.8%, while the average price increase was 30.2%.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The broker said it believes it has meritorious defenses and intends to vigorously fight the claims and seek recourse against third parties where appropriate.

-

Depressed M&A activity is a headwind likely to impact Aon for the remainder of the year.

-

The growth figure represented a 1-point deceleration from the previous quarter.

-

The scale of the coverage offered by the firm means buyers in the emerging line of business face a challenge to swap out their capacity.

-

Areas of focus should include hiring external talent, securing capital for M&A, speeding up US growth, and answering the reinsurance question.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The firm said it had identified two specific transactions in which “collateral inconsistencies” were in question.

-

The coverage is designed to reduce the island’s obligation to the US Federal Emergency Management Agency.

Related

-

Marsh recruits Aon’s Spiridis as US project risk leader

June 25, 2025 -

Aon finds ‘significant increase’ in W&I claims in 2024

June 24, 2025 -

Aon launches AI platform Broker Copilot

June 23, 2025 -

Cyber rates fall for 10th quarter straight: Aon

June 17, 2025 -

Aon promotes Rieth to global cyber lead

June 16, 2025