Aon

-

Market dislocation and macroeconomic disruption were listed as the second and third most prominent risks, with the economic environment as a key concern.

-

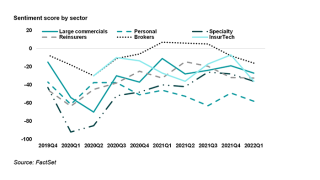

Sentiment scores are down across the industry, indicating pessimism regarding inflation and the economy.

-

The Warren Buffett-led conglomerate also remained firm in its position in rival broker Aon.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

The broker promoted Eduardo Hussey to succeed Gregory as part of the leadership changes in Miami.

-

Rate rises in the commercial lines market have decelerated in most insurance markets, but executives expect increases to remain above loss costs for some time.

-

The broker put ILS capital at $96bn by year end, $1bn lower than mid-2021 but ahead of its $94bn year-end 2020 estimate.

-

The figure marks a slowdown from the last three quarters, when price increases registered at 3.7% in Q4, 7.3% in Q3 and 14.2% in Q2 2021.

-

Inside P&C’s morning summary of the key stories to get you up to speed fast.

-

Inside P&C’s news team canters through the week’s key developments.

-

The broker said it planned to ramp up investment for hiring talent, as well as developing employees with improved analytical and technological tools.

-

The broker posted earnings per share ahead of analyst expectations and expanded margins.

Related

-

Marsh recruits Aon’s Spiridis as US project risk leader

June 25, 2025 -

Aon finds ‘significant increase’ in W&I claims in 2024

June 24, 2025 -

Aon launches AI platform Broker Copilot

June 23, 2025 -

Cyber rates fall for 10th quarter straight: Aon

June 17, 2025