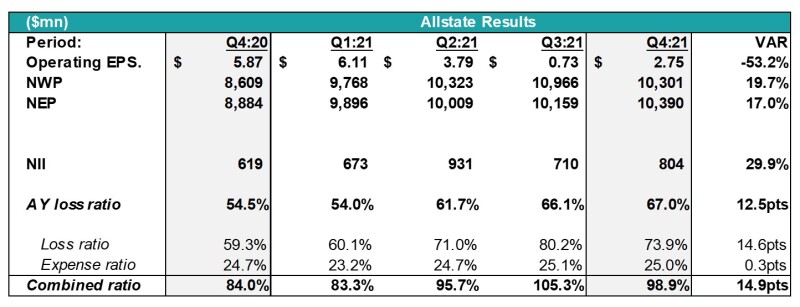

Management pointed to inflation’s impact on the severity and the easing of pandemic frequency benefits as the reasons for elevated loss cost. Accordingly, it focused a significant portion of the call on offsetting tactics, namely expense reduction, raising rates and claims effectiveness.

Our earnings preview noted that the return to pre-pandemic frequency was happening despite the emergence of new Covid variants, with rate action the story to follow as the sector as companies chart courses in the rising loss cost sea.

Below, we look into Allstate’s loss cost predicament and its plan to offset the trend.

Firstly, the loss ratio is (still) on the rise.

As discussed in previous notes, the personal auto insurance industry is experiencing a spike in severity, which is driving loss cost trends.

According to the Manheim used car index, inflation has pushed the price of used vehicles to record highs, 47% higher YoY. As severity continues to rise, frequency levels are also reaching pre-pandemic rates. Mobility data from Apple and Google indicate that the ongoing Omicron wave is not depressing driving behavior as much as expected.

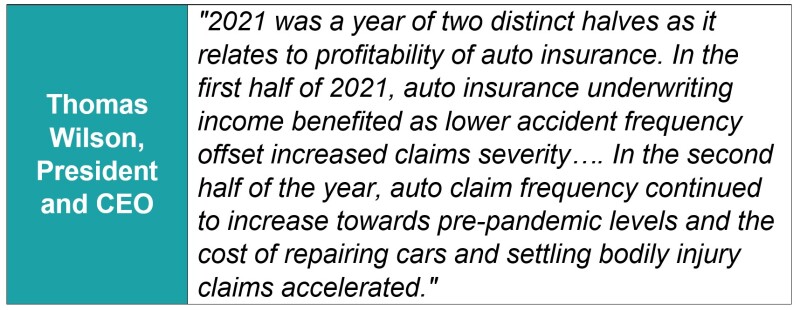

The chart below shows that the firm’s Q1 2021 loss ratio was lower than Q4 2020, but has risen every quarter since. As a result, Allstate’s loss ratio now sits above its pre-pandemic levels.

The company reiterated its desire to achieve a mid-90s combined ratio on a reported basis. Management noted that rate increases are the number one focus for improving personal auto profitability and touted the firm’s successful implementation of rate increases in 25 states.

While the firm’s loss ratio may compare favorably with Progressive’s in the chart above, what remains unsaid is that because Progressive is primarily a direct insurer, it has a lower expense ratio than mostly agency insurer peers like Allstate. As a result, the savings in expense ratio allow Progressive more wiggle room in its loss ratio while keeping the firm in the green.

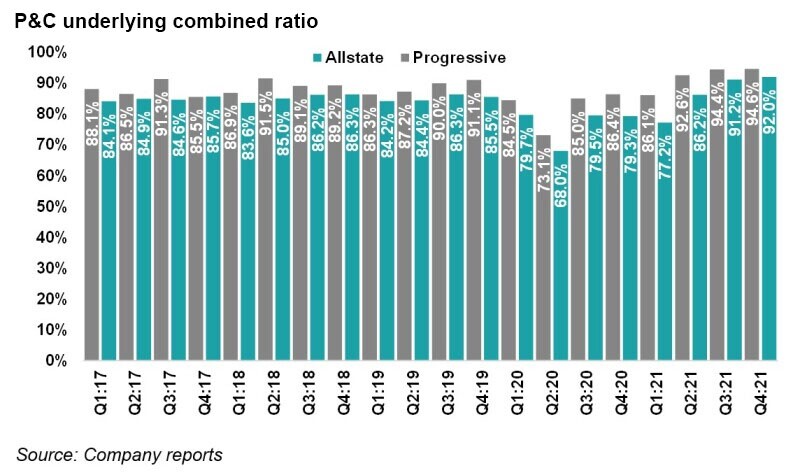

Secondly, the firm is working on reducing its expense ratio to mitigate the loss ratio trend.

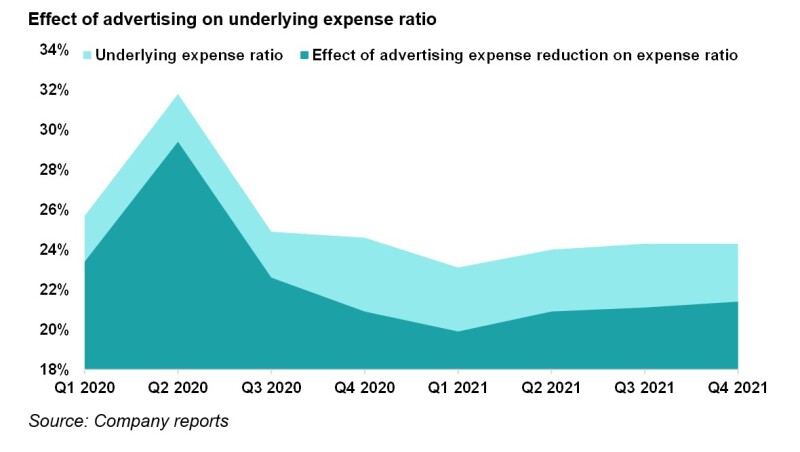

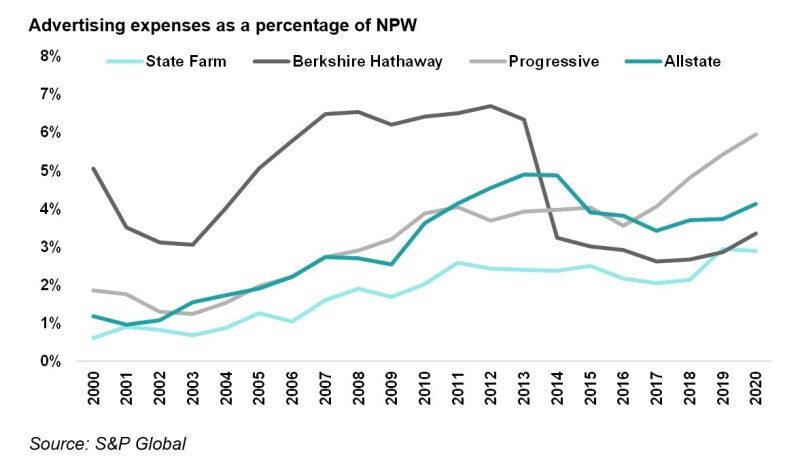

On the earnings call, management highlighted reductions in advertising expenses as a tool to maintain profitability. The chart below shows the impact advertising cost savings has had on Allstate’s underlying expense ratio over the past two years.

Compared to other personal auto carriers, it remains to be seen how much Allstate can pull back on advertising before it starts impacting revenue generation.

Thirdly, the firm is raising rates following industry movements.

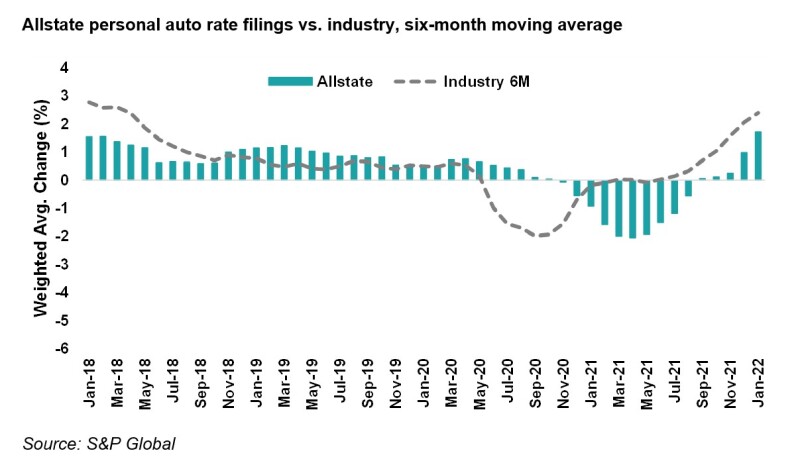

In response to rising frequency and high severity, the firm also began taking rate in the second half of 2021, following the wider industry trend.

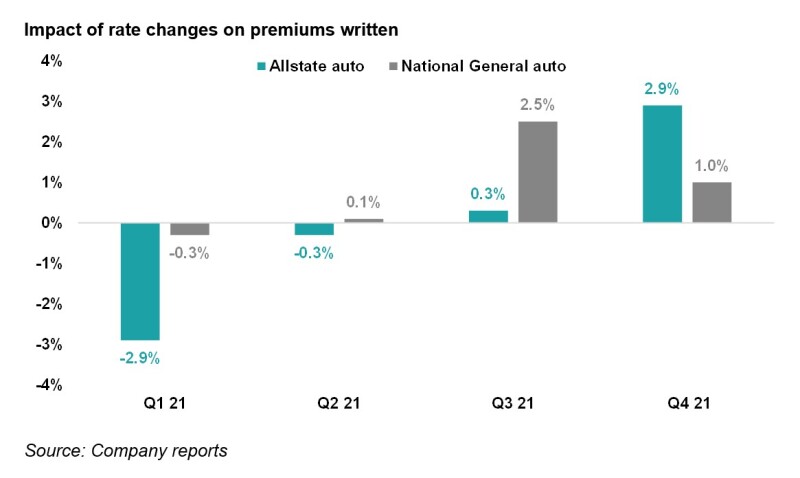

In the first half of 2021, Allstate had implemented rate decreases made possible by pandemic-era frequency benefits. But as inflation escalated and loss cost trends rose in the latter half of the year, the firm backtracked and began to increase rates.

The chart below shows the impact of rate changes on premiums written on Allstate’s personal auto subsidiaries.

While the firm is taking action, it may be somewhat behind the curve. For example, the chart below shows that Allstate's effective rate filings have lagged behind the overall industry’s rate action. Note that, similar to other carriers, there is a lag effect when rates are earned so it will be a few quarters before the impact on margin can be seen, assuming loss costs remain stable.

Note, starting in 2022, Allstate is beginning to report rate filing data directly, meaning that in the future we will be able to understand the firm’s rate action better.

In conclusion, the firm still has more to do in expense ratio reduction and rate action to offset adverse loss cost trends. Accordingly, we anticipate Allstate and other personal auto carriers will continue to take rate action through 2022 and address rising severity and normalizing frequency.

In addition, direct writers such as Progressive, that were ahead of the curve in recognizing the trend and taking rate action, might come out on top as this cycle reverses.