Last week, my colleague on sister title Insurance Insider Marcel Le Gouais published a piece on lackluster insurance innovation.

The heavily researched piece is worth your time. It stressed barriers to progress like multiple hurdles for innovation teams in insurers around management approvals, reinsurance and regulators. It also identified poor incentive structures for underwriters around new product development and issues caused by layers of legacy systems.

I would perhaps place more emphasis in my own explanation on a decomposed industry structure that leaves everyone looking to everyone else for innovation, and the limited first-mover advantage that can be gained in a sector where the product is just a (copyable) set of words on a page.

Culturally, the industry also suffers from risk aversion around change – companies like to do what they have always done, partially because this is what investors expect. And even when good ideas do surface, there can then be a market adoption problem.

But there can be no argument that sector innovation is weak, and our slightly different diagnoses may just suggest this is an overdetermined phenomenon.

Sluggish innovation matters in itself, but it also dramatizes the broader problem with the industry in the way it works with clients.

Aon CEO Greg Case has analyzed and laid out the problem best.

The Case Doctrine essentially maintains that if it does not change, the insurance industry risks a slide to irrelevance. This reflects its practice of wheeling out the same old product set and fighting over the same market share in a world of fast-evolving risk, growing unmet client need and ever larger businesses.

As evidence for this position, Case has noted that the insurance sector’s share of GDP has fallen in recent decades, and stressed that the industry has full or partial solutions for only five of insureds’ top 10 risks.

The analysis is sound, and one of the unfortunate by-products of the distorting massiveness of the Aon-Willis deal is that this message has not cut through as strongly as it would have otherwise – because it’s something the sector needs to hear, and a challenge it must rise to.

A lack of innovation is not the only manifestation of the industry’s client problem.

There is also a tendency to manage emerging risks via exclusion, most recently exemplified by its response to pandemic risk. Of course the sector should not renew cover for burning buildings, but it has also chosen to foreswear providing future protection for communicable disease.

Clearly, it cannot insure this risk in the tail on its own – but it could do something and by doing so it would demonstrate its willingness to be part of the solution.

Moreover, the sector does a bad job telling its own story, with the consequence that it has become something close to a pure commodity product. And as a pure commodity, coverage tightens to deliver a palatable price, storing up problems when uncovered claims arrive.

If it did a better job of setting out its value proposition, it would have a shot at establishing itself as a long-term provider both of reliable claims payouts and value-add risk mitigation advice.

Everyone in the sector is still making a living, and with so much cover legally mandated or involuntary, that looks unlikely to change. So some may say "so what" to this critique.

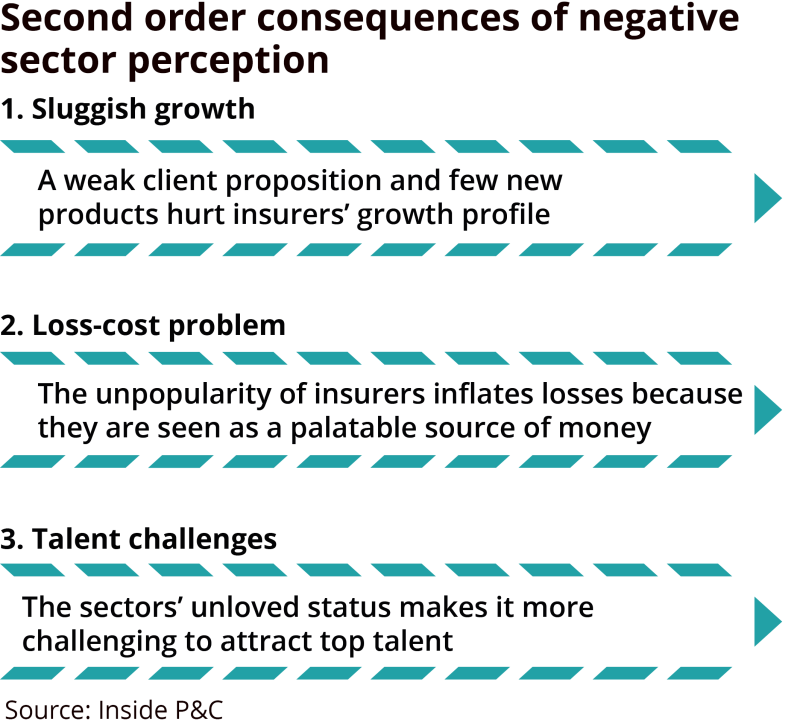

But the second-order effects are huge, and highly damaging.

First, the weak client value proposition and the relative dearth of new products means that growth is sluggish and vulnerable to the soft phase of the cycle.

Second, people and companies disliking insurance companies creates a structural loss-cost problem because it fosters fraudulent claims activity, pushes jury awards higher and encourages politicians to treat insurers as a source of free money after catastrophic events.

Third, the sector’s problem attracting the best talent is exacerbated by its status as an unloved, low innovation slow growth, old world sector. Right now, this micro problem is itself magnified by the macroeconomic challenge around talent shortages and wage inflation.

These are fundamental industry challenges, and not the kind of thing that can be addressed overnight. But a start would be to place a greater emphasis on innovation and new product development, and to put more money behind them. That is a statement of intent around change that any individual company could make.