If you have ever looked at forward earnings estimates, they always seem to show things are headed up, never going down. In fact, humanity is based on the expectation and the optimism that “this will get better in the future.” Sometimes it can get in the way of reality, and, on the whole, it doesn’t really pan out, at least with regard to future earnings expectations.

Cash is real; projections are illusory, hence the saying: one in the hand is better than two in the bush. This can easily apply to the conundrum of whether or not to sell at a perceived loss. Do you take the offer, or do you stick it out and hope things will live up to the earnings estimates one or two or even a few years out?

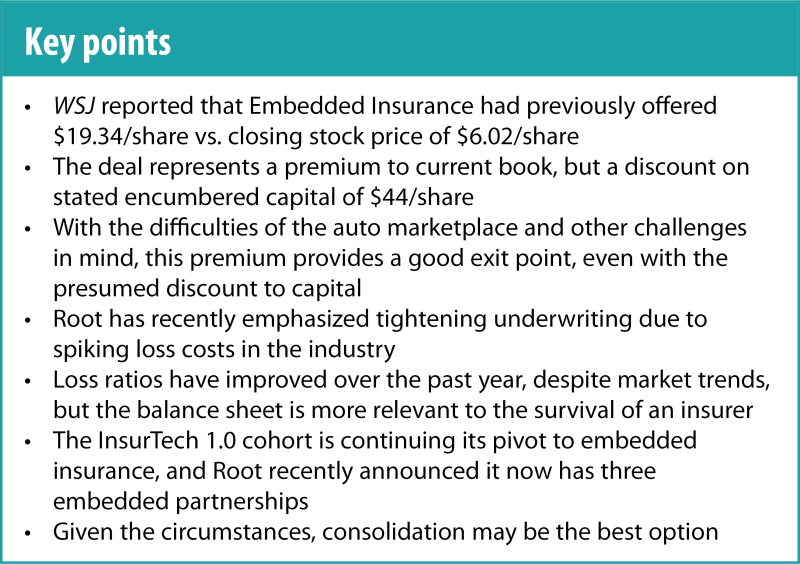

On Wednesday, the Wall Street Journal reported that Embedded Insurance has made multiple approaches to acquire Root at $19.34 per share ($275mn total), which translates into a greater than 3x multiple compared to Root’s price before the announcement. Since that news broke, the stock traded up to a high of $14.80/share closing at $12.90 yesterday.

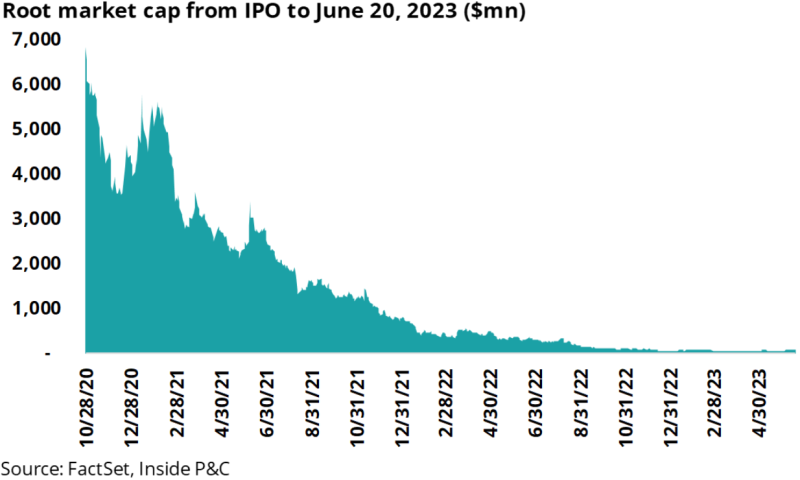

Root IPO’d on October 28, 2020 at a split-adjusted price of $486/share. Recall, the company had reverse split 18-to-1 in mid-2022, and after a temporary reprieve, the share price slump continued and closed at $6.02/share on Tuesday, prior to the WSJ story on Wednesday.

The chart below shows Root’s market cap over this time.

WSJ reports noted that the buyer was willing to escrow the entire amount, which is another surprising aspect of the offer. Typically, we see a mix of cash and contingent consideration as well as an amount tied to the actual performance of the business.

The buyer, Embedded Insurance is still relatively unknown.

If one were to scan for potential buyers of InsurTechs, Embedded Insurance would likely not feature on the list. Its website lists its founders and past insurance dispositions, but these seem to land more on the employee benefits side or personal lines aggregation.

So, we do have question marks around the ability of Embedded Insurance, which is relatively unknown, to be able to corral hundreds of millions of dollars.

That said, in terms of stock ownership, Root’s major VC backers own close to 23% of the shares, and adding co-founder and CEO Alex Timm’s share of 7.6% brings the grand total to 31%. It’s easy to get caught up in historical valuations and focus on the $6.8 billion IPO number, but realistically the current level of premium to closing price is virtually unheard of in public M&A markets.

In our view, Root’s management should take the $19.34/share. The personal auto markets remain challenging as we have seen from Progressive’s monthly results and Allstate’s catastrophe losses.

On the flip side, Root stock was trading at a similar level August 2022, so management might hold out hope that continued improved results might start impacting the stock price and consequently improve any potential deal metrics down the road.

However, with continued cash burn at every quarter, any large volatility in the results could put the shares in another death spiral. A case-in-point is Metromile, which IPO’d through the de-SPAC route. Following difficult results, it started scouting for partners, and as its proxy highlighted, the company struggled to find realistic interest in the insurance and non-insurance space.

This eventually resulted in having to go with Lemonade in an all-stock deal, due to a dearth of competing bidders. It’s human nature to play “what-if” scenarios, but an offer today is better than an uncertain tomorrow in the InsurTech world.

Our note below looks at the deal value and relative metrics. We also revisit Root’s Q1 results and the importance of recent trends. We conclude by reiterating our thoughts on consolidation in this space.

Firstly, the deal values the company at a slight premium to current book but a discount to unencumbered capital

The deal value of $275mn is at a slight premium to its Q1 shareholders' equity of $244mn. However, several other metrics are used by the company and the investor community to value InsurTechs. Root often cites its unencumbered capital, which the company feels is a better measure. This value was $629 million as of Q1, which equates to $44.3/share. However, we would highlight this measure employs Root’s proprietary calculation.

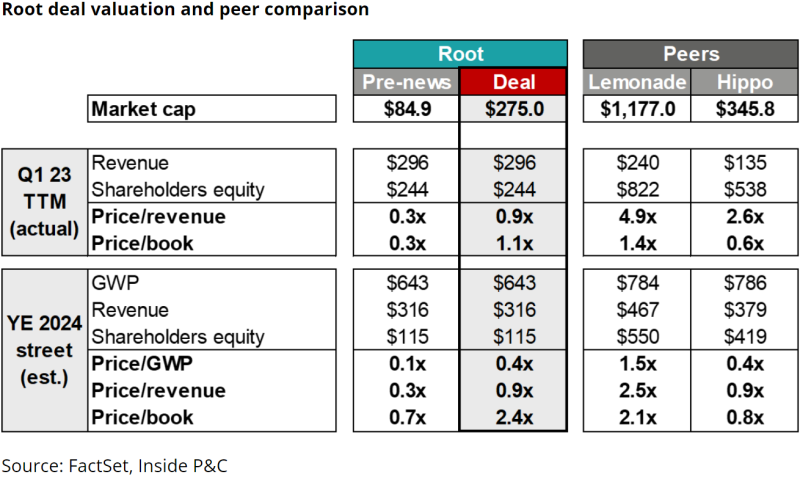

The table below shows some of the myriad measures utilized to value this peer group. Since we grew up in the incumbent world, we often use shareholders' equity as a starting point for any deal valuation. That said, using price to GWP or price to revenue, and even selecting current or forward expectations can result in a raft of valuation scenarios.

On a deal price to forward 2024 GPW basis, the deal equates to 0.4x in line with Hippo’s multiple and at a discount to Lemonade at 1.5x. On a deal price to 2024 revenue basis, the deal equates to 0.9x, again in line with Hippo but at a discount to Lemonade.

On a go-forward deal price to 2024 book basis, the deal equates to a 2.4x premium vs. Lemonade at 2.1x and Hippo at 0.8x. This is also due to the accelerating decline in shareholder’s equity for Root, which falls in half as per consensus estimates by end of 2024 vs. current levels (Note the equity shift from $244 million vs. $115 million for year-end 2024).

Taking a step back, with a 324% premium to closing stock price we believe that the offer today might provide better exit value than exposing the public shareholder base to the vagaries of a noisy personal auto marketplace.

Secondly, an improved loss ratio and tighter underwriting may be overshadowed by a shrinking balance sheet

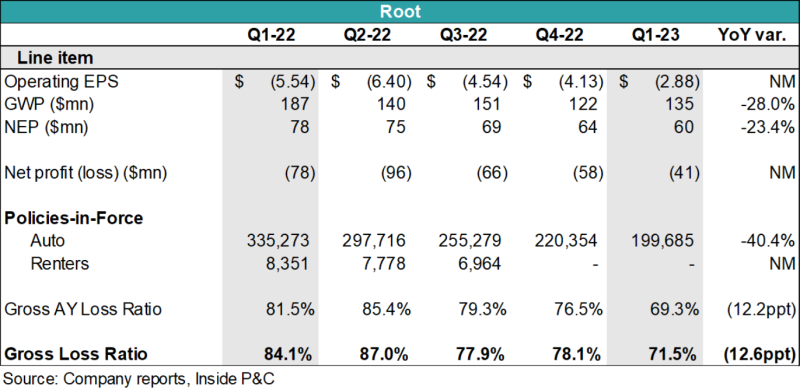

In Root’s first quarter conference call – a call that had a subdued tone and lasted for only 20 minutes – the company’s management spoke of tighter underwriting in response to the spiking industry loss costs they saw in 2022, though the company did see material improvement in their own loss ratio.

The exuberance present in some of the company’s first calls had now been replaced with language of resetting the foundation of the business, renewed focus around limiting cash burn, and reducing expenses.

The following table, shared by the news team on Root’s first quarter earnings, shows the company’s results for the past five quarters. The key takeaways here are the -28% for YoY GWP, the improving loss ratio, and the continued net loss.

Yes, Root has had some success with this near-term game of whack-a-mole. This involved cutting expenses through letting people go, pulling back on marketing expense, and reducing growth.

Let us not forget that InsurTechs came to market on the premise of disrupting the world, and here they are in survival mode. With a much smaller balance sheet, the company is already walking a tightrope on loss costs.

Taking a step back, the net loss trend shown above is more important than the improvement in loss ratios. Insurance is, after all, a highly regulated business, and a balance sheet shrinking from consecutive losses will ring alarm bells when thinking about capital adequacy.

Thirdly, consolidation is the best survival strategy for the InsurTech 1.0 cohort

One item that did generate some excitement from Root management on its Q1 earnings call was the company’s efforts in embedded insurance. They announced that they have three partnerships, continuing to focus on this pivot.

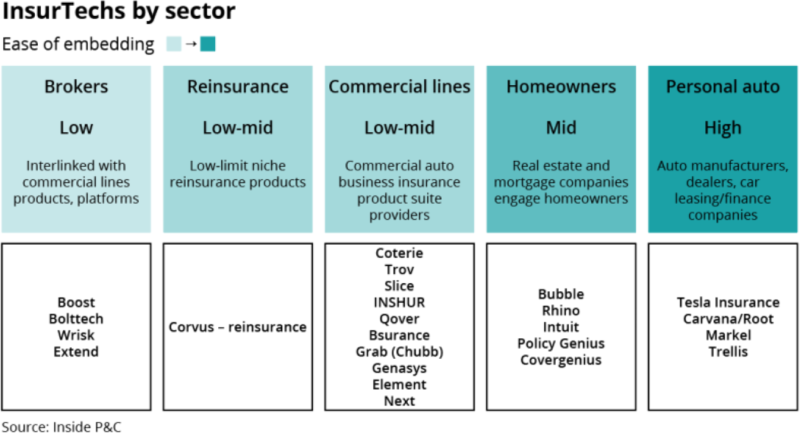

We had discussed this pivot in our InsurTech Insights conference recap as well as in our past notes. The InsurTech 1.0 class is continuing its pivot from “disruptor” to an embedded service provider. The chart below shows the level of difficulty to embed these solutions.

It’s much easier to embed in personal auto and homeowners, and it gets progressively difficult beyond those lines. This should continue to open doors for Root.

Additionally, a new set of eyes might help the company think of other ways to speed up the process and even bring in new capital down the road to ramp up its offerings. Hence, in our view, the initial class of InsurTechs facing capital pressures should evaluate traditional incumbent and non-traditional partnerships.

In summary, if the buyer can drum up the requisite cash in an escrow, in our view, this would be a good exit route for the investors and private equity supporters. There is no shame in learning lessons while attempting to be the pioneers in the InsurTech 1.0 class and taking another go at it down the road.