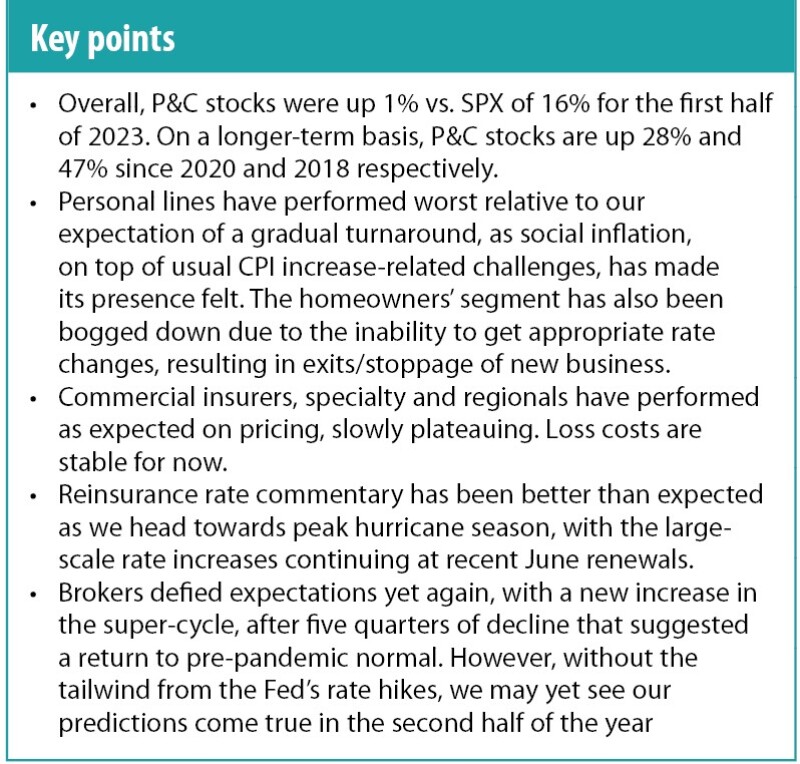

That said, looking back can provide insights into how we are performing compared to how we thought we would be doing, and the reasons for any variance. We are at the six-month mark in the year, so it’s an opportune time to undertake this exercise and see how the P&C sector has fared compared to our predictions at the start of the year.

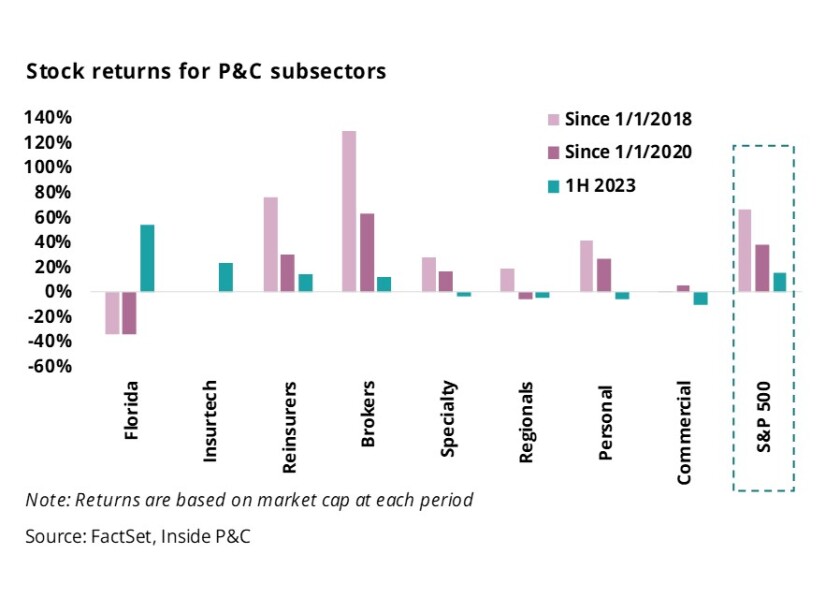

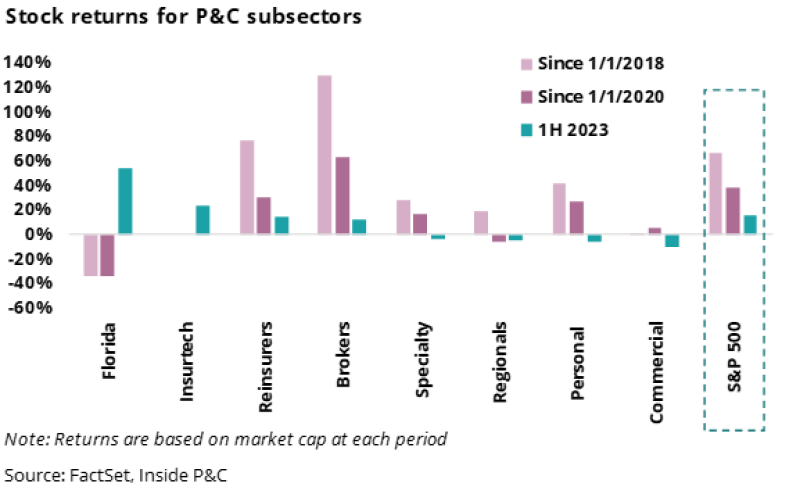

If stock price is a barometer, the first six months have proven less than stellar for multiple insurance sub-groups. The picture improves drastically over a more extended period, as shown below.

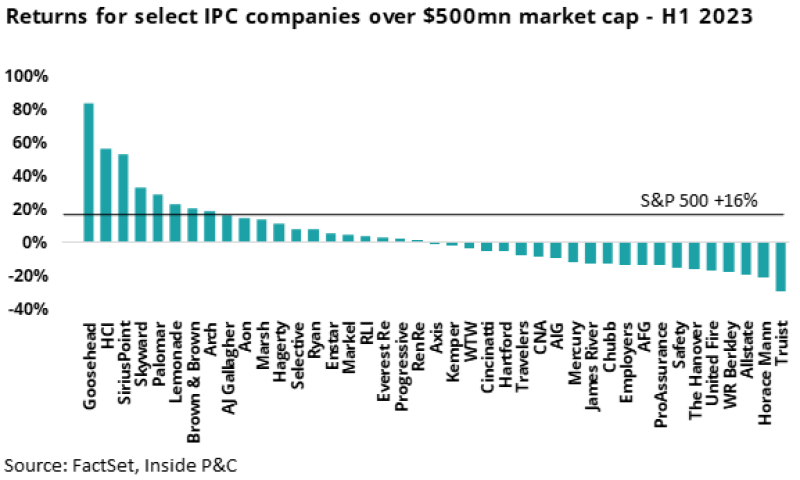

For the first six months, the best performer was the Florida cohort at 54% (excluding UPC), largely due to post-Hurricane Ian recovery of stocks, which were still significantly down at year-end, as well as potentially benefiting from recent legislation. The only other cohort to outperform the S&P (+16%) this half was InsurTechs, which grew 23%.

This brings us to an interesting point. There has been a sector rotation from value to growth, with Russell 1000 Growth up 28% for the year vs Russell 1000 Value at a paltry +4.2%. InsurTechs have consequently led the group, while traditionally stable groups such as personal lines and commercial have had the worst results, with -5% and -11% change respectively.

If anyone expected a quieter 2023 compared to 2022, the first six months have so far proven them wrong. From macro conditions and economic question marks to interest rate changes to sub-sector movements, events have kept prognosticators guessing.

Below, we revisit our expectations and compare them to actual results.

Personal lines: Worse than expected

We wrote in our outlook, “The odds of personal auto players getting it wrong a third time are low, so we’ll likely witness a slow recovery.”

“Fool me thrice, shame on both of us,” as Stephen King once said. Clearly, we were hoping for an earlier recovery but were proven wrong.

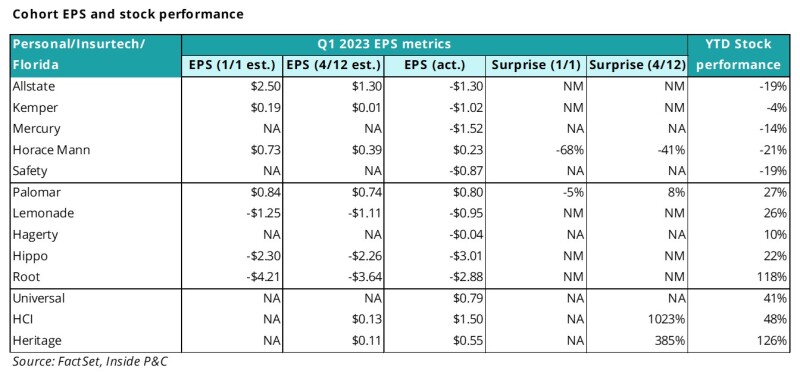

The chart below shows the six-month performance for personal lines players and a look at Q1 earnings vs estimates. The personal auto players remained behind the eight ball as the outlook got murkier, with loss cost trends also elongated due to attorney involvement. Our previous notes discussed the continuing impact of higher severity, repair costs and several other CPI items. A higher catastrophe and non-catastrophe loss year also added to the noise for these players.

One of the bigger surprises was Progressive having to look at its numbers for Florida legal trends and add to its reserves. One of the things to consider this year is – if industry leader Progressive is having trouble figuring out the loss cost environment, should we recalibrate our confidence for the rest of the group? We are still in the middle of a personal auto rate hike environment, and at this stage, we are more cautious than anticipated.

New issues have emerged on the homeowners’/property front, with several insurers officially announcing a stoppage of new business or a slow walk-back in the California market.

Regulators continue to meddle in the free market process, resulting in the current status quo. In the US, 18 states are file and use, 12 are prior approval, and nine use and file. We expected homeowners’ to remain stable over 2023 but with these new roadblocks, this space has the potential to face additional challenges.

On the InsurTech front, carriers such as Root, Hippo and Lemonade had a better-than-expected first half due to better results as well as the sector rotation into growth names. We maintain our pessimism since one quarter does not make a trend, and we are not convinced the cash burn issues have abated.

On the Florida domestic front, companies such as HCI benefited from recent regulatory changes, which is expected to alleviate the runaway loss cost trend in the state. However, we maintain a “wait and watch” attitude, in case we see challenges to the tort reform if we have an active hurricane season.

Commercial lines: Mostly in line with expectations

In our outlook, we noted, “There are two possible outcomes for 2023: Either the industry will have a solid year when all the double-digit rate is earned, or social inflation, loss cost inflation and a slowing economy will intersect with flattening pricing. We believe the second outcome to be more likely.”

It seems that we are slowly moving into the second scenario. We haven't seen gangbuster double-digit earned returns, and questions on conference calls continue to focus on the trajectory of loss cost inflation. If attorney involvement is making its presence felt in personal lines, will other lines be far behind?

Specialty:

On the other hand, specialty and E&S players performed better on underwriting trends as improved business and return opportunities played out over 2023. As the safety valve of commercial lines, specialty writers fortunes are also intertwined with the broader commercial cycle. That said, a higher-quality book should continue to report better RoEs in the property-casualty space.

Regionals:

As a group, regionals have benefited from improving risk selection, translating into improved RoEs. Further, compared to the larger commercials, this group has leaned into the specialty aspect of their business. Apart from improving the stickiness, this has improved the return profile. So even though their rate cycle is a bit more muted, RoEs have been better than larger commercials.

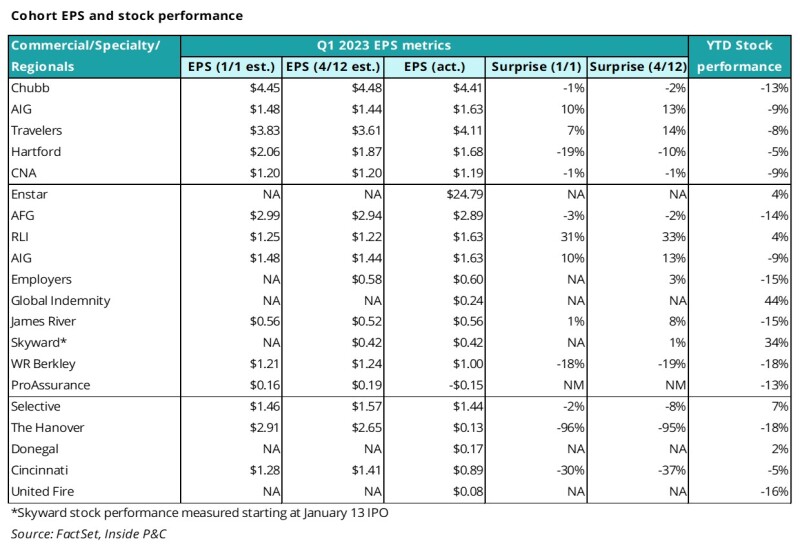

The chart below shows the six-month performance for commercial, specialty, and regional players. Note the negative stock performance for many companies even when reporting results that are better than expected.

The first six months also saw two commercial-predominant players going public: Skyward and Fidelis.

Skyward has had stellar stock movement since its IPO, while Fidelis struggled a tad in its first few days, reflecting its business model complexities. What impact will their moves have on the remaining waiting-in-the-wings-to-IPO players?

Reinsurance: Headline commentary better than expected

In our outlook, we noted, “The focus should be on April and July renewals at this stage, and in our mind there is a question mark over whether this discipline will last into mid-year.”

If one goes by published broker reports, reinsurers continue to have their cake and eat it. We believe many of these reports have a “keep the client happy” angle, so we have guarded optimism on the discussed blockbuster rates. Additionally, many reinsurers have moved away from the feast/famine style of writing majority property-cat and instead have a more balanced book in theory.

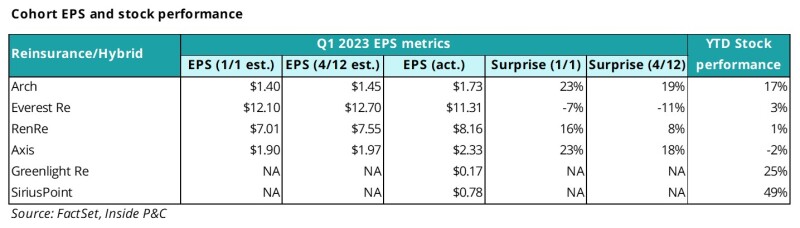

The chart below shows the six-month performance and EPS surprises at first-quarter earnings. Arch has clearly benefited the most from its strategy of deploying in the right segments and sitting back and waiting for opportunities to present themselves.

Brokers: Better than expected, again

Brokers defied industry expectations in 2022, managing to extend the super-cycle several quarters beyond what seemed plausible.

In our outlook, we said we expected broker results to remain positive, though the super-cycle would come to an end. This was supported by a strong downward trend over the five preceding quarters.

However, the two earnings seasons we have had since that piece was published defied expectations again, with a marked upward trend overall and some carriers nearing the highs of 2021.

This was at least in part due to the continuing interest rate boosts from the Fed, combined with the hard property-cat and reinsurance markets that favored brokers that focus on those areas.

While the initial part of the super-cycle was driven by overall commercial pricing, it has been extended on the basis of these two factors. Now that the Fed is slowing/stopping its rate hikes and the reinsurance renewal season is over, we may see our predictions coming true in the second half of the year.

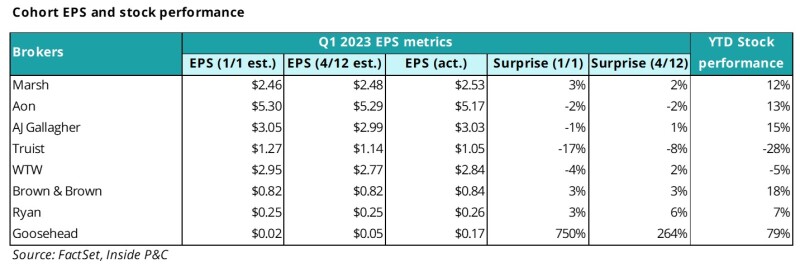

In terms of earnings, the chart below shows estimates from the start of the year. It reflect the sector’s strong performance and consistent results.

With respect to estimates, we can see the cohort generally stayed flat or trended slightly up with the exception of Truist, which was hurt by the banking crisis, and WTW. Actuals came in higher as well, except for Truist again, and Aon which had a slight miss.

Broker stocks continue to outperform most other sectors, with most companies growing by double digits in the year to date.

In summary, the personal lines segment is worse than our expectations, while brokers have fared better in extending the super-cycle. Commercial and reinsurance have been more of a mixed bag, in line with our expectations. Stay tuned as we head into second-quarter earnings in a few weeks.